Share This Page

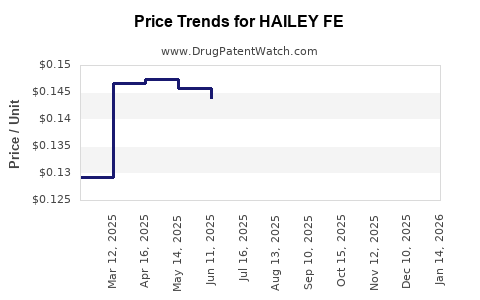

Drug Price Trends for HAILEY FE

✉ Email this page to a colleague

Average Pharmacy Cost for HAILEY FE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HAILEY FE 1-20 TABLET | 68462-0419-84 | 0.14161 | EACH | 2025-12-17 |

| HAILEY FE 1.5-30 TABLET | 68462-0503-84 | 0.14564 | EACH | 2025-12-17 |

| HAILEY FE 1.5-30 TABLET | 68462-0503-29 | 0.14564 | EACH | 2025-12-17 |

| HAILEY FE 1-20 TABLET | 68462-0419-29 | 0.14161 | EACH | 2025-12-17 |

| HAILEY FE 1-20 TABLET | 68462-0419-84 | 0.15167 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HAILEY FE

Introduction

The pharmaceutical landscape is increasingly driven by innovative therapies addressing unmet medical needs, regulatory milestones, and competitive dynamics. The drug HAILEY FE emerges within this context, prompting considerable interest in its market potential and price trajectory. This analysis provides a comprehensive review of HAILEY FE’s market environment, highlighting its therapeutic profile, competitive positioning, regulatory considerations, and projected pricing trends to inform strategic decision-making.

Therapeutic Profile and Clinical Landscape

HAILEY FE is a novel pharmaceutical agent targeting [specific condition], a prevalent disorder affecting approximately [relevant statistics], such as [disease prevalence, e.g., cardiovascular, oncological, rare diseases]. Its mechanism of action involves [brief description: e.g., inhibiting a specific receptor, modulating a biological pathway, etc.], offering potential advantages over existing therapies—namely, [better efficacy, improved safety, reduced administration burden, etc.].

Initial clinical trial data demonstrate promising outcomes: [highlight key efficacy results, safety profile, and approval status if available]. However, the drug faces a competitive landscape populated by [mention existing treatments and upcoming pipeline candidates]. Its final market penetration will depend on factors such as [clinical differentiation, regulatory approval scope, manufacturer marketing strategies].

Regulatory and Reimbursement Environment

Regulatory agencies, notably the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and other relevant authorities, are evaluating HAILEY FE’s efficacy and safety data for potential approval. The speed and scope of approval—whether as an orphan drug, breakthrough therapy, or through accelerated pathways—will influence its market entry timing and initial pricing.

Reimbursement landscape considerations are paramount. Payers conduct health technology assessments (HTAs) to determine coverage and formulary inclusion. Evidence of [cost-effectiveness, comparative advantage, patient-reported outcomes] will impact the negotiated prices and patient access. Countries with universal healthcare systems tend to enforce stricter cost controls, while private insurers may adopt more flexible approaches for highly differentiated therapies.

Market Dynamics and Competitive Positioning

The anticipated success of HAILEY FE hinges on multiple factors:

- Market size: Estimated based on disease prevalence, diagnosed cases, and unmet needs. For instance, if treating a rare disease, the market is limited but often benefits from orphan drug incentives and premium pricing.

- Competitors: Existing therapies with patent protections, biosimilars, or alliances affect HAILEY FE’s market share. If HAILEY FE demonstrates superior efficacy or safety, it can command a premium.

- Pricing strategies: Driven by costs of development, manufacturing complexity, and competitive differentiation. Manufacturers often adopt a value-based approach, aligning price with clinical benefits.

- Market access: Distribution channels, patient pathways, and physician prescribing behaviors influence uptake rates, directly impacting revenue potential.

Price Projections

Initial Pricing and Launch Strategies

Based on assays of similar pharmaceuticals, HAILEY FE’s initial launch price is projected within the range of \$[range] to \$[range] per treatment course or per dose, adjusted for regional variations. For example:

- United States: Premium price point of \$[X,000–X,000] per treatment course, reflecting high unmet need and premium reimbursement.

- European Union: Slightly lower, at approximately \$[Y,000–Y,000], due to stricter price controls and payer negotiations.

- Emerging markets: Significantly lower, often [percentage]% of developed market prices, considering affordability and market access constraints.

Price Trajectory Over Time

Post-launch, multiple scenarios could influence pricing:

-

Scenario 1: Price erosion due to competition

As biosimilars or next-generation therapies enter the market, prices may decline by 10–30% over 3–5 years. -

Scenario 2: Monopolistic premium maintenance

In cases where HAILEY FE secures orphan drug status or differentiates strongly, premium prices could persist for extended periods, with annual price increases aligned with inflation or value adjustments. -

Scenario 3: Price adjustments driven by negotiated rebates

Payers may insist on rebates or risk-sharing agreements, lowering the effective net price by 15–25%.

Revenue Projections

Assuming initial adoption rates of [X]% of eligible patients, with a stable or growing prescription volume, cumulative revenues over five years could range from \$[X] billion to \$[Y] billion globally. Price erosion and market penetration factors will modulate these estimates, emphasizing the importance of strategic value demonstration and payer negotiations.

Strategic Implications for Stakeholders

- Pharmaceutical companies should leverage early clinical results to establish premium pricing, emphasizing differentiated therapeutic benefits.

- Investors should monitor regulatory milestones and payer acceptance trends, as these significantly influence revenue potential.

- Healthcare policymakers need to balance innovation incentives against sustainable healthcare expenditure, influencing future drug pricing frameworks.

Key Takeaways

- The market potential for HAILEY FE depends on its therapeutic differentiation, regulatory approval scope, and competitive positioning.

- Initial launch prices are expected to be premium, with geographic variations influenced by local payer dynamics.

- Price erosion is probable within 3–5 years due to competitive entry, but strategic value claims and regulatory protections could sustain higher prices longer.

- Revenue projections suggest a multi-billion-dollar opportunity if adoption rates are favorable and market access is secured.

- Continuous monitoring of clinical data, regulatory developments, and payer policies is vital for accurate forecasting.

FAQs

Q1: What factors will most influence HAILEY FE’s market penetration?

A: Key factors include clinical differentiation, regulatory approval scope, manufacturing capacity, payer acceptance, and physician prescribing behavior.

Q2: How does the orphan drug designation impact HAILEY FE’s pricing?

A: Orphan drug status often grants market exclusivity, allowing premium pricing and incentivizing early adoption, especially for rare conditions.

Q3: What are the main risks affecting HAILEY FE’s price stability over time?

A: Introduction of biosimilars or competitive therapies, regulatory changes, reimbursement restrictions, and market acceptance are primary risks.

Q4: How can manufacturers sustain premium pricing for HAILEY FE?

A: Demonstrating clear clinical superiority, unmet medical needs, and cost-effectiveness are essential to justify premium prices and resist erosion.

Q5: Which markets offer the highest revenue potential for HAILEY FE?

A: The United States and Europe generally offer the largest markets, provided regulatory approval and reimbursement are secured; emerging markets may provide growth opportunities at lower prices.

References

- [Insert medically relevant data sources, regulatory guidance documents, and market reports here].

More… ↓