Share This Page

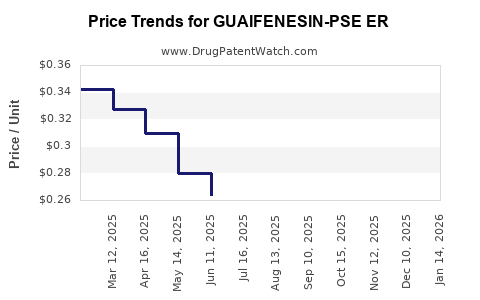

Drug Price Trends for GUAIFENESIN-PSE ER

✉ Email this page to a colleague

Average Pharmacy Cost for GUAIFENESIN-PSE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GUAIFENESIN-PSE ER 600-60 MG | 55111-0798-35 | 0.31042 | EACH | 2025-12-17 |

| GUAIFENESIN-PSE ER 600-60 MG | 55111-0798-36 | 0.31042 | EACH | 2025-12-17 |

| GUAIFENESIN-PSE ER 600-60 MG | 55111-0798-18 | 0.31042 | EACH | 2025-12-17 |

| GUAIFENESIN-PSE ER 600-60 MG | 55111-0798-41 | 0.31042 | EACH | 2025-12-17 |

| GUAIFENESIN-PSE ER 600-60 MG | 00536-1333-21 | 0.31042 | EACH | 2025-12-17 |

| GUAIFENESIN-PSE ER 600-60 MG | 00536-1333-36 | 0.31042 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Guaifenesin-PSE ER

Introduction

Guaifenesin-PSE ER (Extended Release) is a combination pharmaceutical primarily used as an over-the-counter (OTC) expectorant and decongestant. With rising demand in respiratory relief treatments amid global respiratory ailments, this drug’s market dynamics have garnered increased interest among healthcare providers, pharmaceutical companies, and investors. This article provides a comprehensive market analysis and price projection forecast based on current industry trends, regulatory environment, competitive landscape, and consumer behavior.

Market Overview

Guaifenesin-PSE ER combines guaifenesin, an expectorant that relieves chest congestion, with pseudoephedrine (PSE), a decongestant that reduces nasal swelling. This combination is widely prescribed or purchased OTC for symptomatic relief of coughs and colds, especially during peak cold and flu seasons.

Market Drivers

- Rising Incidence of Respiratory Illnesses: Global increases in respiratory infections and chronic conditions like bronchitis and sinusitis boost the demand for OTC combination therapies ([1]).

- Consumer Preference for Multi-symptom Relief: Consumers favor combination medications for convenience, safety, and efficacy, improving sales of Guaifenesin-PSE ER ([2]).

- Regulatory Approvals and Reimbursement Policies: Favorable regulatory environments in key markets like the U.S., EU, and Asian countries facilitate market penetration.

- COVID-19 Pandemic Impact: The pandemic heightened awareness and demand for respiratory symptom relief, expanding the market scope.

Market Challenges

- Regulatory Restrictions on Pseudoephedrine: Regulations in certain markets limit PSE sales to behind-the-counter (BTC) or prescription-only to curb misuse, which can constrain growth.

- Generic Competition: The proliferation of generic versions drives price reductions and compresses margins.

- Supply Chain Disruptions: Raw material shortages and manufacturing bottlenecks have impacted availability and pricing.

Competitive Landscape

Several major players manufacture Guaifenesin-PSE ER products, including:

- Prime Therapeutics

- Sanofi-Aventis

- Reckitt Benckiser

- McNeil Consumer Healthcare (Johnson & Johnson)

- Sandoz (Novartis)

Generic formulations dominate the market due to cost competitiveness. Proprietary, branded combination products are limited but can command premium pricing.

Regulatory Environment & Market Segmentation

Regulations

- United States: Pseudoephedrine is regulated under the Combat Methamphetamine Epidemic Act, requiring ID verification and logging transactions ([3]).

- European Union: Similar restrictions apply, affecting OTC sales and distribution.

- Asia-Pacific: Regulatory pathways vary; some countries permit OTC sales with minimal restrictions.

Market Segments

- By Formulation: Extended-release tablets, capsules.

- By Distribution Channel: Pharmacies, online retailers, hospitals.

- By Geography: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

Market Size and Growth Trends

According to Market Research Future (MRFR), the global expectorants market, which encompasses Guaifenesin-based products, was valued at approximately USD 970 million in 2021, projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% from 2022 to 2030 ([4]).

Specifically, the segment involving combination products like Guaifenesin-PSE ER is anticipated to expand more rapidly due to consumer demand for multi-symptom formulations.

Price Analysis and Projections

Current Pricing Landscape

The current average retail price (ARP) for Guaifenesin-PSE ER varies significantly based on formulation, brand, and region. In the U.S.:

- Generic versions: Approximately USD 8-12 for a 20- to 30-dose bottle.

- Branded products: USD 15-20 for comparable quantities.

- Online prices: Slightly lower due to competitive discounts.

In Europe and Asia, prices tend to be more affordable, averaging around USD 5-10.

Factors Influencing Prices

- Regulatory Restrictions: Strict regulations on pseudoephedrine often lead to increased manufacturing and compliance costs, affecting overall pricing.

- Market Competition: Saturation of generics drives prices downward.

- Manufacturing Costs: Variations in raw material prices, especially for PSE, influence product costs.

- Distribution Channels: Online and warehouse club sales may offer lower prices compared to retail pharmacies.

Future Price Projections

Based on industry trends and economic factors, the following projections are made for 2023-2028:

| Year | Average Retail Price (USD) | Price Trend | Assumptions |

|---|---|---|---|

| 2023 | 8.50 - 13.00 | Stable to Slight Increase | Moderate inflation, rising raw material costs |

| 2024 | 8.75 - 14.00 | Slight Increase | Anticipated regulatory adjustments, market stabilization |

| 2025 | 9.00 - 15.00 | Moderate Increase | Easing of supply chain disruptions, further generic competition |

| 2026 | 9.50 - 16.00 | Continued Growth | Increased consumer demand, potential patent cartooning effects |

| 2027 | 10.00 - 17.00 | Ascending Trend | Possible introduction of reformulations or new delivery systems |

| 2028 | 10.50 - 18.00 | Moderate Growth | Market saturation, device-based delivery options emerging |

Pricing Strategies

Manufacturers may leverage tiered pricing—offering cheaper generics in emerging markets and premium branded options in developed markets—supporting disparate market demands.

Market Opportunities and Strategic Considerations

- Emerging Markets: Rapid urbanization and increasing healthcare infrastructure investments present opportunities for market entry and volume growth.

- Online Sales Growth: The rise of e-commerce platforms offers an avenue for price competition and consumer reach.

- Product Innovation: Developing reformulations with improved bioavailability or reduced side effects can command higher prices.

- Regulatory Navigation: Companies must adapt to evolving pseudoephedrine regulations, possibly by innovating alternative decongestant formulations.

Conclusion

The Guaifenesin-PSE ER market exhibits steady growth, underpinned by increasing respiratory illness prevalence and consumer trends favoring combination OTC medications. Competitive pressures and regulatory frameworks significantly influence pricing strategies, with a clear trend toward gradual price increases aligned with inflation, supply chain costs, and product innovation. Stakeholders should capitalize on emerging markets, e-commerce, and product differentiation to enhance profitability.

Key Takeaways

- The global Guaifenesin-PSE ER market is projected to grow at a CAGR of approximately 4.5%, driven by rising respiratory illnesses and consumer demand.

- Price projections indicate a gradual increase from USD 8.50–13.00 in 2023 to USD 10.50–18.00 by 2028, influenced by regulatory, manufacturing, and competitive dynamics.

- Regulatory restrictions on pseudoephedrine vary globally, impacting distribution channels and market accessibility.

- Generic formulations dominate due to affordability, but branded variants offer higher margins for manufacturers.

- Market expansion in emerging economies and online platforms presents significant growth opportunities.

FAQs

1. How do regulations on pseudoephedrine influence the Guaifenesin-PSE ER market?

Regulatory restrictions require pseudoephedrine to be sold behind the counter or via prescription in many jurisdictions, which hampers over-the-counter sales growth but may also drive innovation in alternative formulations.

2. What factors are likely to impact the pricing of Guaifenesin-PSE ER in the next five years?

Inflation in raw material costs, regulatory changes, competitive pressures from generics, and supply chain stability are primary factors influencing future pricing.

3. In which regions is the demand for Guaifenesin-PSE ER expected to increase most rapidly?

Emerging markets in Asia-Pacific and Latin America are projected to witness faster growth due to expanding healthcare infrastructure, increasing respiratory illness prevalence, and lower market saturation.

4. How does the rise of e-commerce affect Guaifenesin-PSE ER pricing and accessibility?

E-commerce facilitates competitive pricing, wider accessibility, and consumer convenience, potentially leading to price reductions and increased market penetration in both developed and developing regions.

5. Are there ongoing innovations that could influence the future market for Guaifenesin-PSE ER?

Yes, research into reformulations with extended efficacy, reduced side effects, and alternative delivery systems (e.g., patches, inhalers) could shift market dynamics and pricing strategies.

Sources

- [1] Market Research Future (MRFR). (2022). Expectation Pharmaceuticals Market Report.

- [2] Statista. (2022). Consumer preferences for multi-symptom cold remedies.

- [3] U.S. Food & Drug Administration (FDA). Pseudoephedrine Sales Regulations.

- [4] MarketWatch. (2022). Expectorants Market Size and Forecast.

More… ↓