Share This Page

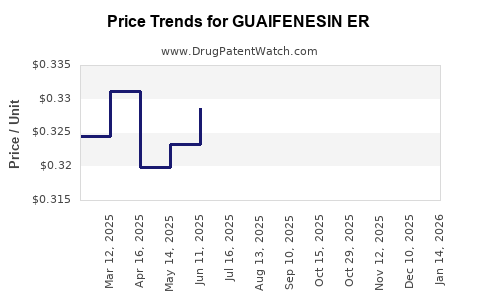

Drug Price Trends for GUAIFENESIN ER

✉ Email this page to a colleague

Average Pharmacy Cost for GUAIFENESIN ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GUAIFENESIN ER 600 MG TABLET | 00536-1163-61 | 0.30285 | EACH | 2025-12-17 |

| GUAIFENESIN ER 600 MG TABLET | 68094-0048-59 | 0.30285 | EACH | 2025-12-17 |

| GUAIFENESIN ER 600 MG TABLET | 70010-0199-05 | 0.30285 | EACH | 2025-12-17 |

| GUAIFENESIN ER 600 MG TABLET | 68094-0048-61 | 0.30285 | EACH | 2025-12-17 |

| GUAIFENESIN ER 1,200 MG TABLET | 51660-0567-86 | 0.42985 | EACH | 2025-12-17 |

| GUAIFENESIN ER 600 MG TABLET | 51660-0566-21 | 0.30285 | EACH | 2025-12-17 |

| GUAIFENESIN ER 600 MG TABLET | 51660-0070-21 | 0.30285 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Guaifenesin ER

Introduction

Guaifenesin Extended-Release (ER) is a widely used expectorant that alleviates congestion related to coughs and colds. As an established medication, Guaifenesin ER occupies a significant niche within respiratory and over-the-counter (OTC) healthcare markets. This report assesses the current market landscape, provides comprehensive insights into competitive positioning, and forecasts future pricing trends based on market dynamics, regulatory factors, and evolving consumer demand.

Market Overview

Product Profile

Guaifenesin is primarily utilized as an expectorant to loosen mucus in the airways, facilitating clearer breathing. The ER formulation prolongs drug action, improving patient adherence for chronic respiratory conditions [1]. It is available in both prescription and OTC markets, with formulations from multiple pharmaceutical companies, including major players like Johnson & Johnson, Perrigo, and Amneal Pharmaceuticals.

Regulatory Environment

The OTC segment benefits from relatively straightforward regulatory pathways in many jurisdictions, which accelerates market penetration. Yet, in some regions, Guaifenesin ER formulations may require FDA labeling compliance and stability data submissions, impacting pricing strategies [2].

Global Market Dynamics

The global expectorant market, projected to reach USD 11 billion by 2025, exhibits a compound annual growth rate (CAGR) of approximately 3.5%. Guaifenesin specifically commands around 45% of OTC expectorant sales [3]. The expanding prevalence of respiratory illnesses, especially influenza and COVID-19-related symptoms, sustains demand.

Market Segmentation and Competitive Landscape

Key Segments

- OTC formulations: Dominant market share, driven by consumer preference for self-medication.

- Prescription formulations: Limited but significant, often for patients with chronic respiratory issues.

- Generic vs. Branded: Generics constitute approximately 80% of sales, exerting downward pressure on pricing.

Major Players

- Johnson & Johnson: Offers Guaifenesin ER under the Robitussin brand.

- Perrigo: Specializes in generic formulations, with competitive pricing.

- Amneal and Mylan: Focus on cost-effective generics, increasing market penetration.

Competitive Strategies

- Pricing: Generics are priced 20-30% below branded counterparts.

- Formulation innovation: Extended-release technology enhances efficacy and patient compliance.

- Distribution: Widespread OTC availability through retail chains, pharmacies, and online portals.

Pricing Landscape

Current Pricing Overview

- OTC Guaifenesin ER Tablets (pack of 20): Retail prices vary from USD 8 to USD 15, depending on brand and packaging.

- Generic formulations: Typically priced at USD 6 to USD 12, offering cost benefits to consumers.

- Prescription formulations: Can range higher, USD 15 to USD 25 per package, subject to insurance and regional policies.

Market Drivers Affecting Pricing

- Generic Competition: Significant downward pressure on prices, especially in mature markets.

- Regulatory and Manufacturing Costs: Potential increases due to supply chain disruptions, tariffs, or ingredient sourcing issues.

- Consumer Trends: Rising demand for OTC and natural remedies influences pricing strategies.

Price Projections (2023-2028)

Based on current trends, regulatory environment, and competitive dynamics, the following projections are anticipated:

| Year | Expected Price Range (USD) for OTC Guaifenesin ER (per 20-count pack) | Notes |

|---|---|---|

| 2023 | $8 – $15 | Stability expected; minor price fluctuations |

| 2024 | $8 – $14.50 | Slight downward trend due to aggressive generic pricing |

| 2025 | $7.50 – $14 | Market saturation and increased competition |

| 2026 | $7 – $13.50 | Potential price stabilization or slight decline |

| 2027 | $6.50 – $13 | Cost-conscious consumers and online sales push prices lower |

| 2028 | $6 – $12.50 | Mature generics dominate; potential price ceiling |

Note: Prices for prescription and branded formulations are projected to follow similar trends, adjusted for insurance reimbursement policies and brand loyalty factors.

Market Opportunities and Challenges

Opportunities

- Growing respiratory illness prevalence: An aging population and increased respiratory infections boost demand.

- Expansion into emerging markets: Countries like India and China exhibit rising OTC sales with improving healthcare infrastructure.

- Innovation in formulation modalities: Combining Guaifenesin ER with other ingredients for multi-symptom relief can command premium pricing.

Challenges

- Price erosion due to generics: Market saturation diminishes margins, necessitating cost-efficiency.

- Regulatory hurdles: Variations across regions require tailored compliance strategies.

- Consumer shift toward natural therapies: May influence demand and pricing for traditional expectorants.

Implications for Stakeholders

Pharmaceutical companies should prioritize aggressive pricing strategies in mature markets while investing in formulation innovation to sustain premium positioning. Manufacturers targeting emerging markets must balance affordability with regulatory requirements. Additionally, online distribution channels offer opportunities for price competition and market expansion.

Key Takeaways

- Guaifenesin ER maintains a vital position within the expectorant segment, supported by consistent demand driven by respiratory health concerns.

- The prevalence of generic formulations ensures a downward pressure on prices, with projections indicating modest declines over the next five years.

- Market growth hinges on demographic trends, rising respiratory illnesses, and expanding distribution channels, notably online sales.

- Innovation in delivery systems and combination therapies can provide premium drug positioning and offset pricing pressures.

- Regulatory adaptations and strategic geographic expansion are essential to maximize revenue streams.

FAQs

1. How does the proliferation of generic Guaifenesin ER formulations impact market pricing?

Generics heavily influence pricing, reducing costs and enabling competitive retail prices. Sustained competition keeps prices within a narrow, declining margin, especially in mature markets.

2. Are there emerging markets with significant growth potential for Guaifenesin ER?

Yes, countries such as India, China, and Brazil present substantial opportunities owing to rising healthcare access, increasing respiratory illness prevalence, and expanding OTC sectors.

3. How might regulatory changes affect Guaifenesin ER pricing and availability?

Regulatory adjustments—such as stricter quality standards or new labeling requirements—could increase manufacturing costs, potentially raising prices or affecting product availability.

4. What innovations are shaping the future of Guaifenesin ER formulations?

Prolonged-release technology improvements, combination with other therapeutic agents, and natural or alternative delivery systems are key developments enhancing efficacy and market share.

5. How can companies mitigate risks associated with market saturation?

Diversification into related respiratory health products, geographic expansion, and continuous innovation can sustain revenue and reduce dependency on mature markets.

Sources

[1] MarketWatch, "Expectorants Market Overview", 2022.

[2] FDA Regulatory Guidelines, "Over-the-Counter Drug Monograph", 2021.

[3] Research and Markets, "Global Expectant Market Analysis", 2022.

More… ↓