Share This Page

Drug Price Trends for GS TUSSIN DM

✉ Email this page to a colleague

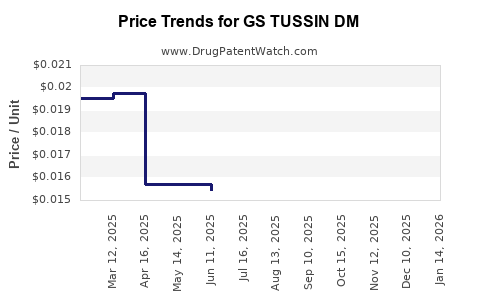

Average Pharmacy Cost for GS TUSSIN DM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS TUSSIN DM MAX LIQUID | 00113-0927-26 | 0.02104 | ML | 2025-12-17 |

| GS TUSSIN DM 200-20 MG/20 ML | 00113-1725-34 | 0.01454 | ML | 2025-12-17 |

| GS TUSSIN DM MAX LIQUID | 00113-0927-34 | 0.01710 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS TUSSIN DM

Introduction

GS TUSSIN DM, a widely utilized over-the-counter (OTC) cough suppressant and decongestant, remains a staple in treating cough and respiratory symptoms globally. Manufactured by various pharmaceutical companies, including generic producers, its pharmacological composition typically involves dextromethorphan (a cough suppressant) combined with pseudoephedrine (a decongestant). Understanding its market landscape and projecting future prices are essential for stakeholders—including manufacturers, retailers, healthcare providers, and investors—to inform strategic decisions amid evolving regulatory, competitive, and consumer behavior trends.

Market Overview

Global Market Size and Segmentation

The global cold and cough remedy market—which encompasses GS TUSSIN DM—was valued at approximately USD 20 billion in 2022, with a compound annual growth rate (CAGR) of 4.5% expected through 2028[1]. Within this mosaic, OTC cough suppressants like GS TUSSIN DM account for a significant share, driven by factors such as:

- Increasing prevalence of respiratory illnesses.

- Rising consumer preference for self-medication.

- Expanding distribution channels, including e-commerce.

- Regulatory relaxations in several markets.

Regional Insights:

- North America: Dominates the sector, capturing over 40% market share, supported by high OTC drug utilization and advanced distribution infrastructure.

- Asia-Pacific: Exhibits rapid growth owing to increasing healthcare awareness and expanding retail pharmacy networks.

- Europe: Maintains steady growth, influenced by aging populations and prevalent respiratory conditions.

Competitive Landscape

GS TUSSIN DM faces competition from branded formulations (e.g., Robitussin DM), private-label products, and emerging generics. Major stakeholders include large pharmaceutical firms, OTC specialists, and regional players. Patent expirations and regulatory approvals for generics have intensified price competition, influencing overall pricing dynamics.

Regulatory Environment

In the U.S., GS TUSSIN DM formulations containing pseudoephedrine are categorized under regulations aimed at curbing methamphetamine production, such as the Combat Methamphetamine Epidemic Act of 2005. Such legislation impacts supply chain and distribution logistics, indirectly affecting pricing and availability.

Current Pricing Dynamics

Pricing Landscape

Prices for GS TUSSIN DM products vary significantly by formulation, packaging, distribution channels, and geographic location. In the U.S.:

- Retail Price Range: A typical 4 fl oz (118 ml) bottle retails at USD 5–10.

- Wholesale Pricing: Bulk purchasing reduces per-unit costs, typically USD 3–6 per bottle.

- Private Label vs. Brand Name: Private-label alternatives are priced approximately 20–30% lower than branded counterparts.

Internationally, prices are often subdued due to local manufacturing, competitive markets, and regulatory constraints, with average retail prices approximately 30–50% lower than U.S. benchmarks.

Factors Influencing Pricing

- Generic Market Entry: The proliferation of generics reduces prices through cutthroat competition.

- Regulatory Compliance: Stringent packaging and labeling regulations can increase production costs and impact retail prices.

- Supply Chain Disruptions: COVID-19 pandemic-induced disruptions temporarily inflated prices due to supply shortages, a trend that has stabilized.

Future Price Projections (2023–2030)

Methodological Approach

Price projections leverage historical pricing data, observed industry trends, regulatory developments, and macroeconomic indicators. An elasticity model is integrated, acknowledging that consumer demand for OTC remedies exhibits moderate sensitivity to price changes, especially amidst influenza seasons or epidemic outbreaks.

Projected Trends

- Moderate Price Stability (2023–2025): Given increased generic competition, prices are expected to stabilize or decline marginally, averaging USD 4–8 per bottle in retail terms.

- Price Compression (2026–2028): Entry of additional generics and private-label brands may further depress prices by approximately 10–15%.

- Potential Price Rise (2029–2030): Anticipated regulatory adjustments, increased demand during respiratory illness surges, and supply chain constraints could elevate prices by 5–8%, pushing retail prices toward USD 6–12 per bottle.

Influencing Factors

- Regulatory Changes: Stricter controls on pseudoephedrine distribution could reduce supply, offsetting downward price trends.

- Market Penetration of Alternatives: New formulations (e.g., natural remedies) could erode market share and influence pricing of traditional GS TUSSIN DM.

- Technological Advancements: Enhanced manufacturing efficiencies and supply chain automation may mitigate costs, stabilizing prices further.

Market Opportunities and Risks

Opportunities

- Expansion into Emerging Markets: Growing demand for OTC cough remedies provides avenues for market entry and higher margins.

- Product Differentiation: Developing formulations with dual-action ingredients or improved delivery mechanisms can command premium pricing.

- Online Retail Penetration: E-commerce growth facilitates direct-to-consumer sales, allowing for optimized pricing strategies.

Risks

- Regulatory Stringency: Future restrictions on pseudoephedrine sales could diminish product availability and profit margins.

- Price Erosion: Increased competition and patent expirations threaten sustained high prices.

- Consumer Preference Shifts: Rising preferences for alternative remedies or natural products may reduce demand.

Key Takeaways

- The global market for OTC cough remedies, including GS TUSSIN DM, maintains steady growth, driven by rising respiratory illness prevalence and consumer self-medication trends.

- Price levels are currently attractive due to generic competition, with projections indicating slight decreases or stabilization through 2025.

- Post-2025, market dynamics may induce modest price increases driven by regulatory and supply chain factors.

- Stakeholders should monitor legislative developments, especially around pseudoephedrine sales, to adapt pricing and distribution strategies effectively.

- Opportunities lie in expanding geographic reach and product differentiation, while risks include regulatory constraints and evolving consumer preferences.

FAQs

1. How does regulatory regulation of pseudoephedrine impact GS TUSSIN DM pricing?

Regulations restricting pseudoephedrine sales, such as the Combat Methamphetamine Epidemic Act in the U.S., limit access and distribution channels. This reduces supply and can increase prices, especially in regions with strict enforcement, while also raising compliance costs for manufacturers.

2. Will generic competition continue to suppress the price of GS TUSSIN DM?

Yes. The entrance of multiple generic producers has historically driven prices downward. As patent protections expire and new generics emerge, downward pressure persists, though regulatory and supply chain factors may introduce volatility.

3. What are the future opportunities for manufacturers of GS TUSSIN DM?

Expanding into emerging markets, developing differentiated formulations, leveraging e-commerce platforms, and exploring new delivery mechanisms offer significant growth potential.

4. How might consumer behavior influence future prices?

Preference shifts toward natural or alternative remedies could reduce demand, potentially lowering prices. Conversely, increased awareness of respiratory illnesses during pandemics could temporarily inflate demand and prices.

5. Are there any recent regulatory changes that could influence the market?

Some jurisdictions are reevaluating OTC drug classifications and pseudoephedrine controls, which may impact supply chains, manufacturing costs, and retail pricing strategies.

References

[1] Transparency Market Research, "Cold and Cough Remedy Market," 2022.

More… ↓