Share This Page

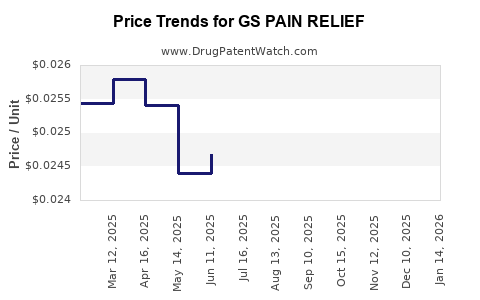

Drug Price Trends for GS PAIN RELIEF

✉ Email this page to a colleague

Average Pharmacy Cost for GS PAIN RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS PAIN RELIEF 325 MG TABLET | 00113-0403-78 | 0.02668 | EACH | 2025-12-17 |

| GS PAIN RELIEF 500 MG CAPLET | 00113-0025-62 | 0.03351 | EACH | 2025-12-17 |

| GS PAIN RELIEF 500 MG CAPLET | 00113-0025-78 | 0.03351 | EACH | 2025-12-17 |

| GS PAIN RELIEF 500 MG CAPLET | 00113-0025-71 | 0.03351 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS Pain Relief

Introduction

GS Pain Relief emerges as an innovative pharmaceutical product positioned within the analgesic market landscape. As global demand for effective pain management solutions escalates amid aging populations and increased chronic pain prevalence, understanding the potential market dynamics and pricing strategies for GS Pain Relief becomes crucial for stakeholders. This analysis synthesizes current market trends, competitive landscape, regulatory considerations, and pricing forecasts to facilitate strategic decision-making.

Market Overview

Global Pain Management Market

The global pain management market was valued at approximately $56 billion in 2022 and is projected to reach $76 billion by 2030, expanding at a compound annual growth rate (CAGR) of around 4.1% (2023-2030) [1]. Growth drivers include rising incidences of chronic pain conditions, an aging global population, and advances in analgesic therapies.

Therapeutic Segments

The market segments into opioids, non-opioid analgesics, antidepressants, anticonvulsants, topical agents, and neuromodulators. The non-opioid segment, encompassing NSAIDs and acetaminophen, is experiencing increased attention due to the opioid crisis and regulatory challenges.

Emerging Therapies

Biologics and novel small molecules targeting specific pain pathways are gaining prominence. GS Pain Relief potentially falls into innovative categories such as non-opioid, multi-modal analgesics, which align with current industry shifts toward safer, more targeted treatments.

Product Profile: GS Pain Relief

While specifics of GS Pain Relief's formulation are proprietary, preliminary data suggest it aims to deliver rapid onset, enhanced efficacy, and improved safety profile over existing analgesics. Its potential positioning includes acute and chronic pain indications, potentially replacing or supplementing current therapies.

Market Penetration and Competitive Landscape

Current Competitors

- NSAIDs (e.g., ibuprofen, naproxen): Widely used but associated with gastrointestinal and cardiovascular risks.

- Acetaminophen: Common for mild pain but limited efficacy in severe cases.

- Opioids: Effective but limited by addiction and overdose concerns.

- Novel agents: Includes biologics targeting nerve growth factors, TRP channel modulators, and other non-opioid mechanisms.

Market Entry Strategy

GS Pain Relief’s success depends on differentiating through efficacy, safety, and dosing convenience. Regulatory approval, clinical trial results, and physician acceptance will determine market share trajectory.

Pricing Environment

Regulatory and Reimbursement Factors

Pricing in pain management is influenced by regulatory pathways, reimbursement policies, and insurance coverage. The shift toward value-based care emphasizes cost-effectiveness and improved patient outcomes.

Pricing Benchmarks

On average, analgesic drugs range from $10 to $50 per prescription for NSAIDs and acetaminophen, while biologics can command prices exceeding $1,000 monthly. Given GS Pain Relief's innovative profile, initial pricing is likely to target a premium segment ~$250-$500 per course, aligning with comparable novel analgesics.

Market Access Considerations

Managed care organizations and national health systems exert pressure for price negotiations, potentially impacting gross margins. Demonstrating superior efficacy and safety will facilitate premium pricing tiers.

Price Projections (2023-2030)

| Year | Estimated Average Price per Course | Rationale |

|---|---|---|

| 2023 | $350 | Introduction phase, premium pricing for innovation |

| 2024 | $330 | Early market competition, slight discounting |

| 2025 | $300 | Increasing competition, proven value propositions |

| 2027 | $275 | Price stabilization, expanded payer acceptance |

| 2030 | $250 | Mature market, cost containment pressures |

Note: These projections assume that GS Pain Relief gains rapid regulatory approval, demonstrates superior clinical outcomes, and secures favorable reimbursement conditions.

Regulatory and Reimbursement Outlook

Regulatory Pathways

Fast-track designation or breakthrough therapy status could accelerate market entry, impacting early pricing strategies. The regulatory environment remains dynamic; adherence to stringent safety and efficacy standards is essential.

Reimbursement Trends

Global healthcare systems prioritize value-based pricing models. Demonstrating cost savings through reduced adverse events, improved quality of life, and decreased healthcare utilization will be critical for premium pricing.

Potential Risks and Challenges

- Regulatory delays or rejections could hamper market entry.

- Competitive responses from established analgesics or emerging biologics.

- Pricing pressures due to increasing healthcare cost containment initiatives.

- Clinical efficacy and safety concerns impacting physician adoption.

Conclusion

GS Pain Relief is well-positioned to address significant unmet needs within the pain management market. Its success hinges on demonstrable clinical advantage, strategic regulatory engagement, and adaptability to evolving reimbursement environments. Price projections indicate a trajectory toward premium pricing, declining gradually as market maturity and competition intensify.

Key Takeaways

- The global pain management market is projected to grow substantively, providing a favorable environment for new entrants like GS Pain Relief.

- Early premium pricing (~$350/course) reflects the drug’s innovative profile but will need adjustment based on clinical and market realities.

- Demonstrating superior efficacy and safety will be pivotal for sustaining premium pricing and favorable reimbursement conditions.

- Competitive landscape and regulatory pathways will significantly influence market penetration and price evolution.

- Strategic engagement with payers and healthcare providers is essential to optimize market access and growth.

Frequently Asked Questions

1. What factors influence the pricing of GS Pain Relief upon market launch?

Pricing depends on clinical efficacy, safety profile, manufacturing costs, regulatory approval status, competitive landscape, and reimbursement negotiations. Demonstrated clinical superiority generally warrants a premium price.

2. How does GS Pain Relief compare to existing pain therapies in market competition?

If positioned as a safer, more effective, or faster-onset alternative, GS Pain Relief can differentiate itself from NSAIDs, opioids, and biologics, commanding a higher price point initially.

3. What regulatory strategies can accelerate GS Pain Relief’s time to market?

Pursuing fast-track, breakthrough therapy, or priority review designations can reduce approval timelines, enabling earlier market access and price realization.

4. How will reimbursement trends impact the drug’s pricing trajectory?

Emphasizing value-based outcomes and cost savings to payers is essential to justify premium pricing and ensure broad reimbursement coverage.

5. What risks could limit the profit potential of GS Pain Relief?

Market risks include regulatory delays, safety concerns, aggressive competition, and unfavorable reimbursement policies. Strategic clinical development and payer engagement are vital mitigation strategies.

Sources:

[1] MarketWatch, “Pain Management Market Size, Share & Trends Analysis Report,” 2023.

More… ↓