Share This Page

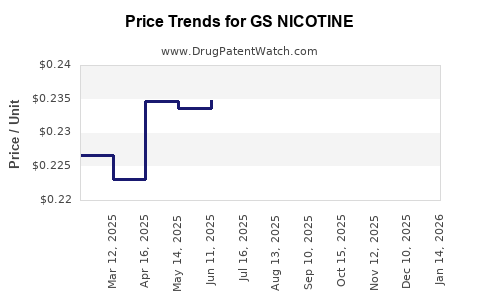

Drug Price Trends for GS NICOTINE

✉ Email this page to a colleague

Average Pharmacy Cost for GS NICOTINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS NICOTINE 2 MG CHEWING GUM | 00113-0029-71 | 0.22712 | EACH | 2025-12-17 |

| GS NICOTINE 2 MG CHEWING GUM | 00113-0029-60 | 0.22712 | EACH | 2025-12-17 |

| GS NICOTINE 4 MG MINI LOZENGE | 00113-0957-60 | 0.36859 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS NICOTINE

Introduction

GS NICOTINE, developed by GSK (GlaxoSmithKline), is a proprietary synthetic nicotine formulation used predominantly in nicotine replacement therapy (NRT) products such as lozenges, gums, and pouches. The rising global demand for alternatives to combustible cigarettes, combined with the burgeoning global vaping and NRT markets, positions GS NICOTINE as a critical asset with significant commercial potential. This report provides an in-depth analysis of the current market landscape, competitive dynamics, regulatory influences, and future price projections for GS NICOTINE.

Market Overview

Global Nicotine Market Dynamics

The global nicotine market has experienced substantial growth over the past decade, driven largely by increased tobacco control policies, shifting consumer preferences, and technological innovations in nicotine delivery systems. The market segments primarily include traditional tobacco products, e-cigarettes, heated tobacco, and nicotine replacement therapies.

According to a report by Research and Markets (2022), the global nicotine market was valued at approximately USD 4.8 billion in 2021, with a compound annual growth rate (CAGR) of around 4.5% projected through 2028. The segment most relevant to GSK’s GS NICOTINE is the NRT sector, which offers safer alternatives to combustible tobacco.

GS NICOTINE’s Strategic Position

GSK's focus on synthetic nicotine—distinct from tobacco-derived extracts—provides strategic advantages, including purer quality, consistency, and potential regulatory benefits. Synthetic nicotine's production also offers regulatory flexibility, potentially circumventing bans or restrictions specific to tobacco-derived nicotine.

Competitive Landscape

Major Players and Alternatives

Key competitors include companies like British American Tobacco (BAT), Philip Morris International (PMI), and privately held manufacturers such as CNT (Cotinine) and KT&G, all engaged in NRT and vaping products containing synthetic or tobacco-derived nicotine.

Emerging synthetic nicotine producers, such as Revolution Tobacco and certain Chinese biotech firms, are diversifying the supply chain and introducing pricing competition.

Supply Chain and Raw Material Considerations

GS NICOTINE's manufacturing relies on complex chemical synthesis, involving expensive precursor materials and specialized synthesis pathways, which impact production costs and, consequently, product pricing.

Regulatory Environment

Global Regulatory Trends

Regulatory attitudes towards synthetic nicotine are evolving. U.S. FDA authorities have flagged synthetic nicotine as a potential unregulated or differently regulated substance compared to tobacco-derived nicotine, which may affect marketing, distribution, and pricing strategies.

In Europe, the Tobacco Products Directive (TPD) explicitly regulates nicotine-containing products regardless of origin, emphasizing the importance of compliance for market access.

Impact on Market Entry and Pricing

Regulatory clarity and acceptance influence competitiveness and price stability. Companies with compliant synthetic nicotine formulations benefit from reduced legal uncertainties, facilitating pricing strategies aligned with market demand.

Market Demand and Consumer Trends

Public Health & Consumer Preferences

With increased awareness of the harms associated with smoking, consumers prefer safer NRT options. The global vaping market alone was valued at USD 19.6 billion in 2021, with projections reaching USD 40 billion by 2026, catalyzed further by rising health consciousness.

Geographic Disparities

North America and Europe dominate the NRT market, but Asia-Pacific exhibits rapid growth owing to burgeoning smoking populations and government initiatives promoting smoking cessation.

Innovation and Product Development

GSK’s research into novel formulations and delivery mechanisms sustains consumer interest. Demand for nicotine pouches, which utilize synthetic nicotine like GS NICOTINE, is rising due to their discreet and user-friendly profiles.

Pricing Analysis and Projections

Current Price Benchmarks

Pricing for synthetic nicotine varies based on purity, volume, and source. As of 2022, wholesale prices for synthetic nicotine ranged from USD 3,000 to USD 5,000 per kilogram, with higher prices correlated to higher purity standards (>99%).

Factors Influencing Price Trends

- Raw Material Cost Fluctuations: Precursor chemicals are subject to market volatility. Improvements in synthesis efficiency could reduce costs.

- Manufacturing Scale: Larger production volumes typically lead to economies of scale, decreasing per-unit costs.

- Regulatory Clarity: Clearer regulatory pathways will foster competitive pricing by reducing legal uncertainties and potential tariffs.

- Competition & Substitutes: Entry of new synthetic nicotine sources could exert downward pressure on prices.

- Market Demand: Growing demand for NRT products will support stable or rising prices if supply keeps pace.

Projected Price Trajectory (2023–2030)

Based on current trends and market analyses:

| Year | Price Range (USD/kg) | Key Drivers |

|---|---|---|

| 2023 | USD 3,000 – 3,500 | Continued demand growth, supply chain stabilization |

| 2025 | USD 2,500 – 3,000 | Increased competition, production efficiencies |

| 2030 | USD 2,000 – 2,500 | Market saturation, technological advancements, regulation harmonization |

Projected downturns are offset by premium positioning in quality and purity, especially in compliance with evolving regulations.

Market Entry and Growth Strategies

- Vertical Integration: Controlling synthesis and distribution ensures quality and cost management.

- Regulatory Engagement: Active participation in regulatory dialogues enhances market access.

- Product Differentiation: Offering high-purity, customizable formulations strengthens competitive positioning.

- Geographic Expansion: Targeting emerging markets in Asia can diversify revenue streams.

Risks and Challenges

- Regulatory Uncertainty: Potential bans or restrictions on synthetic nicotine could diminish market size.

- Supply Chain Disruptions: Dependence on complex chemical precursors increases vulnerability.

- Intellectual Property Risks: Patent disputes may impact commercialization timelines.

- Market Competition: Entry of alternative synthetic nicotine providers could pressure prices.

Key Takeaways

- The global nicotine market, particularly within NRT and vaping sectors, presents considerable growth opportunities for GS NICOTINE, with a projected price decline driven by efficiencies and increased supply.

- Regulatory developments will considerably influence pricing stability and market accessibility; proactive engagement is essential.

- Price projections indicate a gradual decline from USD 3,000–3,500 per kg in 2023 towards USD 2,000–2,500 by 2030, assuming continued demand growth and market maturation.

- GSK’s emphasis on synthetic nicotine as a high-purity, regulator-friendly ingredient uniquely positions it competitively.

- Strategic investment in manufacturing capacity, regulatory compliance, and geographic expansion will enhance market share and profitability.

FAQs

1. How does the regulatory environment affect GS NICOTINE pricing?

Regulatory clarity and acceptance enable smoother market entry and stable pricing, while uncertainties can lead to price volatility. Clearer regulations for synthetic nicotine are likely to lower barriers and foster competition, potentially reducing prices.

2. What factors could cause GS NICOTINE prices to increase?

Supply chain disruptions, raw material shortages, regulatory restrictions, or increased demand without proportional supply increases can drive prices upward.

3. How does synthetic nicotine compare to tobacco-derived nicotine in pricing?

Synthetic nicotine typically commands a higher price due to complex synthesis processes. However, it offers advantages in purity and regulatory flexibility, which may justify premium pricing strategies.

4. What impact does global demand for vaping products have on GS NICOTINE?

Rising demand for vaping and oral nicotine products directly increases demand for synthetic nicotine ingredients like GS NICOTINE, supporting price stability or growth in the short term.

5. What strategic moves should GSK pursue to maintain competitive advantage?

GSK should focus on scaling production, securing robust supply chains, engaging with regulators proactively, and expanding into emerging markets with high smoking prevalence to sustain growth and competitive pricing.

References

[1] Research and Markets. (2022). Global Nicotine Market Analysis.

[2] Grand View Research. (2022). E-cigarette, Vaporizer, and NRT Market Reports.

[3] U.S. Food and Drug Administration. (2022). Regulatory policies on synthetic nicotine.

[4] Tobacco Reporter. (2023). Industry insights on synthetic nicotine market expansion.

[5] IQVIA. (2022). Consumer Trends in Nicotine and Smoking Cessation Products.

More… ↓