Share This Page

Drug Price Trends for GS MUCUS DM ER

✉ Email this page to a colleague

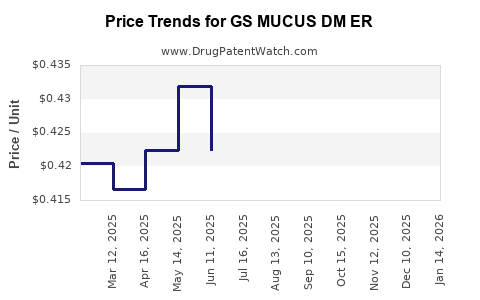

Average Pharmacy Cost for GS MUCUS DM ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS MUCUS DM ER 600-30 MG TAB | 00113-2219-49 | 0.37766 | EACH | 2025-12-17 |

| GS MUCUS DM ER 600-30 MG TAB | 00113-2219-49 | 0.39171 | EACH | 2025-11-19 |

| GS MUCUS DM ER 600-30 MG TAB | 00113-2219-49 | 0.39914 | EACH | 2025-10-22 |

| GS MUCUS DM ER 600-30 MG TAB | 00113-2219-49 | 0.40722 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

rket Analysis and Price Projections for GS MUCUS DM ER

Introduction

GS MUCUS DM ER, a prescription medication combining guaifenesin and dextromethorphan extended-release (ER), is indicated for symptomatic relief of cough and mucus congestion associated with respiratory conditions. As a prominent entrant in the respiratory therapeutics sector, understanding its market dynamics and pricing trajectory is critical for stakeholders. This analysis evaluates current market positioning, competitive landscape, regulatory considerations, and forecasted pricing trends for GS MUCUS DM ER within the evolving pharmaceutical landscape.

Market Overview

Therapeutic Market Context

The respiratory cough and cold market remains substantial, driven by seasonal epidemics and chronic COPD or asthma conditions. The U.S. cough and cold segment was valued at approximately $7.8 billion in 2022, with an expected CAGR of around 3% through 2027[1]. Extended-release formulations like GS MUCUS DM ER aim to meet unmet needs for sustained symptom control, positioning themselves as premium options within this market segment.

Target Patient Demographics

Primarily, GS MUCUS DM ER targets adults and adolescents suffering from persistent cough and mucus congestion. With increasing awareness of quality-of-life impacts, physicians are favoring formulations offering longer-lasting relief, especially in outpatient settings. The aging population amplifies demand, as chronic respiratory diseases become more prevalent.

Market Penetration and Adoption Factors

The product's success hinges on factors such as physician prescribing habits, patient compliance, reimbursement policies, and competition. GS MUCUS DM ER's extended-release technology provides convenience, possibly bolstering adherence and health outcomes, thus fostering market adoption.

Competitive Landscape

Key Competitors

Major competitors include traditional immediate-release combinations like Robitussin DM, Mucinex DM, and other generic formulations containing guaifenesin and dextromethorphan. Recently, new entrants and reformulations from generic and branded manufacturers have intensified competition[2].

Differentiators

GS MUCUS DM ER's extended-release profile can improve dosing frequency, distinguishing it from immediate-release counterparts. Its bioequivalent formulation must demonstrate comparable efficacy and safety to gain prescriber trust and coverage benefits.

Regulatory and Market Entry Considerations

The drug's approval status, patent protections, and exclusivity periods significantly influence market access and pricing ability. As an ER formulation, patent protections may extend, delaying generic competition and enabling premium pricing strategies.

Price Analysis

Current Pricing Landscape

As of late 2022, the average wholesale price (AWP) for branded GS MUCUS DM ER ranged from $25 to $35 per bottle (30-count), translating to roughly $0.83 to $1.17 per dose[3]. Generic alternatives, where available, trade at approximately 40-60% of brand prices, exerting downward pressure on the overall market prices.

Pricing Strategies and Value Proposition

Premium position owing to convenience and extended relief allows for higher price points compared to immediate-release counterparts. Payers and insurers may influence net prices via formulary placements and prior authorization requirements, especially if the drug demonstrates improved adherence outcomes.

Pricing Trends Forecast (2023–2028)

-

Short-Term (2023–2024):

Initially, prices are expected to remain stable, driven by patent protections and limited generic competition. Launch strategies emphasizing the benefits of ER technology support premium pricing, which could sustain premium margins. -

Medium-Term (2025–2026):

Patent expirations or biosimilar entries could commence, exerting downward pressure on prices. Anticipated price reductions for generics could bring the average cost per dose down by up to 50%. Concurrently, formulary negotiations may incentivize rebates, influencing net pricing. -

Long-Term (2027–2028):

As generics dominate, branded prices may decline by approximately 30–50%. However, if GS MUCUS DM ER can demonstrate clear clinical advantages—such as improved adherence or reduced healthcare utilization—its premium pricing could persist, especially in managed care settings.

Regulatory and Economic Considerations

Regulatory pathways, including potential approval for multi-indication use, can expand market access and justify pricing. Cost-effectiveness analyses that demonstrate reduced healthcare resource utilization could further support sustained or increased pricing.

Market Entry and Pricing Risks

-

Intense Competition:

The presence of numerous generic options constrains pricing power. -

Reimbursement and Formularies:

Payer policies might favor generics, pressuring branded prices. -

Regulatory Changes:

Policy initiatives targeting drug pricing may limit profit margins or enforce price caps. -

Patent Challenges:

Patent litigations or invalidations could accelerate generic entry and price erosion.

Strategic Recommendations

-

Value-Added Differentiation:

Highlight ER technology’s benefits for patient adherence and symptom control to justify higher prices. -

Market Penetration:

Engage in targeted physician education and robust pharmacoeconomic studies to establish clinical superiority. -

Pricing Flexibility:

Prepare for a tiered pricing model, incorporating discounts or rebates in managed care negotiations.

Key Takeaways

-

GS MUCUS DM ER occupies a strategic niche in the respiratory therapeutics market, with potential for premium pricing due to its extended-release formulation.

-

Immediate-term pricing stability is projected, with potential declines following patent expirations and increased generic competition.

-

Demonstrating clinical superiority and cost-effectiveness can prolong premium pricing and market share.

-

Navigating payer policies and formulary dynamics remains essential for maximizing revenue streams.

-

Strategic marketing emphasizing compliance, convenience, and health outcomes can optimize positioning amid competitive pressures.

Conclusion

The trajectory of GS MUCUS DM ER’s pricing hinges on regulatory exclusivities, innovation differentiation, and market competition. While current pricing models sustain premium margins, imminent generic competition necessitates adaptive strategies emphasizing value and differentiation. Stakeholders must monitor patent statuses, payer policies, and emerging clinical evidence to capitalize on market opportunities optimally.

FAQs

-

What factors influence the pricing of GS MUCUS DM ER in the current market?

The primary factors include patent protections, brand positioning, manufacturing costs, competitive generic pricing, reimbursement policies, and perceived clinical benefits. -

How does patent expiry impact the price of GS MUCUS DM ER?

Patent expiry opens the market to generic competitors, leading to substantial price reductions—often 50% or more—due to increased competition and generic entry. -

Can clinical advantages of GS MUCUS DM ER sustain its premium pricing after generics enter?

Yes, if the product demonstrates clear clinical benefits—such as improved adherence, reduced healthcare utilization, or superior efficacy—payers and physicians might support higher prices. -

What role do insurance and formulary negotiations play in pricing?

They directly influence net prices, with favorable formulary placement and rebates enabling better market penetration and profitability, even if branded prices are higher. -

What strategies can manufacturers employ to maintain revenue amid increasing generic competition?

Focus on differentiating through clinical data, expanding indications, optimizing manufacturing efficiencies, and employing value-based pricing approaches tailored to payers and patients.

Sources

[1] IQVIA. (2022). U.S. Cough and Cold Market Report.

[2] FDA. (2022). Drug Approvals and Generic Competition Updates.

[3] RedBook Online. (2022). Average Wholesale Prices for Respiratory Medications.

More… ↓