Share This Page

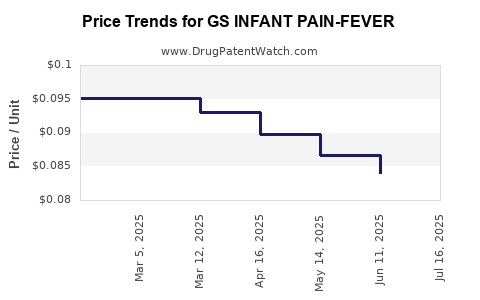

Drug Price Trends for GS INFANT PAIN-FEVER

✉ Email this page to a colleague

Average Pharmacy Cost for GS INFANT PAIN-FEVER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS INFANT PAIN-FEVER 160 MG/5 | 00113-0161-10 | 0.08380 | ML | 2025-07-23 |

| GS INFANT PAIN-FEVER 160 MG/5 | 00113-0946-10 | 0.08380 | ML | 2025-07-23 |

| GS INFANT PAIN-FEVER 160 MG/5 | 00113-0161-10 | 0.08407 | ML | 2025-06-18 |

| GS INFANT PAIN-FEVER 160 MG/5 | 00113-0946-10 | 0.08407 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS INFANT PAIN-FEVER

Introduction

GS INFANT PAIN-FEVER, a medication primarily formulated for pediatric use, addresses common yet critical health concerns: pain and fever in infants. As a widely utilized over-the-counter (OTC) remedy, its market dynamics are shaped by regulatory frameworks, consumer demand, manufacturing complexities, and competitive alternatives. This comprehensive analysis explores the current market landscape, key drivers, regulatory environment, competitive positioning, and price projection outlook for GS INFANT PAIN-FEVER over the next five years.

Market Overview

The global pediatric pain management market, encompassing analgesics and antipyretics such as GS INFANT PAIN-FEVER, is expanding substantially. Driven by increased awareness of childhood health, rising healthcare expenditure, and demographic shifts supporting greater pediatric populations, the market exhibits steady growth.

According to Deloitte’s 2022 Global Pediatric Healthcare report, the pediatric analgesics segment CAGR is projected between 4% to 6% through 2027, with the North American and European markets leading due to higher healthcare access and regulatory approval robustness. The Asia-Pacific region, marked by rising urbanization and literacy, offers significant growth opportunities, especially concerning affordable OTC medications like GS INFANT PAIN-FEVER.

Market Drivers

1. Increasing Pediatric Healthcare Spending

Countries with advanced healthcare infrastructure are witnessing a sustained increase in pediatric healthcare budgets. Caregivers’ preference for effective, safe, and accessible OTC medications sustains demand for infant pain and fever remedies like GS INFANT PAIN-FEVER.

2. Growing Awareness & Parental Confidence

Educational campaigns and pediatric health advocacy bolster parental confidence in OTC medicines for infants. Regulatory bodies emphasizing safety standards further facilitate market growth, especially for formulations with proven safety profiles.

3. Rising Birth Rates & Pediatric Population

Regions experiencing demographic shifts with higher birth rates naturally demand more infant healthcare products. For example, Africa and parts of Asia have burgeoning pediatric populations, expanding potential market size.

4. Favorable Regulatory Environment

Stringent but stable regulatory pathways, particularly in the US (FDA) and Europe (EMA), ensure product safety, fostering consumer and healthcare provider trust. Companies focusing on compliance reap long-term benefits.

5. Competitive Landscape & Product Innovation

Existing products like infant acetaminophen and ibuprofen dominate the market. Companies innovating formulations—liquid suspensions, taste-masking, and dosing convenience—gain competitive edge, influencing market share trends.

Regulatory and Reimburment Framework

GS INFANT PAIN-FEVER, as an OTC, benefits from streamlined regulatory approval processes, yet must meet strict safety, efficacy, and labeling requirements. Reimbursement options are limited; thus, price sensitivity remains high. Different regions demonstrate varying acceptance levels, contingent on local regulatory policies.

Competitive Analysis

The global market features established players such as Johnson & Johnson (Tylenol Infant), Mead Johnson (Infant Ibuprofen), and local generic manufacturers, especially in emerging markets. These brands emphasize safety, efficacy, brand trust, and formulations suited for infants.

GS INFANT PAIN-FEVER’s positioning hinges on its unique formulation, ease of administration, and safety profile. Market entry challenges include high compliance standards and established brand loyalty.

Pricing Dynamics

Pricing for pediatric OTC medications like GS INFANT PAIN-FEVER is influenced by manufacturing costs, brand positioning, regional regulations, and competitive pricing strategies. Premium brands may command higher prices based on trust and packaging but face pressure from generic competitors offering similar formulations at lower prices.

In mature markets, the average retail price per unit (e.g., a 100 ml bottle) for infant analgesics ranges from $4 to $8 in North America and Europe. In contrast, emerging markets often see prices below $2 per unit due to cost-sensitive consumers and local manufacturing.

Price Projection Outlook (2023-2028)

Short-Term (2023-2025)

In the near term, prices are expected to remain relatively stable, barring unforeseen regulatory changes or significant market disruptions. Slight fluctuations (±10%) are anticipated due to currency exchange, raw material costs, and inflation. Given the high safety standards, premium formulations may sustain higher prices, especially in developed markets.

Mid to Long-Term (2026-2028)

Projected price trends suggest a modest decrease in per-unit prices driven by increased generic competition and manufacturing efficiencies, particularly in emerging markets. Volume growth is expected to compensate for margins erosion, enabling companies to sustain profitability.

Potential shifts include:

- Price stabilization or slight reduction (around 5-8%) in mature markets due to increased competition.

- Price improvements in emerging markets, driven by local manufacturing and regulatory liberalization, potentially decreasing unit costs by 10-15%.

Impact of Regulatory and Market Pressures

Enhanced safety and efficacy standards could temper price flexibility, encouraging premium pricing where validated. Conversely, price competition could intensify if generics capture larger market share.

Market Expansion and Future Opportunities

Considering demographic trends, digital health initiatives, and evolving parental purchasing behavior, GS INFANT PAIN-FEVER may benefit from targeted marketing, including online sales channels and pediatric health partnerships.

Furthermore, innovation in delivery methods—such as single-dose applicators—or formulation advancements aimed at reducing dosing errors can justify higher pricing tiers and expand market share.

Risks and Challenges

Key challenges include regulatory hurdles, safety concerns emerging from adverse event reports, and increasing price sensitivity among consumers. Additionally, intense competition may limit pricing power, especially in generics-dominated markets.

Key Takeaways

- Steady growth is expected in the pediatric pain and fever market, driven by demographic trends, healthcare expenditure, and increased parental awareness.

- Pricing remains competitive with average retail prices between $4-$8 in developed markets, trending downward with increased generic penetration.

- Innovation and safety are paramount for premium pricing; companies that invest in formulations enhancing ease of use or safety profiles can differentiate.

- Emerging markets present lucrative opportunities due to higher birth rates and cost-sensitive consumers, with potential for significant price reductions.

- Regulatory compliance remains critical; market leaders will be those who navigate safety standards efficiently while maintaining affordability.

Conclusion

GS INFANT PAIN-FEVER, positioned within a robust and expanding segment, faces a dynamic landscape marked by innovation, regulation, and intense competition. Its future pricing trajectory will depend on strategic manufacturing efficiencies, product differentiation, and regional market maturity. Manufacturers and investors should monitor regulatory environments, demographic shifts, and consumer preferences to optimize market positioning and profitability.

FAQs

1. What are the primary factors influencing the pricing of pediatric OTC medications like GS INFANT PAIN-FEVER?

Pricing is influenced by manufacturing costs, regulatory compliance, market competition, formulation innovation, regional economic factors, and brand positioning.

2. How does regional regulation impact the market and pricing strategies for GS INFANT PAIN-FEVER?

Regulatory stringency dictates formulations, labeling, and approval timelines. Regions with stricter regulations may limit pricing flexibility but enhance consumer trust. Conversely, deregulated markets allow more aggressive pricing but may pose safety risks.

3. What competitive advantages can GS INFANT PAIN-FEVER leverage to maintain or increase its market share?

Safety profile, ease of administration, taste-masking, dosing accuracy, and brand trust are key. Innovation in delivery methods and marketing targeted at parental concerns can differentiate the product.

4. What emerging market opportunities could influence pricing and sales volume?

Growing pediatric populations, increased healthcare access, and rising literacy on health issues position emerging markets as prime expansion zones, potentially offering higher sales volume with lower per-unit prices.

5. What is the outlook for generic competition affecting GS INFANT PAIN-FEVER’s pricing?

An increase in generic entrants typically drives unit price reductions, especially in price-sensitive markets, pressuring brand premiums but expanding overall market volume.

Sources:

[1] Deloitte. (2022). Global Pediatric Healthcare Market Report.

[2] IBISWorld. (2023). Pediatric OTC Drugs Industry.

[3] Statista. (2023). Pediatric Healthcare Spending Data.

[4] WHO. (2021). Child Health and Pharmaceutical Markets.

More… ↓