Share This Page

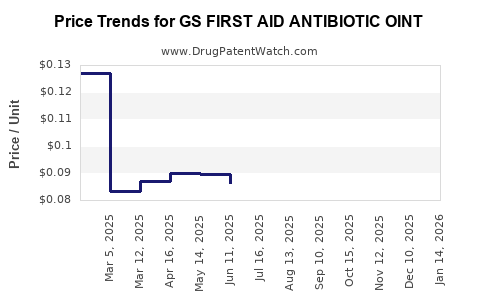

Drug Price Trends for GS FIRST AID ANTIBIOTIC OINT

✉ Email this page to a colleague

Average Pharmacy Cost for GS FIRST AID ANTIBIOTIC OINT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS FIRST AID ANTIBIOTIC OINT | 00113-0084-64 | 0.08664 | GM | 2025-11-19 |

| GS FIRST AID ANTIBIOTIC OINT | 00113-0084-64 | 0.08331 | GM | 2025-10-22 |

| GS FIRST AID ANTIBIOTIC OINT | 00113-0084-64 | 0.07998 | GM | 2025-09-17 |

| GS FIRST AID ANTIBIOTIC OINT | 00113-0084-64 | 0.08199 | GM | 2025-08-20 |

| GS FIRST AID ANTIBIOTIC OINT | 00113-0084-64 | 0.08311 | GM | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS First Aid Antibiotic Ointment

Introduction

The pharmaceutical landscape for topical antibiotics is characterized by high demand driven by widespread consumer use, increasing incidences of skin injuries, and rising awareness around wound care. GS First Aid Antibiotic Ointment occupies a significant segment within this category, primarily serving over-the-counter (OTC) markets for minor cuts, abrasions, and burns. As a branded or generic product, its market stability hinges on factors such as formulation efficacy, regulatory status, consumer trust, and competitive positioning. This analysis aims to evaluate current market dynamics and project future price trends, providing actionable insights for stakeholders and investors.

Market Overview

Global and Regional Demand

The global wound care market is projected to grow at a compound annual growth rate (CAGR) of approximately 6.4% from 2021 to 2028, reaching an estimated USD 22.9 billion by 2028 [1]. Ointments and topical antibiotics form a substantial share, driven by their affordability and ease of use. Key regional markets include North America, Europe, Asia-Pacific, and Latin America, with North America dominating due to consumers' high health awareness, robust OTC distribution systems, and patent protections favoring brand retention.

The rising incidence of pediatric skin injuries, sports-related wounds, and chronic conditions like diabetic ulcers contribute to sustained demand. Additionally, over-the-counter availability ensures buoyant sales, especially in retail pharmacies and drug stores.

Competitive Landscape

Major players in topical antibiotic ointments include Johnson & Johnson (Bacitracin), GlaxoSmithKline, and numerous generic manufacturers. The market has seen increased competition from store brands and private label products, often priced lower than branded counterparts.

GS First Aid Antibiotic Ointment competes by positioning itself as a reliable, efficacy-verified product. Its success depends on factors such as:

- Product efficacy and safety profile

- Brand recognition and consumer trust

- Distribution reach and marketing efforts

- Regulatory approvals in target markets

Given the generic nature or similar formulations, price elasticity plays a key role in consumer choice.

Regulatory and Market Entry Considerations

GS First Aid Antibiotic Ointment's compliance with FDA (U.S.), EMA (Europe), or equivalent regulatory standards ensures market access. The expiration of patents or exclusivities typically results in increased generic competition, impacting pricing strategies.

Additionally, the product's formulation—commonly including bacitracin, neomycin, polymyxin B, or similar antibiotics—must meet safety and efficacy standards, influencing manufacturing costs and, consequently, pricing.

Current Pricing Strategies

Typical retail prices for topical antibiotic ointments range from USD 2 to USD 8 per tube, depending on brand, formulation, pack size, and regional market dynamics. Generic versions often retail at a 20-50% discount compared to branded products, attracting price-sensitive consumers.

GS First Aid Antibiotic Ointment, as a mid-tier product, likely commands a retail price around USD 4-6 per 1 oz (28g) tube in North American markets, aligning with similar products.

Market Challenges and Opportunities

Challenges:

- Price competition from generics

- Regulatory fluctuations

- Consumer behavior shifting toward natural or alternative wound care remedies

- Potential antibiotic resistance concerns limiting use or leading to reformulations

Opportunities:

- Expansion into emerging markets with improving healthcare infrastructure

- Development of value-added formulations (e.g., combined antiseptics, moisturizers)

- E-commerce growth facilitating direct-to-consumer sales

- Strategic branding to enhance consumer loyalty and differentiate from generics

Price Projection Outlook (2023–2028)

Short-term (2023–2025)

In the near term, prices are expected to remain relatively stable, influenced by existing competitive structures and regulatory environments. Any fluctuations will likely stem from:

- Raw material cost changes (e.g., antibiotics, excipients)

- Regulatory adjustments requiring reformulations or label changes

- Strategic price reductions by competitors to gain market share

Projection: Retail prices for GS First Aid Antibiotic Ointment are anticipated to hover around USD 4-6 per tube, with moderate variation up to ±5% driven by inflation, supply chain costs, and regional market factors.

Medium to Long-term (2026–2028)

Emerging market penetration and shifts toward economic formulations may pressure prices downward, especially as generic competitors intensify. Conversely, increasing consumer preference for trusted brands or specific formulations could sustain or slightly increase prices.

Innovations such as combined formulations or organic/targeted wound care ointments could redefine pricing tiers, potentially adding premium segments.

Projection: Average retail price per tube could decline marginally to USD 3.50–5.50 by 2028, with price elasticity influenced by regional market maturity, competitive dynamics, and regulatory shifts.

Market Growth Drivers Impacting Pricing Strategies

-

Regulatory Landscape: Stringent regulations can elevate costs, leading to higher retail prices. Conversely, streamlined approval processes may facilitate competitive pricing.

-

Consumer Trends: Growing consumer awareness and preference for branded or natural products can sustain premium pricing segments.

-

Distribution Channels: Expansion through online retail and supply chain optimizations may offer cost advantages, affecting retail pricing structures.

-

Patent and Exclusivity Expirations: The expiration of patents on branded antibiotics opens markets for generics, exerting downward pressure on prices.

-

Innovation and Product Differentiation: Differentiated formulations with enhanced efficacy or added benefits can justify higher price points.

Strategic Implications

Stakeholders should monitor regulatory developments, regional market entry opportunities, and consumer health trends to adapt pricing models accordingly. Emphasizing product efficacy, safety profile, and consumer trust remains fundamental in maintaining market share and pricing power.

Key Takeaways

- The global wound care and OTC topical antibiotic market is expanding, driven by increasing skin injury incidences and rising consumer health awareness.

- GS First Aid Antibiotic Ointment competes amid a saturated market with price-sensitive consumers, requiring strategic positioning to balance affordability and brand value.

- Current retail prices are approximately USD 4-6 per tube; projections indicate a slight decline toward USD 3.50–5.50 by 2028 due to increased generic competition.

- Future pricing strategies should capitalize on regional expansion, product differentiation, and consumer education.

- Regulatory landscape and innovation dynamics critically influence market prices and growth opportunities.

FAQs

1. How does patent expiration impact the pricing of GS First Aid Antibiotic Ointment?

Patent expiration typically allows generic manufacturers to enter the market, increasing competition and exerting downward pressure on prices. Brand-specific formulations may retain higher prices temporarily through brand loyalty, but overall market prices tend to decline over time.

2. Are there regional differences in pricing for topical antibiotics?

Yes. Developed markets like North America and Europe generally sustain higher prices due to regulatory standards, higher consumer purchasing power, and established distribution channels. Emerging markets often have lower prices driven by economic factors and competitive strategies.

3. What role do regulatory approvals play in price projections?

Regulatory compliance costs influence manufacturing expenses and retail prices. Stricter regulations can increase costs, potentially raising prices, whereas streamlined approval processes can reduce costs and facilitate competitive pricing.

4. How does consumer perception influence pricing trends?

Trust in brand efficacy and safety sustains premium pricing. Increasing preference for natural or organic wound care products may shift consumer demand away from traditional antibiotics, impacting pricing strategies for existing products.

5. What strategies can stakeholders adopt to optimize profits amid price competition?

Innovating formulations, expanding international presence, enhancing brand reputation, and leveraging e-commerce channels can sustain margins. Differentiation through added benefits and consumer education can justify higher prices despite competitive pressures.

References

[1] MarketsandMarkets, "Wound Care Market by Product, Application, and Region – Global Forecast to 2028," 2021.

More… ↓