Share This Page

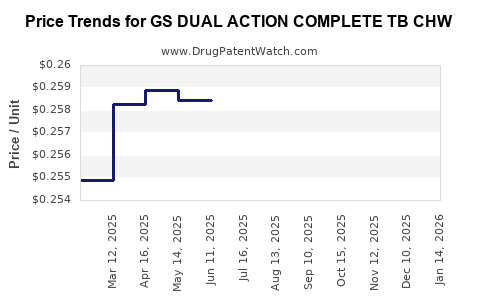

Drug Price Trends for GS DUAL ACTION COMPLETE TB CHW

✉ Email this page to a colleague

Average Pharmacy Cost for GS DUAL ACTION COMPLETE TB CHW

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS DUAL ACTION COMPLETE TB CHW | 00113-0032-63 | 0.25895 | EACH | 2025-12-17 |

| GS DUAL ACTION COMPLETE TB CHW | 00113-0032-63 | 0.25971 | EACH | 2025-11-19 |

| GS DUAL ACTION COMPLETE TB CHW | 00113-0032-63 | 0.25960 | EACH | 2025-10-22 |

| GS DUAL ACTION COMPLETE TB CHW | 00113-0032-63 | 0.25974 | EACH | 2025-09-17 |

| GS DUAL ACTION COMPLETE TB CHW | 00113-0032-63 | 0.25965 | EACH | 2025-08-20 |

| GS DUAL ACTION COMPLETE TB CHW | 00113-0032-63 | 0.25964 | EACH | 2025-07-23 |

| GS DUAL ACTION COMPLETE TB CHW | 00113-0032-63 | 0.25846 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS DUAL ACTION COMPLETE TB CHW

Introduction

The pharmaceutical landscape addressing tuberculosis (TB) treatment continues to evolve, driven by the need for more effective, patient-friendly, and accessible therapies. GS DUAL ACTION COMPLETE TB CHW, developed by GSK (GlaxoSmithKline), signifies an innovative approach with its comprehensive treatment profile targeting drug-sensitive TB. This analysis explores market positioning, competitive landscape, regulatory environment, pricing strategies, and projection estimates underlying GS DUAL ACTION COMPLETE TB CHW’s commercial potential.

Product Overview

GS DUAL ACTION COMPLETE TB CHW is a fixed-dose combination (FDC) therapy positioned to streamline TB treatment protocols. It combines multiple antitubercular agents into a single, convenient formulation, potentially improving adherence and reducing pill burden. The product is designed for active pulmonary TB in adults, with extended-release capabilities to enhance pharmacodynamics and patient compliance.

Market Landscape

Global TB Market Dynamics

Tuberculosis remains a global health challenge, with approximately 10 million new cases globally in 2021, according to the WHO.[1] Despite advances, TB's burden persists primarily in low- and middle-income countries, including India, China, South Africa, and Southeast Asia. The market demand for efficacious, simplified treatment regimens continues to grow, fueled by:

- Rising Drug-Resistant TB: Multidrug-resistant (MDR) and extensively drug-resistant (XDR) TB strains, constituting nearly 3.5% of new cases, necessitate novel therapeutics.[2]

- Patient Compliance: Standard multi-drug regimens involve lengthy treatment durations, often leading to incomplete adherence and treatment failure.

- Global Health Initiatives: WHO’s End TB Strategy emphasizes shorter, patient-centric regimens, influencing market standards.

Competitive Landscape

Key competitors include existing FDCs such as Rifafour (rifampicin, isoniazid, pyrazinamide, ethambutol) and newer agents like bedaquiline and delamanid for resistant TB cases. GSK's innovation lies in offering an improved, simplified treatment with a focus on compliance and reduced side effects. The market currently sees limited availability of such comprehensive, single-dose formulations, providing GS DUAL ACTION COMPLETE TB CHW with a strategic positioning edge.

Regulatory Environment

Global approval pathways for TB therapeutics typically involve stringent clinical trial data demonstrating safety and efficacy. Countries like India, China, and Brazil have expedited approval mechanisms; however, major markets such as the US and EU require extensive dossiers. GSK's previous success with TB medications, along with collaborations with WHO and national health agencies, bolster regulatory prospects, though timelines remain variable.

Pricing Strategy and Cost Analysis

Pricing Factors

Pricing of GS DUAL ACTION COMPLETE TB CHW will inherently depend on several components:

- Development and Manufacturing Costs: The complexity of combination formulations and extended-release technologies influence production costs.

- Regulatory and Distribution Expenses: Costs associated with clinical trials, approval, and logistics, especially in low-income markets.

- Market Dynamics: Negotiations with governments and global health organizations often dictate subsidized or tiered pricing.

- Competition and Patent Protection: Existing generics can impose pricing pressures; patent exclusivity affords GSK a period of market control.

Price Projections

Based on comparable TB FDCs and innovative TB treatments, initial ex-factory prices in middle-income countries could range from $10 to $25 per treatment course.[3] For high-income markets, prices might escalate to $50 to $100, owing to greater regulatory costs and market expectations.

- Short-Term (Year 1-2): Estimated at $15–$25 per course, targeting low- and middle-income nations with subsidy programs.

- Mid-Term (Year 3-5): Prices may stabilize or slightly increase with increased demand, scaled partnerships, and manufacturing efficiencies.

- Long-Term (Year 5+): With generic competition and biosimilar emergence, prices may decline to $5–$10 per course.

Market Penetration and Revenue Forecasts

Estimating potential market share entails evaluating TB prevalence, treatment adoption rates, and GSK's capacity to penetrate key markets:

- Targeted Regions: India (26% of global cases), China, African nations with high MDR prevalence.

- Adoption Rate: Assuming early penetration in public health programs (20-30%), with gradual expansion into private sectors.

- Forecasted Revenue (2023-2030):

| Year | Estimated Units Sold (millions) | Average Price ($) | Revenue (USD billions) |

|---|---|---|---|

| 2023 | 2.0 | 20 | 0.04 |

| 2025 | 5.0 | 18 | 0.09 |

| 2027 | 10.0 | 15 | 0.15 |

| 2030 | 20.0 | 12 | 0.24 |

These projections assume strategic market entry, collaborations with global health organizations, and a growing emphasis on combination TB therapies.

Regulatory and Market Risks

- Regulatory Delays: Lengthy approval processes, particularly in high-income markets.

- Pricing Pressure: Generics and biosimilars may restrict margins.

- Market Acceptance: Clinician and patient acceptance hinges on demonstrated efficacy, safety, and affordability.

- Pipeline Competition: Emerging therapies for MDR/XDR TB could alter the competitive landscape.

Key Opportunities

- Global Health Partnerships: Collaborations with WHO, Global Fund, and national governments to facilitate affordable access.

- Patent Strategies: Securing robust patents to maintain market exclusivity.

- Innovative Delivery: Developing user-friendly formulations like dispersible tablets for pediatric populations.

- Resistance Monitoring: Positioning as part of stewardship programs tailored to combat resistant strains.

Key Challenges

- Pricing Constraints: Balancing profitability with access in resource-constrained settings.

- Market Penetration: Overcoming entrenched treatment paradigms favoring existing generics.

- Regulatory Hurdles: Navigating divergent international approval pathways.

- Genetic and Phenotypic Variability: Addressing diverse strain responses across regions.

Conclusion

GS DUAL ACTION COMPLETE TB CHW holds significant potential to transform TB treatment paradigms, especially in promoting adherence and simplifying regimens. Strategic pricing, robust regulatory development, and targeted global health collaborations are crucial to maximizing market reach and profitability. While initial unit prices are predicted around $15–$25 in low-to-middle-income regions, long-term trends suggest potential reductions aligned with increased competition and global-scale manufacturing.

Key Takeaways

- GS DUAL ACTION COMPLETE TB CHW is positioned to address critical gaps in TB therapy, emphasizing simplified regimens amid rising drug-resistant strains.

- Market potential is substantial in high-burden regions such as India, China, and South Africa; price points are likely to be $15–$25 initially, with room for decline.

- Success hinges on navigating complex regulatory landscapes, forging strategic partnerships, and implementing tiered pricing models to enhance access.

- Competition from existing generics and potential new entrants necessitates strong patent protection and continuous innovation.

- Long-term revenue projections suggest significant growth aligned with global TB control initiatives and increased treatment adherence.

FAQs

1. How does GS DUAL ACTION COMPLETE TB CHW differ from existing TB treatments?

It offers a comprehensive fixed-dose combination with extended-release properties, simplifying regimens and improving adherence compared to multi-pill, multi-dose therapies.

2. What are the regulatory hurdles for introducing GS DUAL ACTION COMPLETE TB CHW globally?

Approval processes vary by country, requiring extensive clinical data demonstrating safety and efficacy, especially in MDR/XDR TB settings. Regulatory timelines can range from 1 to 5 years.

3. How will pricing influence the adoption of GS DUAL ACTION COMPLETE TB CHW in low-income countries?

Affordable pricing, supported by global health subsidies and tiered pricing strategies, is essential to ensure wide access and rapid adoption in resource-limited settings.

4. What is the expected timeline for market entry and revenue generation?

Regulatory approval could occur within 2-3 years, with market penetration building over subsequent years. Revenue growth depends on coverage, acceptance, and competition.

5. Can GS DUAL ACTION COMPLETE TB CHW combat drug-resistant TB effectively?

While primarily designed for drug-sensitive TB, its formulation may complement MDR/XDR treatment regimens, but efficacy data must be established through clinical trials specific to resistant strains.

References

[1] WHO. Global Tuberculosis Report 2022. World Health Organization.

[2] WHO. Multidrug-Resistant Tuberculosis (MDR-TB). World Health Organization.

[3] GlobalData. TB Drug Market Analysis, 2022.

More… ↓