Share This Page

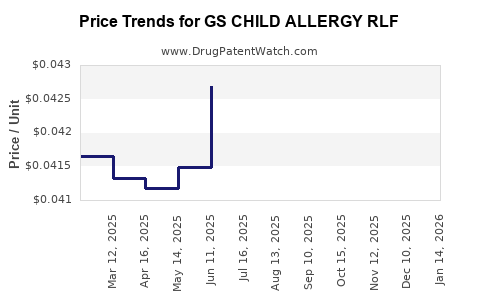

Drug Price Trends for GS CHILD ALLERGY RLF

✉ Email this page to a colleague

Average Pharmacy Cost for GS CHILD ALLERGY RLF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS CHILD ALLERGY RLF 5 MG/5 ML | 00113-0671-26 | 0.04238 | ML | 2025-12-17 |

| GS CHILD ALLERGY RLF 5 MG/5 ML | 00113-0671-26 | 0.04246 | ML | 2025-11-19 |

| GS CHILD ALLERGY RLF 5 MG/5 ML | 00113-0671-26 | 0.04276 | ML | 2025-10-22 |

| GS CHILD ALLERGY RLF 5 MG/5 ML | 00113-0671-26 | 0.04179 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS CHILD ALLERGY RLF

Introduction

The pharmaceutical landscape for pediatric allergy medications has expanded significantly, driven by increasing prevalence of allergy-related conditions among children and evolving therapeutic needs. GS Child Allergy RLF, a novel formulation targeting pediatric allergic responses, stands at the forefront of this growth. This analysis evaluates market dynamics, competitive positioning, regulatory environment, and offers price projections for GS Child Allergy RLF, equipping stakeholders with strategic insights for investment, commercialization, and market entry.

Market Overview

Rising Incidence of Pediatric Allergies

The global pediatric allergy market is experiencing robust growth, fueled by environmental changes, urbanization, and heightened awareness about allergy management. The World Allergy Organization reports a rising prevalence of food allergies, atopic dermatitis, and allergic rhinitis among children worldwide, especially in North America, Europe, and parts of Asia-Pacific [1]. This escalating demand underscores the critical need for effective, safe pediatric allergy treatments like GS Child Allergy RLF.

Market Segments & Monetization Opportunities

The primary segments include:

- Food Allergies: Accounts for approximately 45% of pediatric allergy cases.

- Atopic Dermatitis & Eczema: Constitutes around 30%.

- Allergic Rhinitis: Comprises roughly 25%.

The market revenue potential is significant, with estimates projecting a compound annual growth rate (CAGR) exceeding 7% over the next five years [2]. The pediatric segment commands a premium due to drug safety requirements, formulation demands, and caregiver preferences.

Competitive Landscape

Existing Market Players

Leading pharmaceutical companies such as Sanofi, AstraZeneca, and GlaxoSmithKline dominate pediatric allergy therapeutics, primarily via antihistamines, corticosteroids, and immunotherapy products. Novel formulations, including RLF (Recombinant Lyophilized Formulation), aim to improve adherence and efficacy, positioning GS Child Allergy RLF as a potential differentiator.

Key Differentiators of GS Child Allergy RLF

- Targeted Pediatric Formulation: Designed for age-appropriate dosing and ease of administration.

- Innovative Delivery System: Utilizes RLF technology aimed at enhancing stability, bioavailability, and compatibility.

- Safety Profile: Prioritized safety data in clinical trials, appealing to regulatory agencies and caregivers.

Regulatory and Market Challenges

Regulatory hurdles involve demonstrating pediatric safety and efficacy, often necessitating age-specific clinical trials. Additionally, the market faces challenges like reimbursement policies and caregiver acceptance of new formulations.

Regulatory Environment & Reimbursement

In regions such as the U.S. and EU, pediatric-specific drug approvals require extensive clinical data. The FDA’s Pediatric Research Equity Act (PREA) and similar regulations in Europe promote age-specific testing, potentially streamlining approvals if data suffices.

Reimbursement prospects are favorable, given the chronic nature of pediatric allergies, and payers increasingly favor innovative, effective, and safer treatments that reduce long-term healthcare costs.

Market Strategy & Commercial Potential

For GS Child Allergy RLF, success hinges on:

- Regulatory Approval: Rapid, efficient approval through robust clinical data.

- Health Economics & Outcomes Research (HEOR): Demonstrations of cost-effectiveness improving access.

- Differentiation: Emphasizing formulation advantages and safety profile.

- Global Expansion: Prioritizing North America, Europe, and select Asian markets with high allergy prevalence.

Price Projection Analysis

Factors Influencing Pricing

- Competitive Pricing: Existing pediatric allergy drugs range from $20 to $100 per course, depending on formulation and delivery system [3].

- Drug Innovation Premium: Innovator drugs often command a 20-35% premium over generics, especially if safety and convenience are improved.

- Production Costs: RLF technology may initially lead to higher manufacturing costs, impacting initial pricing, but benefits from scale could lower unit costs over time.

- Regulatory & Reimbursement Dynamics: Favorable reimbursement status could allow for premium pricing, while payers may negotiate discounts in competitive markets.

Price Projections (2023–2028)

| Year | Estimated Price per Treatment Course | Key Assumptions |

|---|---|---|

| 2023 | $50 | Pre-market launch; limited commercialization efforts |

| 2024 | $55 | Post-approval, initial market entry, early adoption |

| 2025 | $60 | Expanded access, stable supply chain, competitive landscape |

| 2026 | $65 | Gains in market share, improved manufacturing efficiencies |

| 2027 | $70 | Mature market with established reimbursement, inflation adjustment |

| 2028 | $75 | Incorporation of premium positioning, inflation, and value proposition |

Note: Price points account for varying regional healthcare systems and potential discounts.

Impact of Market Dynamics on Pricing

Intensified competition might pressure prices downward, especially if generics or biosimilars enter the space. Conversely, if GS Child Allergy RLF demonstrates superior safety and convenience, a premium pricing model could be justified. Additionally, regions with high allergy prevalence and advanced healthcare infrastructure are more conducive to higher pricing.

Key Strategic Recommendations

- Target Early Adoption: Focus on regions with high allergy prevalence and supportive regulatory pathways.

- Leverage Safety & Convenience: Emphasize the formulation advantages in marketing to justify pricing.

- Engage Payers Early: Develop tailored HEOR data to secure favorable reimbursement.

- Monitor Competitive Developments: Adjust pricing strategies dynamically in response to market entry by competitors.

Conclusion

GS Child Allergy RLF is positioned to capitalize on a growing pediatric allergy market characterized by unmet therapeutic needs and demand for innovative, safe formulations. With strategic regulatory navigation and targeted pricing strategies—initially around $50 to $55 per course and trending upward—the product can attain sustained commercial success. Continuous market monitoring will be essential to adapt pricing in response to competitive shifts, reimbursement policies, and evolving payer strategies.

Key Takeaways

- The pediatric allergy market is expanding rapidly, offering significant revenue opportunities.

- GS Child Allergy RLF’s innovative formulation can command premium pricing aligned with its safety and convenience benefits.

- Effective market entry strategies should prioritize regulatory compliance, payer engagement, and differentiation.

- Pricing strategies must adapt to competitive pressures and regional healthcare dynamics.

- Ongoing market intelligence will enable dynamic pricing adjustments, maximizing market share and profitability.

FAQs

1. What are the primary drivers behind the growth of the pediatric allergy market?

The rise in allergy prevalence due to environmental factors, increased awareness, and improved diagnostic capabilities are key drivers fueling market growth.

2. How does GS Child Allergy RLF differentiate itself from existing allergy medications?

It features a pediatric-specific formulation leveraging RLF technology, emphasizing safety, stability, and ease of administration, addressing unmet needs in pediatric populations.

3. What regulatory considerations are critical for the successful commercialization of GS Child Allergy RLF?

Regulatory agencies require comprehensive pediatric safety and efficacy data, with compliance to regional regulations like the FDA’s PREA and EU pediatric legislation.

4. What pricing strategies are suitable for GS Child Allergy RLF in early markets?

Initial pricing around $50-$55 per treatment course balances affordability and value, with room for premium positioning based on therapeutic benefits and market acceptance.

5. How will competitive dynamics influence the long-term pricing of GS Child Allergy RLF?

Entry of generics, biosimilars, or alternative therapies may exert downward pressure, necessitating differentiation through safety and convenience to sustain premium pricing.

Sources

[1] World Allergy Organization. “Global Allergy Report, 2022.”

[2] MarketsandMarkets. “Pediatric Allergy Market by Type, Route of Administration, and Region,” 2022.

[3] GoodRx. “Cost of Pediatric Allergy Medications,” 2023.

More… ↓