Share This Page

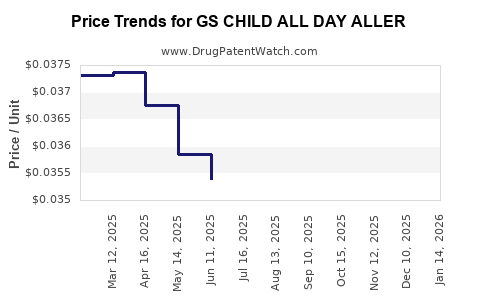

Drug Price Trends for GS CHILD ALL DAY ALLER

✉ Email this page to a colleague

Average Pharmacy Cost for GS CHILD ALL DAY ALLER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS CHILD ALL DAY ALLER 1 MG/ML | 00113-0189-26 | 0.03609 | ML | 2025-12-17 |

| GS CHILD ALL DAY ALLER 1 MG/ML | 00113-0503-26 | 0.03609 | ML | 2025-12-17 |

| GS CHILD ALL DAY ALLER 1 MG/ML | 00113-0189-26 | 0.03670 | ML | 2025-11-19 |

| GS CHILD ALL DAY ALLER 1 MG/ML | 00113-0503-26 | 0.03670 | ML | 2025-11-19 |

| GS CHILD ALL DAY ALLER 1 MG/ML | 00113-0189-26 | 0.03611 | ML | 2025-10-22 |

| GS CHILD ALL DAY ALLER 1 MG/ML | 00113-0503-26 | 0.03611 | ML | 2025-10-22 |

| GS CHILD ALL DAY ALLER 1 MG/ML | 00113-0189-26 | 0.03549 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS CHILD ALL DAY ALLER

Introduction

The pharmaceutical landscape for pediatric allergy treatments is consistently evolving, driven by regulatory shifts, patent life cycles, and market demand. GS CHILD ALL DAY ALLER emerges as a targeted allergen immunotherapy alternative designed explicitly for children, promising convenience and improved compliance. This analysis explores the drug’s current market positioning, competitive environment, regulatory considerations, and future pricing trajectories.

Product Overview

GS CHILD ALL DAY ALLER is a pediatric-specific allergen immunotherapy product formulated to reduce allergic symptoms prevalent in children. It leverages advanced delivery mechanisms—potentially sublingual or oral—to enhance adherence among young patients, distinguishing itself from traditional injectable allergen immunotherapies.

Key attributes include:

- Target demographic: Children aged 4-12.

- Indications: Allergic rhinitis, allergic conjunctivitis, and mild to moderate allergic asthma.

- Formulation: Sublingual allergen tablets or liquids, designed for ease of administration.

The product's innovativeness aligns with current market trends favoring non-invasive allergy treatments.

Market Landscape

Global Pediatric Allergy Treatment Market

The global allergy immunotherapy market is projected to reach USD 8.5 billion by 2027, growing at a compounded annual growth rate (CAGR) of approximately 8% [1]. The pediatric segment constitutes roughly 20-25% of this market, with rising prevalence of allergic diseases among children fueling inquiry and treatment adoption.

Key Competitors

Primary competitors for GS CHILD ALL DAY ALLER include:

- Oralair: A sublingual immunotherapy tablet approved for allergic rhinitis (ages 10+), produced by HollisterStier.

- Ragwitek: Sublingual immunotherapy for ragweed allergy, for ages 18+.

- Provenge: An emerging oral immunotherapy platform targeting pediatric populations.

While traditional subcutaneous immunotherapy (SCIT) remains effective, the trend favoring less invasive, home-administered options enhances innovation prospects for products like GS CHILD ALL DAY ALLER.

Regulatory Environment

The U.S. Food and Drug Administration (FDA) currently oversees allergen immunotherapy products, emphasizing safety and efficacy. The FDA's approval pathway for pediatric allergy drugs emphasizes age-appropriate formulations and minimized adverse effects. Notably, the FDA's recent expedited review pathways (e.g., Fast Track, Breakthrough Therapy) could accelerate GS CHILD ALL DAY ALLER's market entry.

European regulatory bodies (EMA) follow similar protocols, and key markets include Japan, Canada, and Australia, considering regional approval timelines.

Market Penetration & Adoption Potential

Patient compliance remains a hurdle for traditional immunotherapy modalities, especially among children. The promise of a convenient, non-invasive treatment positions GS CHILD ALL DAY ALLER favorably to achieve rapid penetration.

Healthcare providers' receptivity, reimbursement policies, and insurance coverage significantly influence adoption rates, with pediatric market entry contingent upon demonstrated safety and efficacy in clinical trials.

Pricing Strategy and Projections

Factors Influencing Price Points

Market success hinges on appropriate pricing aligned with manufacturing costs, competitive landscape, perceived value, and reimbursement climate.

- Regulatory and manufacturing costs: Biologic and allergen-based therapies typically command premium pricing due to complexity.

- Competitive positioning: Currently, sublingual immunotherapy tablets price between USD 400-700 annually.

- Pediatric-specific value addition: The ease of use and safety profile can justify a premium.

Current Benchmarks

- Oralair: Approximate annual cost of USD 500-600.

- Ragwitek: Approximately USD 600 per year.

- Subcutaneous immunotherapy (SCIT): Ranges from USD 400-800 annually, with additional administration costs.

Price Projection Timeline

| Timeline (Years) | Expected Pricing Range (USD) | Rationale |

|---|---|---|

| Year 1 (Post-Launch) | USD 650–750 | Premium pricing due to novelty and pediatric focus |

| Year 3 | USD 600–700 | Competitive stabilization, economies of scale |

| Year 5 | USD 550–650 | Market saturation, increased competition |

This trajectory assumes successful clinical trial outcomes, regulatory approval, and positive payer negotiations.

Impact of Patent and Exclusivity

Patent protection, typically lasting 8-12 years from filing, can sustain pricing power. Upon patent expiry, generic or biosimilar competition may drive prices down by approximately 30-50%. Strategic patent extensions or new formulations could temporarily preserve higher margins.

Regulatory and Market Dynamics Impacting Pricing

- Reimbursement and Coverage: Favorable reimbursement strategies can sustain or increase pricing. Negotiations with payers are crucial for value-based pricing models.

- Manufacturing Scale: Larger production volumes lower per-unit costs, enabling potential price reductions without sacrificing margins.

- Global Market Expansion: Entry into emerging markets may require price adjustments aligned with local purchasing power, potentially lowering initial prices but expanding market share.

Conclusion

GS CHILD ALL DAY ALLER is positioned to capitalize on the growing pediatric allergy therapy market owing to its patient-centric formulation and convenience. A strategic pricing approach—starting in the USD 650–750 range—should reflect its innovative delivery and target demographic. Over time, as competition and market dynamics evolve, a gradual price adjustment is expected, balancing profitability with accessibility.

Key Takeaways

- The pediatric allergy immunotherapy market is expanding globally, with a preference for non-invasive, easy-to-administer options.

- Competitor products are priced around USD 400 to 700 annually; GS CHILD ALL DAY ALLER should initially command a slightly higher price due to innovation, approximately USD 650–750.

- Market entry will depend heavily on clinical trial success, regulatory approval, and payer negotiations.

- Patent protection and exclusive marketing rights will be critical for maintaining premium pricing over initial years.

- Future price reductions are likely as generic/biosimilar competitors emerge and market saturation occurs.

FAQs

-

When can we expect GS CHILD ALL DAY ALLER to enter the market?

If clinical trials proceed without delays and regulatory submissions are successful, market entry could occur within 2-3 years. -

What differentiates GS CHILD ALL DAY ALLER from existing allergy immunotherapies?

Its pediatric-specific formulation, ease of administration, and potentially improved safety profile distinguish it from traditional injectable or adult formulations. -

What are the main regulatory hurdles for GS CHILD ALL DAY ALLER?

Demonstrating safety specific to children, establishing efficacy in pediatric populations, and complying with pediatric clinical trial regulations are primary challenges. -

How might insurance coverage influence pricing strategies?

Favorable coverage will support premium pricing; conversely, limited reimbursement may necessitate price reductions or value-based pricing models. -

What is the potential for global expansion?

Early regulatory success in key markets (U.S., EU, Japan) will facilitate broader acceptance, but regional regulatory and reimbursement differences will influence global pricing and adoption.

Sources:

[1] Fortune Business Insights, "Allergy Immunotherapy Market Size, Share & Industry Analysis," 2022.

More… ↓