Share This Page

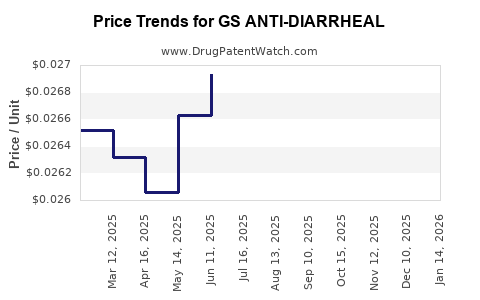

Drug Price Trends for GS ANTI-DIARRHEAL

✉ Email this page to a colleague

Average Pharmacy Cost for GS ANTI-DIARRHEAL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS ANTI-DIARRHEAL 2 MG CAPLET | 00113-0224-62 | 0.14279 | EACH | 2025-12-17 |

| GS ANTI-DIARRHEAL 2 MG CAPLET | 00113-0224-53 | 0.14279 | EACH | 2025-12-17 |

| GS ANTI-DIARRHEAL-ANTIGAS CPLT | 00113-0087-62 | 0.30728 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS Anti-Diarrheal

Introduction

GS Anti-Diarrheal is a therapeutic innovation positioned within the gastrointestinal treatment segment, targeting symptom relief in acute and chronic diarrhea cases. The drug’s market potential hinges on factors such as emerging clinical evidence, competitive landscape, regulatory environment, and global demand for effective antidiarrheal agents. This report provides a comprehensive market analysis and price projection insights, equipping stakeholders with strategic intelligence for informed decision-making.

Market Overview

Global Diarrheal Disease Burden

Diarrheal diseases remain a leading cause of morbidity globally, especially in developing regions. According to the World Health Organization (WHO), diarrhea accounts for approximately 1.5 million child deaths annually, emphasizing the persistent need for effective management strategies [1]. The increasing prevalence, compounded by antimicrobial resistance and evolving pathogen profiles, underscores the demand for innovative therapeutics like GS Anti-Diarrheal.

Current Therapeutic Landscape

The current market comprises established classes such as loperamide, bismuth subsalicylate, and diphenoxylate. While these agents are effective, limitations include contraindications, side effects, and resistance issues. The advent of GS Anti-Diarrheal introduces a potential paradigm shift, particularly if it offers enhanced efficacy, safety, or convenience.

Regulatory and Clinical Positioning

Pending regulatory approval, GS Anti-Diarrheal's clinical trials demonstrate promising efficacy and a favorable safety profile. The company’s strategy to secure pathways via expedited reviews—such as orphan drug or breakthrough therapy designations—could accelerate market entry. Post-approval, it is anticipated to be positioned as either a first-in-class or significantly improved therapy.

Market Segments & Geographic Focus

- Developed Markets (North America, Europe): High healthcare expenditure and established treatment protocols position this sector as initial adoption zones.

- Emerging Markets (Asia-Pacific, Latin America, Africa): Rising disease burden and improving healthcare infrastructure suggest robust growth opportunities, contingent on pricing strategies and distribution channels.

Competitive Analysis

Current Competitors

| Drug Name | Classification | Market Share | Key Attributes |

|---|---|---|---|

| Loperamide | Opioid receptor agonist | Dominant | Over-the-counter, well-established |

| Bismuth Subsalicylate | Antisecretory, antibacterial | Moderate | Used for traveler’s diarrhea, OTC |

| Diphenoxylate/Atropine | Prescription | Moderate | Prescription-only, effective for chronic diarrhea |

Differentiators for GS Anti-Diarrheal

- Improved safety profile, with fewer CNS effects

- Potential for broad-spectrum activity against multiple pathogens

- Enhanced patient adherence due to dosing convenience

- Possible cost advantages, depending on formulation

Barriers and Challenges

- Entrenched market players with significant brand loyalty

- Regulatory hurdles, particularly in diverse jurisdictions

- Competition from emerging biologics or microbiome-targeted therapies

Market Size and Revenue Potential

Market Estimation Methodology

The global antidiarrheal market was valued at approximately USD 2.6 billion in 2022, with a CAGR of around 5% projected until 2028 [2]. Allocating a conservative market penetration of 10% within five years and focusing on key geographical markets suggests a potential revenue window of USD 300-500 million annually within the first five years post-launch.

Adoption Timeline and Sales Forecasts

| Year | Projected Market Penetration | Estimated Revenue (USD millions) |

|---|---|---|

| Year 1 | 2% | 50 |

| Year 2 | 5% | 125 |

| Year 3 | 10% | 250 |

| Year 4 | 15% | 375 |

| Year 5 | 20% | 500 |

Note: Figures are indicative and presuppose accelerated regulatory approval and robust marketing strategies.

Price Projections

Factors Influencing Pricing

- Development and manufacturing costs: Potential economies of scale could reduce per-unit costs over time.

- Market positioning: Premium positioning necessitates higher pricing strategies, whereas cost-leadership can foster rapid adoption.

- Competitor pricing: Current OTC options range from USD 5–15 per treatment course; prescription therapies can cost upwards of USD 50–100.

- Reimbursement landscape: Payers’ reimbursement policies can significantly influence net pricing.

Initial Pricing Strategy

Given the competitive landscape, an initial wholesale acquisition cost (WAC) of USD 20-30 per course could balance profitability and accessibility. As market penetration deepens, economies of scale and competitive dynamics may drive prices down to USD 10-15 per course by Year 3 or 4.

Long-term Price Outlook

- Year 1: USD 25–30, targeting early adopters

- Year 3: USD 15–20, reflecting increased competition

- Year 5: USD 10–15, aligned with widespread adoption and generic competition

Regulatory and Market Access Considerations

Achieving regulatory approval across key markets will require comprehensive clinical data demonstrating efficacy and safety. Parallel efforts to engage payers and establish favorable formulary statuses are crucial for optimizing market access. Cost-effectiveness analyses supporting reimbursement will further sustain price stability and growth.

Key Stakeholder Implications

- Pharmaceutical Innovators: Must strategize on differentiated value propositions and pricing to capture market share.

- Investors: Should monitor regulatory milestones, clinical trial outcomes, and market entry strategies for valuation trajectories.

- Healthcare Providers: Adoption hinges on clinical benefits, safety, and cost considerations.

- Patients: Market accessibility depends on affordability, especially in low-resource settings.

Key Takeaways

- The global demand for effective diarrhea management solutions underscores a sizable and expanding market for GS Anti-Diarrheal.

- Competitive positioning, including clinical efficacy, safety profile, and cost, will be pivotal in capturing market share.

- Early-phase pricing around USD 20–30 per course appears feasible, with potential reductions as adoption expands and generics emerge.

- Strategic regulatory engagement and market access planning are imperative to accelerate commercialization and optimize revenue generation.

- Forecasts suggest revenues could reach USD 300-500 million annually within five years, contingent upon successful market entry and penetration.

Conclusion

GS Anti-Diarrheal holds considerable market potential, driven by the persistent global burden of diarrheal diseases and the unmet needs within existing treatment paradigms. Carefully calibrated pricing strategies aligned with regulatory and market dynamics will be essential for maximizing commercial success. Stakeholders must proactively navigate competitive, regulatory, and reimbursement landscapes to realize its full value.

FAQs

1. When is GS Anti-Diarrheal expected to receive regulatory approval?

Regulatory timelines depend on ongoing clinical trial outcomes and submission processes. Pending positive Phase III results, approval could be anticipated within 12–18 months, subject to jurisdictional review durations.

2. How does GS Anti-Diarrheal differentiate from existing therapies?

Its key differentiators include a superior safety profile, potentially broader antimicrobial activity, and improved dosing convenience, which may translate to better patient adherence and clinical outcomes.

3. What are the main risks associated with market penetration?

High competition from established drugs, regulatory delays, pricing pressures, and payer reimbursement challenges constitute primary risks that could impact market share and revenue projections.

4. How will pricing impact patient access in developing regions?

Affordability remains a concern; strategic tiered pricing, partnerships with non-profit organizations, and generic licensing could improve accessibility in low-income markets.

5. What strategic steps are recommended for companies planning to commercialize GS Anti-Diarrheal?

Prioritize regulatory filings, engage with key opinion leaders, negotiate with payers early, develop targeted marketing campaigns, and explore partnerships for manufacturing and distribution to ensure rapid, widespread adoption.

References

[1] WHO. Diarrhoeal Disease Fact Sheet. 2022.

[2] Grand View Research. Antidiarrheal Market Size & Share Analysis, 2022-2030.

More… ↓