Share This Page

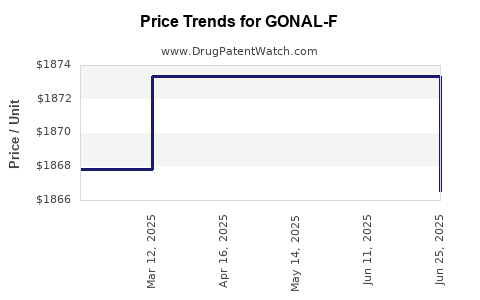

Drug Price Trends for GONAL-F

✉ Email this page to a colleague

Average Pharmacy Cost for GONAL-F

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GONAL-F RFF REDI-JECT 900 UNIT PEN | 44087-1117-01 | 1873.34445 | ML | 2025-06-18 |

| GONAL-F RFF REDI-JECT 900 UNIT PEN | 44087-1117-01 | 1873.34445 | ML | 2025-05-21 |

| GONAL-F RFF REDI-JECT 900 UNIT PEN | 44087-1117-01 | 1873.34445 | ML | 2025-04-23 |

| GONAL-F RFF REDI-JECT 900 UNIT PEN | 44087-1117-01 | 1873.34445 | ML | 2025-03-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GONAL-F

Executive Summary

GONAL-F (follitropin alfa), a recombinant follicle-stimulating hormone (rFSH), is a leading therapeutic used in assisted reproductive technology (ART) procedures such as in-vitro fertilization (IVF). Market dynamics are shaped by demographic trends, technological advancements, healthcare policies, and competition from biosimilars and innovative therapies. The global GONAL-F market is projected to reach approximately $1.5 billion by 2027, growing at a compound annual growth rate (CAGR) of 6-8% (2023–2027). Price projections indicate a possible decline in per-unit costs driven by biosimilar entries and increased market competition, though premium pricing persists in certain high-income segments.

This analysis synthesizes current market data, competitive landscape, regulatory factors, and pricing trends to inform stakeholders on future opportunities and risks.

Market Overview

Product Profile

GONAL-F is manufactured by Merck Serono (a division of Merck KGaA, Darmstadt, Germany). It is primarily indicated for stimulating follicular development in women undergoing fertility treatments, and for inducing spermatogenesis in men with certain infertility conditions. GONAL-F's unique recombinant technology ensures high purity and consistent quality, supporting its premium pricing.

Global Market Size and Growth

| Metric | 2022 | Projected 2027 | CAGR (2023–2027) |

|---|---|---|---|

| Market Size | ~$1.0 billion | ~$1.5 billion | 6-8% |

- Key Markets: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

- Consumption Drivers:

- Rising infertility prevalence (WHO estimates ~10-15% globally),

- Increased access to assisted reproductive techniques (ART),

- Technological innovations improving success rates.

Market Segmentation

| Segment | Description | Estimated Share (2023) | Key Trends |

|---|---|---|---|

| Therapeutic Use | Ovarian stimulation in IVF, egg donation, and ovulation induction | 70% | Shift towards personalized protocols |

| Male Infertility | Inducing spermatogenesis | 20% | Growing acceptance and treatment options |

| Biosimilar Competition | Cost-effective alternatives | 10% | Rapid expansion, especially in cost-sensitive markets |

Competitive Landscape

Major Players

| Company | Product/Brand | Market Share (Est.) | Key Differentiators |

|---|---|---|---|

| Merck KGaA | GONAL-F | 80% | Proven efficacy, extensive clinical data |

| Siprano (Teva) | Biosimilar GnRH analogs | ~10% | Lower price point, expanding geographically |

| Pfizer | Ovaleap (biosimilar follitropin alfa) | ~5% | Competitive pricing, growing footprint |

| Other biosimilars | Various | ~5% | Price-sensitive markets |

Biosimilar Impact

Biosimilars, introduced in Europe since 2015 and gradually in the US after 2020, are exerting downward pressure on prices. Price reductions of 15-30% are observed in key markets, with some markets experiencing more aggressive discounts due to patent expirations and regulatory support.

Regulatory and Policy Factors Influencing Market & Pricing

| Factor | Impact | Notes |

|---|---|---|

| Patent Expiry | Accelerates biosimilar entry | GONAL-F patents started facing challenge from biosimilars post-2020 |

| Reimbursement Policies | Variability across countries | More restrictive policies in Europe favor biosimilars; in the US, favorable reimbursement supports premium brands |

| Quality and Pharmacovigilance | Critical for biosimilar approval | Stringent in Europe; evolving in emerging markets |

Price Dynamics and Projections

Historical Price Trends (Per IU)

| Period | Approximate Price (USD) | Comments |

|---|---|---|

| 2018 | $10 - $15 | Premium pricing, high brand loyalty |

| 2020 | $8 - $12 | Slight decrease amid biosimilar competition |

| 2022 | $7 - $11 | Further reductions due to increased biosimilar offerings |

Future Price Trends

| Projection Year | Estimated Price (USD per IU) | Trends & Drivers |

|---|---|---|

| 2023 | $6 - $10 | Continued biosimilar entry, policy influence |

| 2025 | $5 - $8 | More biosimilars, price-based market share shifts |

| 2027 | $4 - $7 | Market stabilization at lower price points |

Note: Price elasticity varies by region—higher in emerging markets, somewhat stable in North America and Europe due to reimbursement and clinical preferences.

Market Drivers and Challenges

Drivers

- Increasing infertility rates globally.

- Advancements in ART techniques improving success rates.

- Patient preference for recombinant over urinary-derived products.

- Growing acceptance of biosimilars in licensed markets.

Challenges

- Cost containment pressures from payers.

- Regulatory hurdles for biosimilar approval.

- Variability in reimbursement policies.

- Competition from novel biologics and alternative treatments.

Comparison of GONAL-F with Competitive Alternatives

| Attribute | GONAL-F (Recombinant FSH) | Biosimilars (e.g., Ovaleap, Bemfola) | Urinary-derived FSH (e.g., Follistim) |

|---|---|---|---|

| Efficacy | Proven, consistent | Similar efficacy; clinical evidence supporting equivalence | Slightly variable due to heterogeneity |

| Safety | Robust data | Similar safety profile | Slight concerns over impurities |

| Price | Premium | Discounted (15-30%) | Lowest, but with potential for variability |

| Patient Preference | High | Growing | Declining due to safety and efficacy concerns |

Implications for Stakeholders

| Stakeholder | Strategy & Outlook |

|---|---|

| Manufacturers | Focus on biosimilar development, optimizing supply chain, and navigating regulatory landscapes. |

| Healthcare Providers | Prioritize patient outcomes; consider cost and efficacy balance. |

| Policymakers & Payers | Promote biosimilar adoption through reimbursement policies to reduce costs. |

| Investors | Monitor biosimilar pipelines and regulatory developments for valuation opportunities. |

Key Opportunities & Risks

| Opportunities | Risks |

|---|---|

| Expanding footprint in emerging markets | Price wars leading to erosion of margins |

| Development of new formulations or delivery methods | Regulatory delays or denials |

| Increased adoption of personalized medicine | Market saturation owing to biosimilar proliferation |

| Strategic partnerships to innovate pricing models | Resistance from established brands |

Conclusion

The GONAL-F market, valued at approximately $1 billion in 2022, is poised for steady growth driven by global infertility trends and ART advancements. Price competition, notably from biosimilars, will likely suppress average prices over the period to 2027. However, high-quality manufacturing, proven efficacy, and strong clinical data sustain GONAL-F’s premium position in developed markets. Strategic adaptation, including biosimilar pipeline development and regional price strategies, is critical for stakeholders aiming to capitalize on this evolving landscape.

Key Takeaways

- Expected market growth (~6-8% CAGR) through 2027, reaching ~$1.5 billion.

- Biosimilars will exert notable downward pressure on prices, particularly in cost-sensitive regions.

- Regulatory and reimbursement policies significantly influence pricing and market access.

- Premium brands like GONAL-F maintain market dominance in developed countries due to trusted efficacy and safety data.

- Future success hinges on innovation, regional strategy, and competitive differentiation.

FAQs

Q1: What factors are most influencing GONAL-F pricing in 2023?

A1: The entry and acceptance of biosimilars, reimbursement policies, regional regulatory frameworks, and manufacturing costs are primary influencers.

Q2: How do biosimilars impact the revenue of Merck Serono's GONAL-F?

A2: Biosimilars introduce competitive pricing, which can reduce GONAL-F’s market share and margins, especially in markets with rapid biosimilar adoption.

Q3: Which regions are expected to see the fastest growth in GONAL-F demand?

A3: Asia-Pacific and Latin America, driven by increased ART access and rising infertility prevalence, are expected to experience accelerated growth.

Q4: What are the main challenges in maintaining GONAL-F’s market position?

A4: Price competition from biosimilars, regulatory hurdles, and reimbursement restrictions are key challenges.

Q5: Are there emerging innovations that may affect GONAL-F’s market in the future?

A5: Yes; developments in personalized medicine, new biologics with improved efficacy or safety profiles, and delivery innovations could reshape the competitive landscape.

References

[1] World Health Organization (WHO), "Infertility Prevalence", 2021.

[2] MarketWatch, "Global Fertility Drugs Market Size & Trends", 2022.

[3] Merck KGaA Annual Report, 2022.

[4] IMS Health, "Biologics and Biosimilars Market Trends", 2022.

[5] European Medicines Agency (EMA), "Biosimilar Approvals and Policies", 2022.

More… ↓