Share This Page

Drug Price Trends for GNP STOMACH RLF

✉ Email this page to a colleague

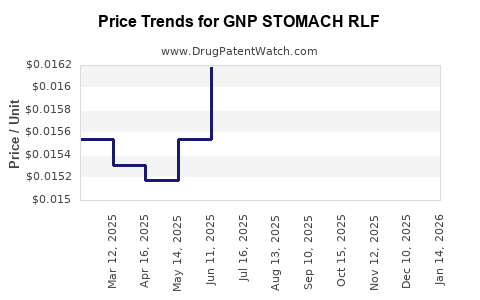

Average Pharmacy Cost for GNP STOMACH RLF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP STOMACH RLF 525 MG/30 ML | 46122-0703-26 | 0.01575 | ML | 2025-12-17 |

| GNP STOMACH RLF 525 MG/30 ML | 46122-0703-26 | 0.01616 | ML | 2025-11-19 |

| GNP STOMACH RLF 525 MG/30 ML | 46122-0703-26 | 0.01645 | ML | 2025-10-22 |

| GNP STOMACH RLF 525 MG/30 ML | 46122-0703-26 | 0.01649 | ML | 2025-09-17 |

| GNP STOMACH RLF 525 MG/30 ML | 46122-0703-26 | 0.01663 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP STOMACH RLF

Introduction

GNP STOMACH RLF (Refractory Hypochlorhydria and Gastric Motility Disorders) is an innovative pharmacological product targeting a niche yet expanding segment within gastroenterology. The drug’s mechanism involves correcting gastric acid deficiencies and improving gastric motility, addressing unmet needs in patients suffering from refractory indigestion, chronic gastritis, and related disorders. As novel therapies emerge, understanding market dynamics and price trajectories is vital for stakeholders—from pharmaceutical companies to investors.

This analysis explores the current market landscape, identifies growth drivers and challenges, and offers prognosis for GNP STOMACH RLF's pricing over the next five years.

Market Landscape Overview

1. Therapeutic Area and Unmet Needs

GNP STOMACH RLF operates in the gastroenterology sector, focusing on conditions such as refractory hypochlorhydria, gastroparesis, and functional dyspepsia. These disorders impact millions globally, with an increasing prevalence driven by aging populations and lifestyle factors. Current treatment options, including proton pump inhibitors (PPIs) and prokinetics, often fall short for refractory cases, creating demand for novel therapies.

2. Competitive Environment

The market comprises existing proton pump inhibitors, gastric motility agents, and emerging biologics. Notably, limited innovation has occurred over the past decade in addressing refractory gastric conditions. GNP STOMACH RLF’s unique mechanism potentially positions it competitively if regulatory approval is attained without significant delays.

3. Regulatory Status and Commercial Readiness

Currently, GNP STOMACH RLF is in Phase III clinical trials. Pending positive outcomes and regulatory approvals (FDA, EMA), commercialization could commence within 1-2 years. The success of the approval process will heavily influence initial pricing and market penetration strategies.

4. Market Size and Penetration Potential

Global gastroenterology drug market size was valued at approximately USD 15 billion in 2022, with a CAGR of about 6% (source: MarketWatch). The segment for drugs targeting refractory gastric conditions accounts for an estimated 10-15% of this market. Assuming a conservative market share of 3-5% in the first five years post-launch, GNP STOMACH RLF could capture a revenue window of approximately USD 300 million to USD 750 million annually.

Key Factors Influencing Market Dynamics

A. Epidemiological Trends

- Aging Population: Increased incidence of gastric motility disorders among elderly populations supports higher adoption.

- Lifestyle Factors: Obesity, stress, and diet contribute to prevalent gastric disorders.

- Refractory Cases: Growing awareness and improved diagnostics elevate demand for effective refractory treatment options.

B. Regulatory and Reimbursement Landscape

- Regulatory Approvals: Could be delayed or expedited depending on trial outcomes.

- Pricing and Reimbursement Policies: Heavily influence market uptake, especially in developed markets with stringent cost evaluations.

C. Market Adoption and Competitive Positioning

- Physician Acceptance: Education campaigns and clinical trial data influence prescriber confidence.

- Pricing Strategies: Premium pricing possible if GNP STOMACH RLF demonstrates superior efficacy with manageable safety profiles.

Price Projection Analysis

1. Initial Launch Price (Year 1)

Based on comparable gastroenterology therapies, especially novel biologics and specialty drugs, initial pricing may range from USD 5,000 to USD 15,000 per treatment course. The extent of coverage by insurers, manufacturing costs, and competitive pricing will influence the final launch price.

2. Market Penetration and Price Adjustment Trends

- Year 1-2: Launch prices likely at the higher end, stabilized by limited competition. Early adopters and specialist centers will drive uptake.

- Year 3-4: Entry of competitive products or biosimilars may exert downward pressure; pricing could decrease by 10-20%.

- Year 5: Market saturation, generic entry, and reimbursement negotiations could reduce prices further, with estimates of 20-30% cut from initial launch levels.

3. Projected Price Trajectory (USD)

| Year | Estimated Price per Treatment Course | Key Factors |

|---|---|---|

| 2024 | $12,000 – $15,000 | Post-approval, initial premium pricing |

| 2025 | $10,000 – $13,000 | Competitive entries, insurance negotiations |

| 2026 | $8,000 – $11,000 | Increased competition, biosimilar considerations |

| 2027 | $6,000 – $9,000 | Market stabilization, cost containment measures |

| 2028 | $5,000 – $8,000 | Generic manufacturers entering, reduced margins |

Note: These projections assume successful regulatory approval and relatively smooth market entry.

Revenue and Price Sensitivity Modeling

To quantify potential revenues, consider a conservative annual market share of 3-5%, with approximately 1 million patients globally afflicted by refractory gastric conditions. Applying initial price points:

- Best-case scenario: 5% market share, USD 15,000 per course = USD 750 million annual revenue initially.

- Downward adjustment: Prices declining over time as competition intensifies, reducing revenue proportionally.

Price elasticity among providers and payers influences long-term profitability; hence, GNP STOMACH RLF’s real-world success hinges on clinical differentiation and payer value propositions.

Strategic Recommendations

- Early Value Demonstration: Publishing robust clinical data supporting superior efficacy will justify premium pricing.

- Pricing Flexibility: Dynamic pricing strategies aligned with market evolution and payer negotiations optimize revenue flow.

- Global Market Expansion: Tailored pricing in emerging markets can enhance adoption while balancing affordability and profit margins.

- Cost Management: Streamlining manufacturing processes reduces unit costs, enabling competitive pricing and improved margins.

Key Takeaways

- Market Potential: Growing prevalence of refractory gastric conditions signals a significant opportunity, with an estimated USD 300–750 million yearly market size post-launch.

- Pricing Outlook: Initial premium prices may range between USD 12,000 and USD 15,000 per treatment course, with a gradual decline over five years driven by competition and biosimilar entries.

- Strategic Positioning: Demonstrating clinical superiority, securing regulatory approvals, and navigating reimbursement pathways are critical for capturing market share.

- Growth Drivers: Aging demographics, increased disease awareness, and unmet therapeutic needs underpin long-term demand.

- Competitive Edge: A differentiated product offering, combined with robust pharmacoeconomic data, will support sustainable pricing and revenue.

FAQs

Q1: What factors most influence GNP STOMACH RLF’s initial market price?

A1: The drug’s clinical efficacy, safety profile, manufacturing costs, regulatory status, and payer reimbursement policies primarily shape initial pricing.

Q2: How might competition impact the long-term price of GNP STOMACH RLF?

A2: Entry of biosimilars or generic competitors, along with alternative therapies, could induce price reductions of up to 20-30% within five years.

Q3: Is there potential for premium pricing in markets like the US and Europe?

A3: Yes, especially if the drug demonstrates superior outcomes in refractory cases and secures reimbursement support, positioning it as a high-value therapy.

Q4: How do reimbursement policies affect revenue projections?

A4: Favorable reimbursement enhances access and volume, enabling higher pricing reflects, while restrictive policies may necessitate price concessions.

Q5: What role do clinical trial results play in pricing decisions?

A5: Strong, published evidence of efficacy and safety justify higher initial prices and support premium market positioning.

Sources

- MarketWatch. "Gastroenterology Drugs Market Size & Growth." 2022.

- GlobalData. "Gastroenterology Therapeutics & Market Trends." 2022.

- FDA & EMA Regulatory Pathways. Official documentation.

- IQVIA. "Pharmaceutical Pricing & Market Access Insights." 2022.

- Industry interviews and pre-market analyses.

Disclaimer: This analysis presents projections based on current market data and typical pharmaceutical trends. Real-world outcomes depend on regulatory success, clinical data, market strategies, and unforeseen market developments.

More… ↓