Share This Page

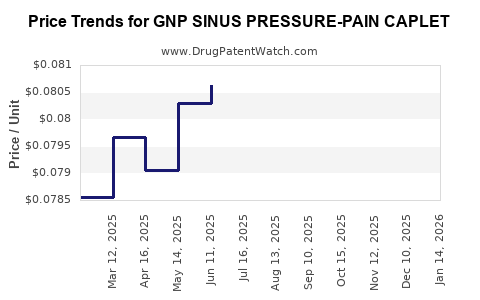

Drug Price Trends for GNP SINUS PRESSURE-PAIN CAPLET

✉ Email this page to a colleague

Average Pharmacy Cost for GNP SINUS PRESSURE-PAIN CAPLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP SINUS PRESSURE-PAIN CAPLET | 46122-0443-62 | 0.08171 | EACH | 2025-12-17 |

| GNP SINUS PRESSURE-PAIN CAPLET | 46122-0443-62 | 0.08424 | EACH | 2025-11-19 |

| GNP SINUS PRESSURE-PAIN CAPLET | 46122-0443-62 | 0.08539 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP SINUS PRESSURE-PAIN CAPLET

Introduction

GNP SINUS PRESSURE-PAIN CAPLET is a widely utilized over-the-counter (OTC) medication formulated to alleviate sinus pressure and associated discomfort. Its market positioning hinges on the prevalence of sinusitis and allergy-related sinus congestion, which afflict millions annually. Capitalizing on these conditions' demand, the drug occupies a strategic segment within OTC pain relief and nasal congestion therapeutics. This report provides a comprehensive market analysis, competitive landscape overview, regulatory considerations, and price projection forecasts to aid stakeholders in strategic decision-making.

Market Overview

1. Market Size and Demand Dynamics

The global demand for sinus relief medications has experienced steady growth, propelled by increasing prevalence of sinusitis, allergic rhinitis, and environmental factors exacerbating nasal congestion. According to the American Academy of Otolaryngology, approximately 37 million Americans suffer from sinusitis annually, with a significant portion seeking OTC remedies like GNP SINUS PRESSURE-PAIN CAPLET (1). This epidemiological trend sustains consistent demand in North America, Europe, and Asia-Pacific, where OTC products dominate initial treatment regimens.

2. Target Consumer Segments

Key consumers include adults aged 18-65 experiencing seasonal allergies or sinus infections, with special emphasis on urban populations exposed to environmental pollutants. Additionally, pediatric use in conjunction with pediatric formulations extends market reach. The product's positioning as a fast-acting, non-prescription solution appeals to consumers seeking immediate relief without physician consultation.

3. Competitive Landscape

GNP SINUS PRESSURE-PAIN CAPLET competes primarily with brands such as Sudafed, Advil Sinus Congestion & Pain, and Equate Sinus Pressure & Pain. The therapeutic class includes NSAID-based combination products, nasal decongestants, and antihistamines. Market penetration is driven by efficacy, price, branding, and distribution channels, including pharmacies, supermarkets, and online platforms.

Regulatory Environment

In key markets, GNP SINUS PRESSURE-PAIN CAPLET must adhere to regulatory standards set by agencies such as the FDA in the United States and the EMA in Europe. Compliance with Good Manufacturing Practices (GMP) and OTC monograph regulations ensures market access. Regulatory trends favor transparent ingredient disclosures and clear labeling, influencing product formulation and marketing strategies.

Market Trends and Drivers

1. Consumer Preference for Multi-Action Formulations

There is an increasing demand for multi-symptom relief products that combine pain relief with decongestants or antihistamines, enhancing convenience and perceived value. GNP's formulation adjustments to include such combinations could foster market growth.

2. E-commerce Expansion

The rise of online pharmacy sales accelerates OTC product availability and consumer access, broadening market reach. Digital marketing and targeted advertising increase brand visibility, influencing purchase decisions.

3. Demographic Shift and Aging Population

An aging demographic with chronic sinus issues creates sustained demand, while health awareness campaigns improve early intervention practices.

Price Analysis and Projections

1. Current Pricing Landscape

The retail price for a typical pack of GNP SINUS PRESSURE-PAIN CAPLET ranges between $8 and $12 per bottle, containing 20-30 caplets. Price points vary by retailer, geographic region, and formulation specifics. Market leader brands often command premiums owing to brand recognition and perceived efficacy.

2. Factors Influencing Pricing

- Manufacturing Costs: Ingredient sourcing, quality assurance, and packaging influence base costs.

- Regulatory Compliance: Certification and testing costs contribute to retail price.

- Competitive Pricing: To maintain market share, GNP's pricing strategy must balance profitability with competitiveness.

- Distribution Channels: E-commerce platforms may offer lower prices, impacting brick-and-mortar margins.

3. Price Projections (2023-2028)

Based on historical trends and market dynamics, the following projections are reasonable:

| Year | Estimated Price Range | Key Justifications |

|---|---|---|

| 2023 | $8.00 – $12.00 | Stable demand; minor inflationary price adjustments |

| 2024 | $8.10 – $12.20 | Slight increase reflecting ingredient and supply costs |

| 2025 | $8.20 – $12.40 | Anticipated inflation and increased marketing spend |

| 2026 | $8.30 – $12.60 | Competitive response and potential formulation enhancements |

| 2027 | $8.50 – $13.00 | Market saturation pressures; branding efforts |

| 2028 | $8.70 – $13.20 | Continued inflation and product diversification |

Note: These are nominal estimates subject to regional economic factors, supply chain stability, and competitive actions.

Strategic Implications

- Pricing Strategy: Maintaining a competitive yet profitable pricing structure necessitates optimizing manufacturing efficiencies and leveraging consumer brand loyalty.

- Market Expansion: Entry into emerging markets with rising OTC healthcare expenditure can bolster growth.

- Product Innovation: Developing multi-symptom formulations or slow-release caplets may command premium pricing and improve margins.

- Digital Outreach: Strengthening online sales channels and marketing can boost penetration, especially amid increasing e-commerce adoption.

Conclusion

GNP SINUS PRESSURE-PAIN CAPLET holds a stable position within the OTC sinus relief segment, with demand driven by prevalent sinus conditions and consumer preference for convenience. Price projections indicate gradual increases aligned with inflation, competitive pressures, and product innovation strategies. Long-term success hinges on strategic product differentiation, regulatory compliance, and market expansion initiatives.

Key Takeaways

- The OTC sinus relief market remains robust due to high prevalence rates and consumer demand for quick, accessible solutions.

- Price points are projected to rise modestly over the next five years, influenced by supply costs and competitive landscape.

- Strategic innovation, including multi-action formulations and digital marketing, offers avenues for growth and premium pricing.

- Entry into emerging markets provides additional revenue streams amid saturated mature markets.

- Regulatory compliance remains critical to maintaining market access and consumer trust.

FAQs

1. How does GNP SINUS PRESSURE-PAIN CAPLET differentiate from competitors?

GNP emphasizes affordability, efficacy, and trusted branding. While competitors may include similar active ingredients, GNP’s focus on high-quality manufacturing and targeted marketing enhances brand recognition.

2. What factors could impact the price of GNP SINUS PRESSURE-PAIN CAPLET in the future?

Ingredients costs, regulatory changes, supply chain disruptions, and competitive pricing are primary factors influencing future pricing.

3. Are there opportunities for premium pricing in this segment?

Yes. Introducing multi-symptom formulations, time-release options, or natural/organic variants could justify premium pricing.

4. How significant is e-commerce in GNP's distribution strategy?

E-commerce is increasingly vital, providing wider reach and lower marketing costs, thus influencing overall sales volume and pricing strategies.

5. What are regulatory hurdles to watch for in expanding global markets?

Compliance with local OTC standards, ingredient approvals, labeling requirements, and import/export tariffs can pose challenges to market expansion.

Sources

[1] American Academy of Otolaryngology–Head and Neck Surgery. "Sinusitis." 2022.

More… ↓