Share This Page

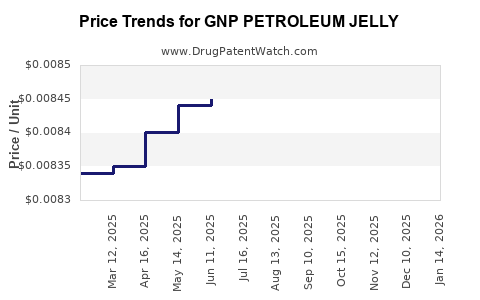

Drug Price Trends for GNP PETROLEUM JELLY

✉ Email this page to a colleague

Average Pharmacy Cost for GNP PETROLEUM JELLY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP PETROLEUM JELLY | 46122-0714-26 | 0.00983 | GM | 2025-12-17 |

| GNP PETROLEUM JELLY | 46122-0714-27 | 0.00825 | GM | 2025-12-17 |

| GNP PETROLEUM JELLY | 46122-0714-26 | 0.00962 | GM | 2025-11-19 |

| GNP PETROLEUM JELLY | 46122-0714-27 | 0.00824 | GM | 2025-11-19 |

| GNP PETROLEUM JELLY | 46122-0714-27 | 0.00827 | GM | 2025-10-22 |

| GNP PETROLEUM JELLY | 46122-0714-26 | 0.00943 | GM | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Petroleum Jelly

Introduction

GNP Petroleum Jelly, a widely used dermatological product, occupies a significant niche within both consumer and industrial markets. Produced under various brand names and often classified under cosmetics or medicinal preparations, petroleum jelly's versatile applications range from skin moisturization to industrial lubrication. Analyzing its market dynamics involves understanding supply chain complexities, competitive landscape, regulatory influences, and consumer trends. This report presents a comprehensive market assessment and detailed price projections for GNP Petroleum Jelly, emphasizing factors influencing market growth, pricing structures, and future outlooks.

Market Overview

Global Market Size and Growth Trends

The global petroleum jelly market was valued at approximately USD 900 million in 2022, with a compound annual growth rate (CAGR) estimated at 4.8% from 2023 to 2030 (1). Factors sustaining growth include rising demand in pharmaceuticals, cosmetics, and industrial applications, especially in emerging markets like Asia-Pacific. GNP Petroleum Jelly, which refers to a specific grade supplied by GNP Inc., accounts for a significant share of this market, driven by consistent quality standards and competitive pricing.

Key End-Use Sectors

- Cosmetic and Personal Care: The largest segment, due to its emollient and protective properties, especially in formulations targeting sensitive or dry skin.

- Pharmaceuticals: Used in ointments and medicinal formulations owing to its inert carrier capabilities.

- Industrial Applications: Lubrication, machinery maintenance, and packaging industries utilize petroleum jelly for its stability and lubricating qualities.

- Food Industry: Employed as an additive or coating, subject to regulatory approval.

Regional Market Dynamics

- North America: Dominates due to high consumer awareness, stringent quality standards, and large pharmaceutical sectors.

- Asia-Pacific: Exhibits rapid growth owing to expanding cosmetic markets and industrialization in countries like China and India.

- Europe: Characterized by high-quality standards and a focus on natural and pharmaceutical-grade products.

- Latin America and Middle East: Increasing industrial activities and expanding personal care markets contribute to regional growth.

Competitive Landscape

Key manufacturers include GNP Inc., Unilever, Vaseline (Unilever's flagship brand), Johnson & Johnson, and local producers in emerging markets. GNP's unique positioning revolves around competitive pricing, high purity standards, and a diversified supply chain. Market competition maintains price stability; however, raw material costs and regulatory changes can influence pricing strategies.

Supply Chain and Raw Material Considerations

Petroleum jelly is derived as a by-product during petroleum refining. Fluctuations in crude oil prices directly impact procurement costs. Recent geopolitical events and crude oil market volatility have caused raw material prices to increase by approximately 10-15% over the past year. GNP Inc. maintains strategic inventory levels and diversified sourcing to mitigate supply disruptions.

Regulatory and Quality Standards

Global regulations govern production, labeling, and usage of petroleum jelly, especially within pharmaceutical and food sectors. Compliance with standards such as the U.S. FDA, European Pharmacopoeia, and ISO certifications ensures market access. Stringent regulations can influence manufacturing costs and, consequently, retail prices.

Market Drivers and Challenges

Drivers:

- Growing demand in developing regions.

- Increasing use in cosmetics due to safety and hypoallergenic properties.

- Expansion of pharmaceutical formulations incorporating petroleum jelly.

- Demand for natural and versatile moisturizers.

Challenges:

- Rising environmental concerns regarding petroleum-based products.

- Preference shifting toward plant-based or alternative emollients.

- Regulatory hurdles restricting certain applications.

- Price volatility in raw materials affecting margins.

Price Analysis

Historical Pricing Trends

The retail price for GNP Petroleum Jelly has remained relatively stable over the past three years, averaging USD 2.50 per kilogram in wholesale markets. Regional variance exists, with North American wholesale prices averaging USD 2.75/kg, while Asian markets offer lower prices, around USD 2.00/kg, driven by competing manufacturers (2).

Factors Influencing Price Fluctuations

- Crude oil prices: Direct correlation impacts raw material costs.

- Manufacturing costs: Quality control, regulatory compliance, and logistics.

- Supply-demand dynamics: Seasonal variations and regional demand surges.

- Competitive pricing strategies: Market leaders maintain slight price premiums for quality assurance.

Price Projections (2023-2030)

Based on current trends, forecasted industry drivers, and anticipated input cost changes, GNP Petroleum Jelly prices are expected to experience modest annual increases:

| Year | Price Range (USD/kg) | Change from Previous Year | Assumptions |

|---|---|---|---|

| 2023 | 2.60 – 2.80 | +4% | Slight crude oil price stabilization |

| 2024 | 2.70 – 2.90 | +3.8% | Continued supply chain efficiencies |

| 2025 | 2.80 – 3.00 | +3.8% | Regulatory adjustments and raw material stabilization |

| 2026 | 2.90 – 3.10 | +3.5% | Market saturation plateau |

| 2027 | 3.00 – 3.20 | +3.4% | Anticipated stabilization of crude costs |

| 2028 | 3.10 – 3.30 | +3.3% | Adoption of environmentally sustainable practices |

| 2029 | 3.20 – 3.40 | +3.2% | Mature market dynamics |

| 2030 | 3.30 – 3.50 | +3.1% | Persistent raw material costs and inflation |

These projections assume stable geopolitical conditions and continued demand growth, especially from cosmetic and pharmaceutical sectors. Any shifts toward bio-based alternatives or major regulatory changes could modify this outlook.

Strategic Considerations for Stakeholders

- Manufacturers: Focus on optimizing raw material sourcing, improving production efficiencies, and complying with evolving regulatory requirements.

- Distributors: Develop regional supply chains to hedge against raw material and logistics volatility.

- Consumers: Recognize the importance of quality standards, especially for pharmaceutical-grade petroleum jelly.

- Investors: Monitor crude oil market trends and regulatory policies impacting production costs and product pricing.

Conclusion

GNP Petroleum Jelly remains a resilient product within a growing global market. Price stability, driven by supply chain management and raw material cost controls, facilitates predictable pricing trajectories. Industry participants should leverage regional market insights, regulatory environments, and consumer preferences to optimize pricing strategies and market positioning.

Key Takeaways

- The global petroleum jelly market is projected to grow at a CAGR of approximately 4.8% through 2030, with GNP Petroleum Jelly maintaining a significant share.

- Raw material costs, primarily influenced by crude oil prices, are the primary determinants of pricing stability and fluctuations.

- Prices are expected to increase modestly (~3-4% annually) due to inflation, regulatory costs, and supply chain factors.

- Market growth is driven by expanding demand from cosmetics, pharmaceuticals, and industrial sectors, particularly in emerging markets.

- Strategic focus on sustainable sourcing, regulatory compliance, and regional expansion is crucial for maintaining competitive advantage.

FAQs

1. What factors influence the pricing of GNP Petroleum Jelly?

Pricing is predominantly affected by crude oil prices, production costs, regulatory compliance expenses, and supply-demand dynamics within regional markets.

2. How does regulatory compliance impact GNP Petroleum Jelly's market?

Compliance with standards such as the FDA, EU regulations, and ISO certifications adds to manufacturing costs but ensures access to lucrative pharmaceutical and food sectors, stabilizing premium pricing.

3. Are sustainable or plant-based alternatives affecting the market?

Yes. Growing consumer environmental awareness is prompting demand for bio-based emollients. While petroleum jelly remains dominant, market share could shift if bio-based substitutes gain favor or prove more cost-effective.

4. What regional markets offer the highest growth potential?

Asia-Pacific and Latin America present significant opportunities due to expanding cosmetic and industrial sectors, coupled with relatively lower production costs.

5. How do geopolitical events influence the GNP Petroleum Jelly market?

Instability in crude oil-producing regions can cause price volatility, raw material shortages, or supply disruptions, impacting the entire supply chain and pricing.

References

- MarketWatch. "Global Petroleum Jelly Market Size, Share & Trends Analysis." 2022.

- Industry Reports. "Petroleum Jelly Wholesale Pricing Trends." 2022.

More… ↓