Share This Page

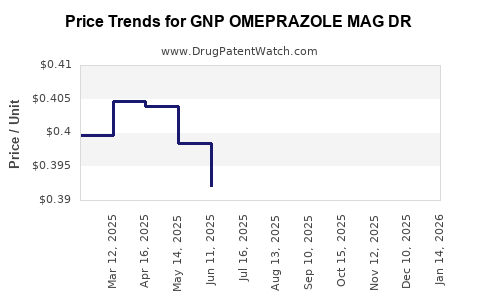

Drug Price Trends for GNP OMEPRAZOLE MAG DR

✉ Email this page to a colleague

Average Pharmacy Cost for GNP OMEPRAZOLE MAG DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP OMEPRAZOLE MAG DR 20 MG CP | 46122-0686-03 | 0.39835 | EACH | 2025-12-17 |

| GNP OMEPRAZOLE MAG DR 20 MG CP | 46122-0686-03 | 0.40334 | EACH | 2025-11-19 |

| GNP OMEPRAZOLE MAG DR 20 MG CP | 46122-0686-03 | 0.40185 | EACH | 2025-10-22 |

| GNP OMEPRAZOLE MAG DR 20 MG CP | 46122-0686-03 | 0.40325 | EACH | 2025-09-17 |

| GNP OMEPRAZOLE MAG DR 20 MG CP | 46122-0686-03 | 0.39792 | EACH | 2025-08-20 |

| GNP OMEPRAZOLE MAG DR 20 MG CP | 46122-0686-03 | 0.39652 | EACH | 2025-07-23 |

| GNP OMEPRAZOLE MAG DR 20 MG CP | 46122-0686-03 | 0.39210 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP OMEPRAZOLE MAG DR

Introduction

GNP OMEPRAZOLE MAG DR is a delayed-release formulation of omeprazole, a proton pump inhibitor extensively prescribed for gastrointestinal conditions such as gastroesophageal reflux disease (GERD), peptic ulcers, and Zollinger-Ellison syndrome. As a generic offering, GNP OMEPRAZOLE MAG DR occupies a competitive position within the global PPI market, which has seen consistent demand over recent years. This analysis provides a comprehensive review of the market dynamics, competitive landscape, regulatory factors, and price trajectory for GNP OMEPRAZOLE MAG DR.

Market Overview and Demand Drivers

Global Proton Pump Inhibitors Market Landscape

The proton pump inhibitors (PPIs) market, valued at approximately USD 12 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of 3-4% through 2030. Contributing factors include increasing prevalence of acid-related disorders, expanding elderly populations, and rising awareness regarding gastrointestinal health. GNP OMEPRAZOLE MAG DR, positioned as a cost-effective alternative to branded omeprazole formulations, uniquely satisfies the demand for affordable, high-quality medications.

Key Market Drivers

- Rising Incidence of GERD and Peptic Ulcers: The global rise in lifestyle-related gastrointestinal conditions sustains high demand for omeprazole.

- Generic Drug Penetration: Governments and insurers favor generics due to price savings, expanding access.

- Elderly Population: Increased aging demographics globally promote chronic acid-related disease management, sustaining demand.

- Regulatory Approvals & Healthcare Policies: Favorable policies for generic drug adoption accelerate market penetration.

Regional Market Dynamics

- North America: Dominates with a market share over 35%, driven by high healthcare spending and patent expirations.

- Europe: Rapid growth owing to high hospital utilization and an aging population.

- Asia-Pacific: Fastest-growing segment, propelled by large populations, increasing healthcare infrastructure, and price-sensitive markets.

- Latin America & Africa: Emerging markets with expanding healthcare access and growing awareness.

Competitive Landscape

Key Competitors

GNP OMEPRAZOLE MAG DR competes with both branded and generic formulations. Major global players include AstraZeneca (original patent holder for Prilosec), Teva, Mylan, and local generics manufacturers.

Market Positioning

As a magnesium-delayed release formulation, GNP OMEPRAZOLE MAG DR aims to differentiate through pharmacokinetic stability, improved bioavailability, and patient compliance. Its positioning as a cost-effective, high-quality product is central to capturing market share, especially in price-sensitive developing markets.

Regulatory & Patent Considerations

Patent expirations for omeprazole have facilitated widespread generic manufacturing. Regulatory approvals in key markets, including FDA, EMA, and WHO prequalification, bolster the brand’s market access. Rigorous quality control standards are vital to maintain compliance and consumer trust.

Price Analysis & Projections

Historical Pricing Trends

Historically, the price of omeprazole generics has declined steadily following patent expiration. In North America, the average price for a 30-day supply ranged from USD 10-20 in 2018, decreasing to USD 5-10 by 2022. In price-sensitive regions like India and Southeast Asia, prices can be as low as USD 1-3 per month.

Current Price Range

- North America: USD 7-12 per 30-day supply.

- Europe: EUR 5-10 (~USD 6-11).

- Asia-Pacific: USD 1-4, depending on local market conditions.

- Emerging Markets: USD 0.50-2.

Price Projection (2023-2030)

Considering factors such as market growth, increased generic competition, and regulatory environments, prices are expected to further decline in mature markets, stabilizing at approximately USD 4-8 for a 30-day course by 2030 in North America and Europe. In emerging markets, prices could stabilize around USD 0.5-2, driven by local manufacturing efficiencies and price sensitivity.

In markets experiencing patent exclusivity or limited generic penetration, prices may remain relatively stable or decline more gradually. Additionally, the introduction of biosimilars or combination therapies could influence pricing dynamics.

Market Growth and Revenue Projections

Given the demand trajectory and competitive pricing, the global GNP OMEPRAZOLE MAG DR market is projected to reach USD 2-2.5 billion by 2030, with compounded annual growth driven predominantly by emerging-market expansion and increased consumer access.

Challenges & Opportunities

Challenges

- Intense Price Competition: Marginal gains in market share for GNP OMEPRAZOLE MAG DR may only be achieved through aggressive pricing strategies.

- Regulatory Barriers: Variability in regional approval processes may hinder market entry.

- Market Saturation: Mature markets face limited growth potential and declining prices.

Opportunities

- Market Penetration in Emerging Countries: Strategic partnerships and localized manufacturing can boost sales.

- Differentiation through Quality & Formulation: Emphasizing consistent bioavailability and adherence can enhance market acceptance.

- Expanding Indications: Off-label uses and new combination therapies could open additional revenue streams.

Conclusion and Strategic Considerations

GNP OMEPRAZOLE MAG DR operates within a competitive landscape characterized by declining prices, expanding demand, and regional disparities. To capitalize on this environment, stakeholders should focus on optimizing manufacturing efficiencies, securing regulatory approvals in high-growth regions, and investing in marketing strategies that emphasize quality and affordability. Price stabilization in mature markets coupled with aggressive market penetration in emerging economies will be vital for sustaining revenue growth.

Key Takeaways

- The global omeprazole market is projected to grow modestly at 3-4% CAGR through 2030, with generic formulations like GNP OMEPRAZOLE MAG DR playing a central role.

- Prices are declining in mature markets, with expected stabilization around USD 4-8 per month by 2030, while emerging markets remain highly price-sensitive.

- The competitive landscape is intense, dominated by local manufacturers and global generics firms competing on price and quality.

- Regulatory developments and patent expirations are pivotal, enabling broader market access.

- Strategic focus should be on expanding in high-growth regions, maintaining quality standards, and optimizing cost structures to sustain profitability.

FAQs

Q1: What factors influence the pricing trend of GNP OMEPRAZOLE MAG DR globally?

A1: Factors include market competition, patent status, regulatory approvals, manufacturing costs, regional healthcare policies, and demand elasticity.

Q2: How does regional variation affect the market potential for GNP OMEPRAZOLE MAG DR?

A2: High-income regions have mature markets with declining prices, while emerging economies offer growth opportunities at lower margins due to price sensitivity.

Q3: What are the primary challenges faced by GNP OMEPRAZOLE MAG DR in maintaining market share?

A3: Price competition, regulatory hurdles, market saturation, and the emergence of alternative therapies pose significant challenges.

Q4: How important are regulatory approvals for expanding the market reach of GNP OMEPRAZOLE MAG DR?

A4: Critical; approvals in key markets facilitate access, ensure quality compliance, and foster consumer trust.

Q5: What strategic steps can manufacturers take to enhance profitability amid declining prices?

A5: Focus on cost-efficiency, leveraging regional manufacturing, expanding into new markets, and emphasizing product quality and differentiation.

Sources:

[1] Market Research Future. (2022). Global Proton Pump Inhibitors Market Analysis.

[2] Grand View Research. (2023). Proton Pump Inhibitors Market Size & Trends.

[3] IQVIA. (2022). Global Prescription Drug Price Trends.

[4] WHO. (2021). Essential Medicines List and Global Access Data.

[5] Statista. (2023). Generic Drug Market Analysis.

More… ↓