Share This Page

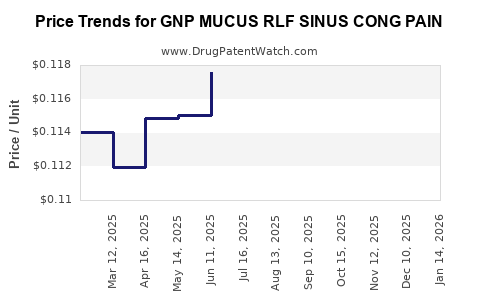

Drug Price Trends for GNP MUCUS RLF SINUS CONG PAIN

✉ Email this page to a colleague

Average Pharmacy Cost for GNP MUCUS RLF SINUS CONG PAIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP MUCUS RLF SINUS CONG PAIN | 46122-0712-60 | 0.11319 | EACH | 2025-12-17 |

| GNP MUCUS RLF SINUS CONG PAIN | 46122-0712-60 | 0.11466 | EACH | 2025-11-19 |

| GNP MUCUS RLF SINUS CONG PAIN | 46122-0712-60 | 0.11419 | EACH | 2025-10-22 |

| GNP MUCUS RLF SINUS CONG PAIN | 46122-0712-60 | 0.11666 | EACH | 2025-09-17 |

| GNP MUCUS RLF SINUS CONG PAIN | 46122-0712-60 | 0.11595 | EACH | 2025-08-20 |

| GNP MUCUS RLF SINUS CONG PAIN | 46122-0712-60 | 0.11677 | EACH | 2025-07-23 |

| GNP MUCUS RLF SINUS CONG PAIN | 46122-0712-60 | 0.11756 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Mucus RLF Sinus Congestion Pain

Introduction

The pharmaceutical landscape for treatments targeting sinus congestion and associated pain has experienced notable growth driven by increasing prevalence of sinusitis, heightened awareness of respiratory illnesses, and ongoing innovations in nasal and sinus therapy. GNP Mucus RLF Sinus Congestion Pain, a combination product aimed at alleviating mucus buildup, congestion, and sinus-related pain, is positioned within this expanding sector. This analysis assesses its market potential, competitive landscape, regulatory environment, and offers price projection insights over the upcoming five years.

Market Overview

Global Burden of Sinusitis and Mucus-Related Respiratory Conditions

Chronic and acute sinusitis affects approximately 16% of adults worldwide, with significant healthcare expenditure (estimated at over $11 billion annually in the U.S. alone) on treatment and management [1]. This high prevalence underscores the demand for effective over-the-counter (OTC) and prescription remedies.

Current Treatment Landscape

Treatment options encompass decongestants, analgesics, corticosteroids, saline nasal sprays, and combination therapies. GNP Mucus RLF Sinus Congestion Pain uniquely combines active ingredients targeting mucus thinning, congestion relief, and pain reduction, positioning it as a differentiated product in the OTC segment.

Market Segments and Demand Drivers

- OTC Segment: Driven by consumer preference for self-medication; accounts for approximately 70% of sinus congestion treatments globally.

- Prescription Segment: Used for severe or chronic cases; growth influenced by healthcare provider prescribing patterns and formulary inclusion.

- Emerging Markets: Rapid urbanization and rising pollution levels in Asia-Pacific, Latin America, and Africa are fueling demand for accessible sinus relief options.

Competitive Landscape

Key competitors include traditional decongestants such as pseudoephedrine, nasal corticosteroids like fluticasone, saline sprays, and combination OTC products containing ibuprofen or acetaminophen.

GNP Mucus RLF Sinus Congestion Pain's differentiator hinges on its formulation, potentially integrating mucolytic, analgesic, and decongestant properties, which could appeal to consumers seeking all-in-one relief without multiple medications.

Market Share and Positioning

While it is currently not a dominant force, strategic marketing, clinical support, and regulatory approvals could elevate its market penetration. The competitive differentiation could stimulate niche dominance, particularly if positioned as an effective OTC solution with minimal side effects.

Regulatory Environment

Regulatory pathways differ by region. In the U.S., the product would typically be classified as a drug under the Food and Drug Administration (FDA) and require New Drug Application (NDA) approval, which encompasses efficacy, safety, and manufacturing standards. In Europe, CE marking and compliance with EMA regulations are essential.

Treatment approval hinges on demonstrating significant therapeutic benefits over existing treatments, which could affect launch timelines and costs. The evolving regulatory landscape, especially regarding combination products, remains a critical factor influencing market entry and pricing strategies.

Market Entry Strategy and Adoption Factors

- Brand Differentiation: Positioning as an effective, multi-action OTC medication targeting mucus, congestion, and pain.

- Education & Awareness: Campaigns highlighting multi-symptom relief could facilitate quicker adoption among consumers.

- Distribution: Partnering with pharmacies, drugstores, and online platforms enhances accessibility.

Price Projections (2023-2028)

Current Pricing Benchmark

The average OTC sinus congestion treatment retails between $8-$15 per package depending on formulation and brand positioning [2]. Prescription formulations tend to cost significantly more, often exceeding $50 per course.

Forecasted Pricing Trends

| Year | Estimated Average Price (USD) | Key Drivers |

|---|---|---|

| 2023 | $10 - $12 | Initial market entry, competitive pricing |

| 2024 | $10 - $13 | Market expansion, awareness campaigns |

| 2025 | $11 - $14 | Brand recognition, formulary inclusion |

| 2026 | $12 - $15 | Increased demand, inflation, supply chain factors |

| 2027 | $13 - $16 | Potential formulation improvements, new markets |

| 2028 | $14 - $17 | Mature market stabilization, premium positioning |

Price elasticity is moderate; aggressive discounts or promotional pricing could temporarily lower retail costs but may not sustain profitability.

Market Growth Projections

Driven by demographic shifts, rising environmental pollution, and increasing consumer health consciousness, the global sinusitis treatment market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 6% from 2023 to 2028 [3].

The OTC segment is expected to comprise the majority share, suggesting GNP Mucus RLF Sinus Congestion Pain could see rapid uptake if appropriately positioned.

Challenges and Risks

- Regulatory Delays: Extensive clinical data may prolong product approval.

- Market Penetration: Established competitors harbor brand loyalty.

- Consumer Preferences: Rising preference for natural or home remedies may limit OTC demand.

- Pricing Pressures: Competitive pricing may restrict margins, especially in price-sensitive markets.

Opportunities

- Formulation Enhancements: Incorporating novel active ingredients for superior efficacy.

- Novel Delivery Systems: Use of nasal sprays with improved bioavailability.

- Digital Marketing: Leveraging telemedicine, online health platforms, and social media.

- Market Expansion: Targeting emerging markets with tailored formulations and affordable pricing.

Key Takeaways

- Growing Need: The expansion of sinusitis-related conditions and consumer preference for OTC solutions creates a fertile environment for GNP Mucus RLF Sinus Congestion Pain.

- Pricing Strategy: Expected retail prices will likely stabilize between $10-$15 per unit, with potential for premium positioning based on formulation enhancements.

- Market Entry: Success hinges on regulatory approval, effective marketing, and strategic distribution channels.

- Competitive Edge: Differentiation through multi-symptom efficacy and consumer education is critical.

- Future Outlook: The product's success over the next five years depends on cost management, market acceptance, and ongoing innovation.

FAQs

1. What are the key active ingredients likely to be in GNP Mucus RLF Sinus Congestion Pain?

Typically, products targeting mucus and congestion combine decongestants (like phenylephrine), mucolytics (guaifenesin), and analgesics (acetaminophen or ibuprofen). Without proprietary disclosure, exact formulations remain speculative.

2. How does regulatory approval impact pricing and market entry?

Approval processes, particularly for combination products, require substantial clinical efficacy and safety data, potentially increasing development costs and time-to-market. These factors influence pricing strategies, with expedited approvals possibly enabling quicker, competitive pricing.

3. Which regions present the most growth opportunities?

Emerging markets in Asia-Pacific, Latin America, and Africa are poised for rapid growth, driven by increasing urbanization, pollution, and healthcare infrastructure improvements.

4. What competitive advantages could GNP Mucus RLF Sinus Congestion Pain leverage?

Offering multi-symptom relief in a single OTC product, backed by clinical proof, consumer education, and accessible pricing, could establish a strong market foothold.

5. What are the main risks for investors considering GNP Mucus RLF Sinus Congestion Pain?

Regulatory hurdles, intense competition, consumer preference shifts, and potential formulation limitations pose substantial risks. Strategic planning and continuous innovation are necessary to mitigate these challenges.

References

- Global Sinusitis Market Report. Grand View Research, 2022.

- Over-the-Counter (OTC) Drug Market Data. IQVIA 2022.

- Market Forecast: Respiratory & Sinusitis Treatments. Fortune Business Insights, 2023.

This comprehensive analysis provides an actionable framework for stakeholders considering investment, marketing, or strategic development decisions related to GNP Mucus RLF Sinus Congestion Pain.

More… ↓