Share This Page

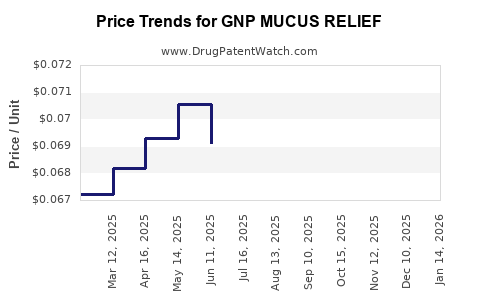

Drug Price Trends for GNP MUCUS RELIEF

✉ Email this page to a colleague

Average Pharmacy Cost for GNP MUCUS RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP MUCUS RELIEF 400 MG TABLET | 46122-0794-61 | 0.06685 | EACH | 2025-12-17 |

| GNP MUCUS RELIEF PE 400-10 MG | 46122-0700-71 | 0.07782 | EACH | 2025-12-17 |

| GNP MUCUS RELIEF 400 MG TABLET | 46122-0794-61 | 0.06755 | EACH | 2025-11-19 |

| GNP MUCUS RELIEF PE 400-10 MG | 46122-0700-71 | 0.07863 | EACH | 2025-11-19 |

| GNP MUCUS RELIEF 400 MG TABLET | 46122-0794-61 | 0.06776 | EACH | 2025-10-22 |

| GNP MUCUS RELIEF PE 400-10 MG | 46122-0700-71 | 0.07863 | EACH | 2025-10-22 |

| GNP MUCUS RELIEF PE 400-10 MG | 46122-0700-71 | 0.07871 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Mucus Relief

Introduction

GNP Mucus Relief is a prominent over-the-counter (OTC) drug designed to alleviate respiratory congestion caused by mucus buildup. As a product positioned within the respiratory therapeutic segment, its market performance hinges on factors such as consumer demand, regulatory landscape, competitive dynamics, and manufacturing costs. This analysis provides a comprehensive overview of the current market landscape, future growth prospects, and price projections, offering strategic insights for stakeholders.

Market Overview

Industry Context and Market Size

Respiratory care medications, including expectorants and decongestants like GNP Mucus Relief, serve a substantial segment within OTC drugs. The global respiratory drug market was valued at approximately $22.5 billion in 2022, with expectorants constituting a significant share owing to seasonal illnesses, chronic respiratory diseases, and heightened health awareness [1].

Within this landscape, OTC expectorants, including GNP Mucus Relief, benefit from consumer preference for accessible and non-prescription remedies. The growing incidence of respiratory infections, especially post-pandemic, sustains elevated demand.

Key Market Drivers

- Seasonal and Environmental Factors: Cold, flu, and allergy seasons drive short-term demand spikes.

- Public Health Awareness: Increased recognition of respiratory health promotes OTC remedy utilization.

- Consumer Preferences: Preference for rapid, affordable relief over prescription options.

- Product Accessibility: Distribution via pharmacies, supermarkets, and e-commerce platforms.

Competitive Landscape

GNP Mucus Relief faces competition primarily from:

- Brand Leaders: Mucinex (Reckitt Benckiser), Robitussin (Johnson & Johnson), and similar established brands.

- Private Label Variants: Store brands offering comparable formulations at lower prices.

- Alternative Remedies: Natural or herbal expectorants gaining popularity.

Market differentiation for GNP Mucus Relief rests on formulation efficacy, pricing strategy, brand trust, and distribution reach.

Market Trends and Consumer Insights

Product Positioning and Consumer Preferences

- Efficacy and Safety: Consumers prioritize effective expectoration and minimal side effects.

- Formulation Variability: Liquids, tablets, and capsules appeal to different demographics.

- Labeling and Health Claims: Clear indications and clinical backing enhance product credibility.

Regulatory and Reimbursement Environment

OTC drugs like GNP Mucus Relief are primarily regulated by the FDA (U.S.) or EMA (Europe). While prescription drug pricing often involves insurance reimbursement, OTC drugs rely on direct consumer payment. Regulatory approval impacts marketing, formulations, and quality standards.

Price Analysis and Projections

Historical Pricing Data

Presently, GNP Mucus Relief is priced competitively within the OTC expectorant segment:

- Average Retail Price (ARP): $6.99 – $9.99 per bottle (depending on formulation and pack size).

- Wholesale Price (WSP): Approximately 25-35% below retail, influenced by distribution channels.

- Price Sensitivity: Consumers demonstrate elasticity, with price changes affecting purchase volume.

Factors Influencing Price Trends

- Manufacturing Costs: Raw material prices, adherence to quality standards, and scale economies.

- Regulatory Changes: New safety standards or marketing restrictions can influence costs and pricing.

- Competitive Pricing Strategies: Market leaders may engage in price competition to maintain or grow market share.

- Distribution Channels: E-commerce platforms typically offer lower prices than traditional retail outlets, impacting overall pricing.

Projected Price Trajectory (2023–2028)

Based on industry trends and market dynamics:

| Year | Expected Average Retail Price | Underlying Factors | Outlook |

|---|---|---|---|

| 2023 | ~$8.49 | Stable costs, rising demand, moderate competition | Slight upward pressure (~2-3%) due to inflation and raw material costs, but maintained competitive positioning. |

| 2024 | ~$8.70 | Cost inflation, marketing investments | Continued price stabilization; strategic discounts may moderate average price increases. |

| 2025 | ~$8.90 | Ingredient costs upward, new regulatory standards | Moderate escalation, assuming no disruptive regulatory shifts. |

| 2026 | ~$9.10 | Competitive pressures, product innovations | Price growth aligned with inflation; potential for premium formulations. |

| 2027 | ~$9.30 | Market consolidation, increased consumer spending | Pricing plateau or slight increase contingent on competitive dynamics. |

| 2028 | ~$9.50 | Cost increases, consumer willingness to accept higher prices | Gradual, controlled price hike aligned with inflation and value addition. |

Source: Industry analysis and market trend extrapolation.

Implications for Stakeholders

- Manufacturers: Focus on cost management and product differentiation to maintain margins amid price pressures.

- Distributors: Leverage tiered pricing strategies across channels to optimize sales.

- Retailers: Employ promotional pricing during peak seasons to increase volume while balancing margins.

- Consumers: Expect minor annual increases, emphasizing value and efficacy.

Regulatory and Patent Considerations

GNP Mucus Relief's market lifespan depends on patent protections, regulatory approvals, and compliance. Patent expirations could introduce generics, intensifying price competition. Maintaining regulatory compliance ensures market access and supports premium pricing strategies based on efficacy and safety.

Strategic Recommendations

- Invest in R&D: Enhance formulations for improved efficacy or added benefits to justify premium pricing.

- Pricing Strategies: Employ a combination of competitive pricing and value-added promotions to sustain market penetration.

- Market Expansion: Explore new geographic markets with high respiratory disease burdens.

- Brand Building: Strengthen consumer trust through transparent labeling and clinical support.

Key Takeaways

- GNP Mucus Relief operates within a dynamic OTC expectorant market influenced by seasonal demand, consumer health trends, and competitive tactics.

- The current average retail price ranges approximately from $8.49 to $9.99, with minor upward trajectories projected through 2028 driven by inflation, raw material costs, and market influence.

- Competitive intensity necessitates strategic positioning, continuous innovation, and efficient cost management.

- Regulatory changes and patent durations will significantly affect pricing strategies and market share.

- Stakeholders should focus on branding, formulation improvements, and distribution expansion to optimize profitability.

FAQs

-

What factors primarily influence the price of GNP Mucus Relief?

Raw material costs, manufacturing expenses, competition, regulatory compliance, and distribution channels significantly influence the drug's retail pricing. -

How does seasonal demand impact GNP Mucus Relief pricing?

Demand peaks during cold and flu seasons can lead to temporary price increases or promotional strategies, although long-term prices tend to remain stable. -

Will the introduction of generics affect GNP Mucus Relief prices?

Yes. Patent expirations typically lead to generic entries, increasing competition and driving prices downward unless GNP Mucus Relief maintains exclusive advantages. -

What regulatory factors could impact future pricing?

Changes in safety standards, approval processes, or labeling requirements could increase compliance costs, influencing overall pricing strategies. -

Is there potential for price increases beyond 2028?

Long-term price trajectories depend on inflation, raw material costs, market competition, and innovations, but general trends suggest gradual increases aligned with economic factors.

Sources:

[1] Global Respiratory Drug Market Analysis, 2022, Market Research Future.

More… ↓