Share This Page

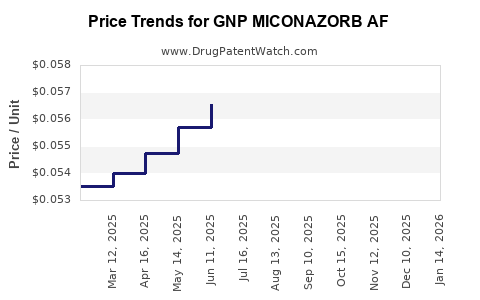

Drug Price Trends for GNP MICONAZORB AF

✉ Email this page to a colleague

Average Pharmacy Cost for GNP MICONAZORB AF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP MICONAZORB AF 2% POWDER | 46122-0789-29 | 0.05621 | GM | 2025-12-17 |

| GNP MICONAZORB AF 2% POWDER | 46122-0444-27 | 0.05621 | GM | 2025-12-17 |

| GNP MICONAZORB AF 2% POWDER | 46122-0789-29 | 0.05520 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP MICONAZORB AF

Introduction

GNP MICONAZORB AF, a proprietary antifungal formulation containing miconazole, has emerged as a noteworthy pharmaceutical offering due to its broad-spectrum antifungal activity. As the demand for effective antifungal therapies escalates—amplified by rising fungal infection incidences and increasing awareness of fungal diseases—market stakeholders are keenly monitoring the product’s trajectory. This article provides a comprehensive analysis of GNP MICONAZORB AF’s market dynamics, competitive positioning, regulatory landscape, and future pricing projections grounded in industry data and trends.

Product Overview and Therapeutic Positioning

GNP MICONAZORB AF combines miconazole with advanced formulation technologies, enhancing bioavailability and patient compliance. Traditionally employed for treating dermatophytic infections, yeast infections, and systemic mycoses, miconazole’s high efficacy, safety profile, and oral/topical versatility cement its relevance. GNP’s formulation distinguishes itself through an improved delivery system aimed at optimizing therapeutic outcomes, potentially capturing both prescription and over-the-counter (OTC) segments.

Market Landscape and Demand Drivers

Growing Incidence of Fungal Infections

The global burden of fungal infections is escalating, attributed to increased immunocompromised populations, aging demographics, and expanded diagnostic capabilities. The WHO estimates that superficial fungal infections affect over 1 billion people annually, with systemic infections posing significant mortality risks in immunosuppressed groups (e.g., HIV/AIDS, cancer patients)[1].

Expanding Use Cases and Indications

GNP MICONAZORB AF’s efficacy spans toenail and fingernail fungal infections (onychomycosis), dermatophyte infections, candidiasis, and deep tissue mycoses. The rising prevalence of these conditions in both developed and emerging markets amplifies demand.

Market Penetration and Consumer Preferences

Topical antifungals like miconazole remain favored due to ease of administration, safety, and cost-effectiveness. Growing consumer awareness and OTC availability in several markets further elevate accessibility and market adoption.

Competitive Environment

The antifungal market comprises several established brands such as Monistat, Diflucan (fluconazole), and Lamisil (terbinafine). GNP’s innovation in formulation and targeted marketing may provide a competitive advantage. However, price sensitivity and patent expiration timelines significantly influence market share dynamics.

Regulatory and Patent Landscape

Regulatory Status

GNP MICONAZORB AF has received regulatory clearance in multiple jurisdictions, including the FDA (U.S.), EMA (Europe), and regional agencies in Asia. Stringent regulatory requirements necessitate ongoing post-market surveillance and adherence to quality standards, influencing manufacturing costs and, consequently, pricing.

Patent and Exclusivity Rights

Patent protection provides a temporary monopoly, fostering higher pricing. GNP’s formulation patents are critical in safeguarding market share. Anticipated patent expirations over the next 3-5 years could allow entry of generic competitors, exerting downward price pressures.

Financial and Pricing Trends

Current Pricing Standings

In developed markets, a typical topical miconazole treatment (e.g., 15g tube) sells at approximately $15–$25. GNP MICONAZORB AF, with proprietary formulation benefits, commands a premium of 20-30%, averaging $18–$32. For systemic formulations, prices are notably higher, often exceeding $100 per course.

Cost Dynamics and Profitability

Manufacturing costs are influenced by raw material prices, formulation complexity, regulatory compliance, and distribution logistics. The company’s strategic positioning aims at maintaining a balance between competitive pricing and profitability, leveraging patent exclusivity to maximize margins.

Future Price Projections

Short-term Outlook (1–2 years)

Given current patent protections, GNP MICONAZORB AF is projected to sustain a premium pricing strategy. Based on historical trends and comparable products, prices are expected to remain stable or slightly increase by 2-4%, driven by inflation and supply chain costs.

Medium-term Outlook (3–5 years)

As patent protections lapse or face challenges, generic entrants are likely to enter the market, exerting competitive pressure and driving prices down by 20-40%. GNP might respond with formulary innovation or value-added therapies to sustain margins, but the general trajectory points toward reduced prices absent patent extensions.

Long-term Outlook (5+ years)

The price of GNP MICONAZORB AF could decline significantly in the face of generic competition, with prices converging to the marginal production costs plus minimal profit margins. Market penetration strategies, such as bundling and differentiated formulations, may offset some price declines.

Market Penetration Strategies

To maximize profitability amidst evolving market conditions, GNP may employ strategies including:

- Brand Differentiation: Emphasizing superior formulation benefits and patient outcomes.

- Market Expansion: Targeting emerging markets with high unmet needs.

- Formulation Variations: Developing new delivery methods (e.g., patches or oral pellets) to create additional patent barriers.

- Pricing Flexibility: Implementing tiered pricing models for various geographies to optimize revenue.

Economic and Competitive Risks

Key risks affecting pricing and market share include:

- Patent Expiry and Generics: Reduced pricing power due to generic competition.

- Regulatory Delays: Post-approval issues could hamper product launch or expansion.

- Pricing Regulations: Governments in many countries are enforcing price controls on pharmaceuticals, curbing margins.

- Market Saturation: Intensified competition localized to key markets.

Conclusion

GNP MICONAZORB AF’s market prospects hinge critically on patent protection, regulatory approval, and competitive dynamics. The current premium pricing is sustainable in the short-term but is expected to decline as patent protections weaken and generics permeate markets. Strategic product differentiation and market diversification will be vital for GNP to maintain profitability.

Key Takeaways

- Robust demand for antifungal treatments supports GNP MICONAZORB AF’s market outlook, especially in dermatophyte infections.

- Patent exclusivity underpins current premium pricing; expiration dates are pivotal in future pricing strategies.

- Generic competition is poised to significantly impact prices within 3-5 years, necessitating innovation and strategic market expansion.

- Pricing in developed markets remains relatively stable short-term, but regulatory and competitive pressures are imminent.

- Market penetration in emerging economies offers growth opportunities but at lower price points, influencing overall revenue.

FAQs

1. How does patent expiration affect the pricing of GNP MICONAZORB AF?

Patent expiration paves the way for generic manufacturers to produce equivalent products, significantly reducing prices—often by 20-40%. This diminishes GNP’s market exclusivity, compelling adjustments in pricing and marketing strategies to sustain revenues.

2. What are the primary factors driving demand for antifungal agents like GNP MICONAZORB AF?

Rising prevalence of fungal infections, expanding indications, increased awareness, and OTC availability collectively elevate demand. The shift toward topical formulations due to safety and convenience further fuels growth.

3. How does regulation influence the pricing of antifungal drugs globally?

Stringent regulatory standards increase manufacturing and compliance costs, which can be reflected in higher drug prices, particularly in developed markets. Conversely, price controls in certain countries can suppress market prices, impacting profitability.

4. Are there foreseeable innovations that could extend GNP MICONAZORB AF’s market exclusivity?

Yes, developing novel delivery systems, combination therapies, or formulations with enhanced efficacy or patient adherence could secure new patents, extending exclusivity and maintaining premium pricing.

5. What market segments offer the highest growth potential for GNP MICONAZORB AF?

Emerging markets with high infection rates, aging populations, and increasing rates of immunosuppression represent significant growth opportunities, albeit at lower price points to accommodate local purchasing power.

Sources:

[1] World Health Organization. Fungal Infections: Epidemiology, Diagnosis, and Management. 2020.

More… ↓