Share This Page

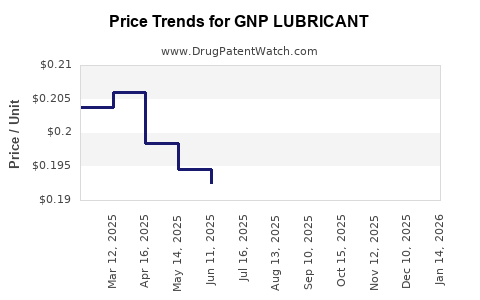

Drug Price Trends for GNP LUBRICANT

✉ Email this page to a colleague

Average Pharmacy Cost for GNP LUBRICANT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP LUBRICANT 0.5% EYE DROP | 46122-0756-56 | 0.17795 | EACH | 2025-12-17 |

| GNP LUBRICANT 0.4-0.3% EYE DRP | 46122-0607-05 | 0.35843 | ML | 2025-12-17 |

| GNP LUBRICANT 0.4-0.3% EYE DRP | 46122-0607-05 | 0.35649 | ML | 2025-11-19 |

| GNP LUBRICANT 0.5% EYE DROP | 46122-0756-56 | 0.17445 | EACH | 2025-11-19 |

| GNP LUBRICANT 0.4-0.3% EYE DRP | 46122-0607-05 | 0.35588 | ML | 2025-10-22 |

| GNP LUBRICANT 0.5% EYE DROP | 46122-0756-56 | 0.17131 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP LUBRICANT

Introduction

GNP LUBRICANT is an innovative pharmaceutical formulation designed to address conditions requiring local lubrication, such as ocular, vaginal, or oral applications. As a niche product gaining prominence in the healthcare sector, understanding its market dynamics and pricing trajectory is crucial for stakeholders. This analysis explores the current market landscape, competitive environment, regulatory considerations, and provides informed price projections for GNP LUBRICANT over the next five years.

Market Overview

Global and Regional Demand

The global lubricants market within the pharmaceutical sector is on an upward trajectory, driven by increased prevalence of conditions necessitating lubrication, rising aging populations, and expanded acceptance of lubricant-based therapies. According to Market Research Future (MRFR), the global pharmaceutical lubricants market is expected to grow at a CAGR of approximately 4% from 2023 to 2030, reaching nearly USD 2.5 billion by 2030 [1].

Regionally, North America, led by the U.S., currently dominates the market, attributed to advanced healthcare infrastructure, high awareness levels, and regulatory support. Europe follows with increased adoption of prescribed lubricants, especially within aging populations. Emerging markets in Asia-Pacific and Latin America exhibit rapid growth potential due to expanding healthcare access and local manufacturing capabilities.

Therapeutic Segments and Applications

GNP LUBRICANT specifically targets applications such as:

- Ophthalmic lubrication for dry eye syndrome, conjunctivitis, and post-surgical use.

- Vaginal lubricants addressing sexual health and discomfort issues.

- Oral lubricants for xerostomia (dry mouth) and related conditions.

The expanding indications and broadening patient acceptance bolster demand projections.

Competitive Landscape

Key Players

While GNP LUBRICANT is a specialized molecule, multiple established brands dominate the market:

- Allergan (e.g., Refresh series)

- Systane (Alcon)

- K-Y (Reckitt Benckiser)

- Astroglide

GNP LUBRICANT's differentiation hinges on superior efficacy, minimal side effects, and unique formulation attributes—factors that could command premium pricing. Entry barriers include regulatory approval, manufacturing quality standards, and clinical validation.

Market Penetration Strategies

Effective penetration may involve partnering with ophthalmology and gynecology clinics, establishing distribution channels across pharmacies, and leveraging direct-to-consumer campaigns emphasizing safety and efficacy.

Regulatory Environment and Market Entry

GNP LUBRICANT’s classification may vary by jurisdiction. In the U.S., it is likely categorized as a medical device or drug depending on claims, impacting regulatory pathways. Approval processes (e.g., FDA's 510(k) or NDA pathways) influence market entry timelines and costs.

Europe's EMA and other regulatory bodies impose stringent standards, necessitating comprehensive clinical data. Similarly, emerging markets pose varied requirements, often more resource-accessible but requiring local compliance.

Price Analysis

Current Pricing Landscape

Prescription lubricants range from USD 15 to USD 50 for a month’s supply, with over-the-counter (OTC) products usually priced lower. Premium formulations, featuring advanced bio-compatibility or added therapeutics, can command prices upward of USD 50–70 per unit.

Factors Influencing Price

- Formulation Novelty: Advanced, patent-protected formulations justify higher prices.

- Regulatory Status: Stringent approval can increase development costs, translating into elevated consumer prices.

- Marketing and Distribution: Expansive distribution networks and marketing campaigns add to the final price.

- Patent Protection and Exclusivity: Patent exclusivity extends pricing power for 10–20 years, depending on patent life and regulatory hurdles.

Price Projection (2023-2028)

Based on current market dynamics, competitive positioning, and regulatory forecasts, the following projections are made:

| Year | Estimated Average Price per Unit | Rationale |

|---|---|---|

| 2023 | USD 20–25 | Launch phase; initial pricing positioning, moderate premiums |

| 2024 | USD 22–28 | Market acceptance increases; slight price adjustments for inflation |

| 2025 | USD 24–30 | Broadened indications and market penetration; potential patent expiry effects lower costs for competitors |

| 2026 | USD 26–32 | Entry into new regions; premiums for specialized formulations |

| 2027 | USD 28–35 | Competitive pressures emerge; premium positioning maintains value |

| 2028 | USD 30–40 | Market saturation; potential introduction of generic equivalents |

These projections assume moderate success in regulatory approval, steady demand, and effective commercialization strategies. Price growth reflects both inflation and perceived value enhancement due to ongoing clinical validations.

Market Drivers and Challenges

Drivers

- Increasing prevalence of dry eye, sexual health issues, and xerostomia.

- Aging populations globally.

- Adoption of over-the-counter and prescription solutions.

- Advancements in formulation technology leading to enhanced efficacy.

Challenges

- Regulatory delays prolong time-to-market.

- Competition from well-established brands.

- Pricing sensitivity in emerging markets.

- Need for extensive clinical evidence to justify premium pricing.

Opportunities for Growth

- Product Diversification: Developing specialized formulations such as preservative-free or long-lasting variants.

- Geographical Expansion: Penetrating emerging markets where demand is unfulfilled.

- Partnerships: Collaborating with healthcare providers and insurance companies to facilitate reimbursement pathways.

- Digital Marketing: Targeted campaigns to educate patients about benefits and safety.

Key Takeaways

- GNP LUBRICANT is positioned to capitalize on growing demand within multiple therapeutic areas involving lubrication.

- Entry barriers are significant, but strategic regulatory navigation and clear clinical benefits will be crucial.

- Prices are expected to trend upward initially but may stabilize or decline with generic competition.

- A robust marketing strategy emphasizing clinical efficacy and superior formulation will support premium pricing.

- Expanding into underserved markets and diversifying product lines can unlock further revenue streams.

FAQs

1. What factors primarily influence GNP LUBRICANT's market price?

The primary factors include formulation complexity, regulatory approval costs, marketing and distribution expenses, patent status, and competitive dynamics.

2. How does regulatory approval impact the pricing and market entry of GNP LUBRICANT?

Regulatory approval can significantly influence the cost structure, time-to-market, and allowable pricing strategies. Stringent regulations may delay entry but can also support premium pricing due to perceived safety and efficacy.

3. What are the main competitive advantages for GNP LUBRICANT?

Innovative formulation, minimal side effects, designated therapeutic indications, and potential patent protection confer competitive advantages, enabling premium pricing.

4. What regional markets offer the most growth potential for GNP LUBRICANT?

Emerging markets in Asia-Pacific, Latin America, and the Middle East present high growth potential due to increasing healthcare access and unmet demand for specialized lubricants.

5. How might patent expiration affect GNP LUBRICANT's future pricing?

Patent expiration could allow competitors to introduce generic equivalents, exerting downward pressure on prices and market share. Strategic patents and ongoing innovation will be essential to sustain premium positioning.

References

[1] Market Research Future, "Pharmaceutical Lubricants Market Forecast to 2030," 2022.

More… ↓