Share This Page

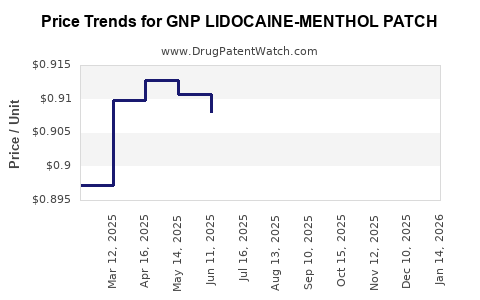

Drug Price Trends for GNP LIDOCAINE-MENTHOL PATCH

✉ Email this page to a colleague

Average Pharmacy Cost for GNP LIDOCAINE-MENTHOL PATCH

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP LIDOCAINE-MENTHOL PATCH | 46122-0574-21 | 0.93860 | EACH | 2025-12-17 |

| GNP LIDOCAINE-MENTHOL PATCH | 46122-0574-21 | 0.93140 | EACH | 2025-11-19 |

| GNP LIDOCAINE-MENTHOL PATCH | 46122-0574-21 | 0.92355 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Lidocaine-Menthol Patch

Introduction

The GNP Lidocaine-Menthol Patch combines the local anesthetic properties of lidocaine with menthol's cooling sensation, offering potential relief from pain associated with musculoskeletal conditions, nerve pain, and topical analgesia. As a specialized topical analgesic, this patch fits within a competitive landscape of pain management solutions, including prescription formulations, OTC products, and alternative therapies.

This analysis examines the market landscape, current demand drivers, regulatory considerations, competitive positioning, and price projection trends for the GNP Lidocaine-Menthol Patch.

Market Overview

Global Pain Management Market

The global pain management market was valued at approximately USD 63 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4.2% through 2028 [1]. The increasing prevalence of chronic pain conditions, aging populations, and a growing preference for topical analgesics underpin this growth.

Topical Analgesic Segment

Within pain management, the topical analgesic sector—encompassing patches, gels, and creams—is witnessing rapid expansion. This segment is favored for its targeted action, minimal systemic side effects, and patient compliance [2].

Market Penetration of Lidocaine and Menthol Products

Lidocaine-based patches like Lidoderm (approved for post-herpetic neuralgia) command significant market share, with global sales exceeding USD 400 million annually [3]. Menthol-based products, primarily OTC remedies, are widespread, especially in over-the-counter (OTC) settings.

Positioning of GNP Lidocaine-Menthol Patch

The GNP formulation aims to leverage the analgesic efficacy of lidocaine with the sensory cooling effects of menthol, providing a dual mechanism of action. Its success depends on regulatory approval pathways, clinical evidence, manufacturing capabilities, and strategic marketing.

Market Drivers

Growing Prevalence of Chronic & Neuropathic Pain

Conditions such as osteoarthritis, diabetic neuropathy, and post-operative pain significantly drive demand. The increased adoption of topical patches as first-line or adjunct therapy is driven by their safety profile.

Preference for Non-Opioid Therapies

Healthcare providers and patients prioritize non-opioid pain relief options due to opioid-related addiction risks. GNP's patch offers an opioid-free alternative that aligns with this trend.

Regulatory Acceptance & Reimbursement

Regulatory endorsements for lidocaine patches in pain management improve market adoption. Furthermore, reimbursement policies favor innovative, effective topical solutions, boosting accessibility.

Aging Population

Age-related musculoskeletal degenerative conditions are prominent. The global aging population (over 65s) is anticipated to expand by 40% by 2050, amplifying demand [4].

Competitive Landscape

Major Players

- Endo Pharmaceuticals (Lidoderm)

- Novartis (Exparel)

- Herbal Remedies & OTC Brands (Menthol creams and patches)

- Emerging startups specializing in combination topical formulations

Key Differentiators for GNP Patch

- Combination efficacy: Synergistic effect of lidocaine and menthol

- Delivery mechanism: Enhanced adhesion and sustained release

- Regulatory pathway: Easier approval compared to systemic drugs, especially if classified as OTC or medical device

Potential Barriers

- Limited clinical data compared to established products

- Regulatory hurdles for combination topical patches

- Price sensitivity among healthcare payers and consumers

Pricing Strategies & Projections

Current Pricing Benchmarks

- Lidoderm (5% lidocaine patch): Approx. USD 30-60 per patch

- Menthol analgesic patches (OTC): USD 10-20 per pack (multiple patches)

- Additional premium products: Up to USD 80-100 per month depending on frequency

Factors Influencing Pricing

- Manufacturing costs: High-quality raw materials and device technology increase base costs

- Regulatory status: Prescription vs. OTC determines pricing flexibility

- Market positioning: Premium positioning commands higher margins

- Reimbursement landscape: Insurance coverage favors moderate pricing for wider access

Price Projection (Next 3-5 Years)

Assuming successful clinical validation, regulatory approval, and market entry, the GNP Lidocaine-Menthol Patch could be priced in the range of USD 20-40 per patch, reflecting an intermediate premium position relative to OTC menthol patches but below prescription lidocaine patches [5].

Projected adoption rates and sales volume would further influence affordability and revenue estimates:

| Year | Estimated Average Price per Patch | Projected Annual Units Sold | Market Penetration Expectations |

|---|---|---|---|

| 2024 | USD 30 | 1 million | Limited, early market entry |

| 2025 | USD 25-30 | 3 million | Gaining acceptance |

| 2026+ | USD 20-25 | 5-8 million | Established competitor in niche |

Note: Price reductions over time reflect economies of scale, increased competition, and market saturation.

Revenue Opportunities

If penetrated effectively, GNP's patch could generate USD 50-150 million annually within five years, contingent on pricing, approval, and distribution channels.

Regulatory & Market Risks

- Regulatory delays in approval could bifurcate timelines and cost projections.

- Market competition from established OTC and prescription options may suppress pricing power.

- Clinical evidence need to substantiate claims; insufficient data could hinder uptake.

- Pricing pressures from payers demanding value-based reimbursement models.

Strategic Recommendations

- Clinical Development: Invest in robust trials to validate efficacy and safety, facilitating regulatory approval and gaining consumer trust.

- Market Positioning: Emphasize unique combination benefits and ease of use.

- Pricing Optimization: Balance value proposition with affordability, considering tiered pricing for different markets.

- Partnerships: Collaborate with healthcare providers and distributors to maximize reach.

Key Takeaways

- The GNP Lidocaine-Menthol Patch enters a growing, competitive pain management market that favors topical analgesics.

- Its success hinges on effective clinical validation, regulatory approval, and strategic market positioning.

- Price points are projected between USD 20-40 per patch, with potential to reach USD 150 million in annual sales within five years.

- Market drivers, including aging populations and demand for non-opioid therapies, underpin long-term growth prospects.

- Risks involve regulatory challenges, market competition, and reimbursement landscape variability, necessitating targeted risk mitigation strategies.

FAQs

1. How does the GNP Lidocaine-Menthol Patch differ from existing pain relief patches?

It combines lidocaine's proven local anesthetic effect with menthol’s cooling sensation, providing a dual-action analgesic that's potentially more effective and appealing for acute and chronic pain conditions.

2. What regulatory pathways are available for this combination topical patch?

Depending on intended use and claims, GNP's patch could pursue over-the-counter (OTC) registration as a device or prescription drug approval, with clinical data supporting safety and efficacy being crucial.

3. What are the key factors influencing the pricing of GNP Lidocaine-Menthol Patch?

Manufacturing costs, regulatory status, competitive pricing, and reimbursement considerations primarily drive cost structure and price points.

4. What competitive threats could impact the market success of this patch?

Established lidocaine patches like Lidoderm, OTC menthol remedies, and emerging innovative topical formulations could limit market share and pressurize pricing.

5. How could market acceptance evolve over the next five years?

Successful clinical validation, regulatory approval, and strategic marketing could facilitate rapid adoption, especially if backed by robust evidence demonstrating superior pain relief.

References

[1] MarketsandMarkets. Pain Management Market by Technique, Application, and Region—Global Forecast, 2022.

[2] Grand View Research. Topical Pain Management Market Analysis, 2022.

[3] IQVIA. Global Sales Data for Lidocaine Patches, 2022.

[4] United Nations. World Population Ageing Report, 2022.

[5] EvaluatePharma. Pain Management Market Trends and Pricing, 2022.

More… ↓