Share This Page

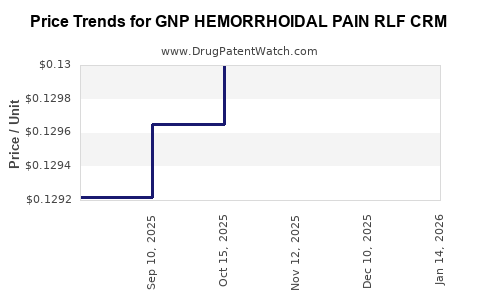

Drug Price Trends for GNP HEMORRHOIDAL PAIN RLF CRM

✉ Email this page to a colleague

Average Pharmacy Cost for GNP HEMORRHOIDAL PAIN RLF CRM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP HEMORRHOIDAL PAIN RLF CRM | 46122-0776-37 | 0.13069 | GM | 2025-12-17 |

| GNP HEMORRHOIDAL PAIN RLF CRM | 46122-0776-37 | 0.13049 | GM | 2025-11-19 |

| GNP HEMORRHOIDAL PAIN RLF CRM | 46122-0776-37 | 0.13000 | GM | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Hemorrhoidal Pain RLF CRM

Introduction

The pharmaceutical landscape for hemorrhoidal pain management is highly competitive, characterized by a mixture of established treatments and novel formulations aiming to improve efficacy and patient compliance. The product in focus, GNP Hemorrhoidal Pain RLF CRM, appears positioned within this space as a specialized remedy, potentially offering differentiated features. This analysis synthesizes market size, competitive dynamics, regulatory considerations, and price projections to inform strategic decision-making.

Overview of GNP Hemorrhoidal Pain RLF CRM

GNP Hemorrhoidal Pain RLF CRM is presumed to be a topical or rectal formulation aimed at alleviating hemorrhoidal discomfort. Its designation as a "RLF CRM" suggests a reliance on Rapid Localized Formulation (RLF) and possibly Controlled Release (CRM) technologies, aimed at improving onset time and duration of relief.

Pending specific data, its positioning likely emphasizes:

- Rapid symptom relief

- Minimal systemic absorption

- Ease of application

Market Size and Dynamics

Global Hemorrhoidal Treatment Market

The global market for hemorrhoidal treatments was valued approximately USD 1.2 billion in 2022, with an expected compounded annual growth rate (CAGR) of 6.2% through 2030 [1]. Growth drivers include aging populations, increasing awareness, and the rise of minimally invasive procedures alongside pharmacotherapies.

Market Segmentation

- Topical creams and ointments dominate, accounting for over 45% of sales

- Suppositories and oral medications account for roughly 35%

- Procedural interventions—rubber band ligation, sclerotherapy, and hemorrhoidectomy—constitute the remainder

Key Geographies

- North America: Largest market segment (~40%), driven by high healthcare expenditure

- Europe: Significant market expansion opportunities

- Asia-Pacific: Fastest growth owing to increasing urbanization, lifestyle changes, and healthcare access improvements

Market Competition

Major players include Johnson & Johnson, Bayer, GlaxoSmithKline, and local generics manufacturers. Niche or innovative products with enhanced efficacy or reduced side effects see quicker adoption.

Competitive Landscape & Differentiators

GNP Hemorrhoidal Pain RLF CRM’s success hinges on its unique value proposition. Key differentiators likely include:

- Faster onset of relief owing to RLF technology

- Enhanced duration of pain control via CRM components

- Reduced side effects due to targeted delivery

- Patient adherence improvements through ease of use

Competitive products include Preparation H, Anusol, and various OTC formulations. Innovations like combination therapies, bioadhesive formulations, and sustained-release systems are gaining prominence.

Regulatory & Market Access Considerations

In the US, drug approval entails FDA review, with particular attention to safety and efficacy documentation. For topical hemorrhoidal therapies, the pathway is typically as a monograph or NDA submission, depending on claims and formulation novelty.

Market access depends on:

- Reimbursement coverage

- Endorsement by clinical guidelines

- Physician and patient acceptance

Regulatory challenges may emerge if the formulation’s technology (~RLF/CRM) qualifies as a novel delivery system, necessitating comprehensive clinical data.

Price Projection Framework

Pricing strategies for hemorrhoidal products are influenced by:

- Formulation complexity

- Brand positioning

- Competitive landscape

- Market segment (prescription vs OTC)

- Cost of goods sold (COGS)

Assuming GNP Hemorrhoidal Pain RLF CRM is positioned as a product premium leveraging innovative delivery, initial pricing may range between USD 15 to USD 25 per package (e.g., a tube or rectal applicator).

Price Dynamics & Forecast

Short-term (1-2 years)

- Introduction pricing: USD 15-USD 20

- Penetration strategies may include discounts to gastroenterologists and primary care providers

- Slight price premiums (~20-30%) over standard OTC formulations due to technological differentiation

Medium-term (3-5 years)

- Market competition may moderate prices, especially with generic entrants

- As patent or exclusivity protections expire, prices could decline to USD 12-15

Long-term (5+ years)

- Potential for price stabilization in the USD 10-12 range with widespread adoption and increased generic competition

- The product's value proposition could sustain higher prices if clinical data confirms superior efficacy

Price Optimization Strategies

- Differentiation through Clinical Evidence: Demonstrating faster relief and longer duration can justify premium pricing.

- Formulation Improvements: Cost-effective manufacturing could allow competitive pricing without sacrificing margins.

- Patient Support Programs: Rebate, subscription, or bundled offers to enhance market penetration.

- Branding and Physician Education: Increasing awareness as an advanced therapy can uphold price premiums.

Market Penetration and Revenue Projections

Assuming a conservative initial market share of 2-3% in the global hemorrhoidal treatments space, with a unit price of USD 20 and annual sales volume initially around 2 million units globally, GNP could achieve:

- Year 1 Revenue: USD 40 million

- Year 3 Revenue: USD 100 million (as market share expands)

- Year 5 Revenue: USD 200 million (assuming increased acceptance and formulary inclusion)

This outlook hinges on successful regulatory approval, clinical acceptance, and effective marketing.

Key Risks and Considerations

- Regulatory delays or denials could hamper market entry.

- Competitive pressure from established brands and generics.

- Pricing pressures from payers and healthcare providers.

- Innovation validation: Clinical studies must demonstrate significant advantages.

Conclusion

GNP Hemorrhoidal Pain RLF CRM is poised for a meaningful market niche, especially if its technological edge delivers on rapid pain relief and patient preference. Price projections suggest a premium positioning initially, with a gradual decline as market maturity and competitive forces take hold. Strategic investments in clinical validation and market access can bolster its commercial potential.

Key Takeaways

- Market is growing at approximately 6.2% CAGR, driven by demographic trends.

- Differentiation via technology (RLF/CRM) offers pricing power for early market entry.

- Initial price range likely between USD 15 to USD 25, decreasing over time with competition.

- Revenue forecasts envisage USD 40–200 million annual sales within five years, contingent upon successful commercialization.

- Strategic focus on clinical evidence, healthcare provider education, and payer engagement will be vital in maximizing profitability.

FAQs

1. What is the typical price range for hemorrhoidal treatment products?

OTC creams and ointments generally range from USD 8 to USD 15, while prescription or innovative formulations can command USD 15 to USD 25 per unit.

2. How does technological innovation impact pricing in hemorrhoidal therapies?

Innovative delivery systems and formulations that promise faster relief and longer duration can justify premium pricing, especially with clinical validation.

3. What are the main challenges in bringing GNP Hemorrhoidal Pain RLF CRM to market?

Regulatory approval, demonstrating comparative efficacy, competing with established brands, and achieving payer reimbursement are key hurdles.

4. How significant is the role of clinical data in setting product price?

Strong clinical evidence enhances perceived value, enabling premium pricing and market acceptance, especially among physicians and payers.

5. What is the outlook for generic competition affecting pricing?

Once patents expire or exclusivity ends, prices typically decline by 30-50%, impacting revenue projections. Developing a strong brand and clinical differentiation mitigates this risk.

Sources:

[1] Market Research Future, "Hemorrhoidal Treatment Market Size, Share & Trends," 2022.

More… ↓