Share This Page

Drug Price Trends for GNP HEMORRHOIDAL OINTMENT

✉ Email this page to a colleague

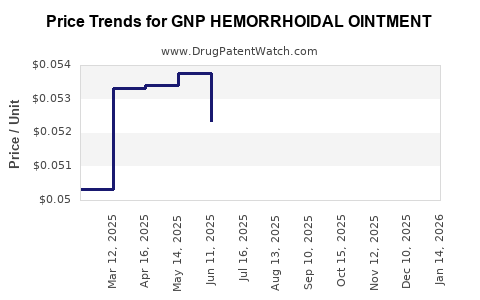

Average Pharmacy Cost for GNP HEMORRHOIDAL OINTMENT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP HEMORRHOIDAL OINTMENT | 46122-0677-46 | 0.05083 | GM | 2025-12-17 |

| GNP HEMORRHOIDAL OINTMENT | 46122-0677-46 | 0.05221 | GM | 2025-11-19 |

| GNP HEMORRHOIDAL OINTMENT | 46122-0677-46 | 0.05450 | GM | 2025-10-22 |

| GNP HEMORRHOIDAL OINTMENT | 46122-0677-46 | 0.05422 | GM | 2025-09-17 |

| GNP HEMORRHOIDAL OINTMENT | 46122-0677-46 | 0.05422 | GM | 2025-08-20 |

| GNP HEMORRHOIDAL OINTMENT | 46122-0677-46 | 0.05302 | GM | 2025-07-23 |

| GNP HEMORRHOIDAL OINTMENT | 46122-0677-46 | 0.05233 | GM | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Hemorrhoidal Ointment

Introduction

GNP Hemorrhoidal Ointment is a topical medication primarily used to treat hemorrhoids, offering symptomatic relief from pain, swelling, and inflammation. As a well-established product in the gastrointestinal therapeutic space, understanding its market dynamics and future pricing trends is vital for pharmaceutical companies, healthcare providers, and investors. This analysis evaluates current market conditions, competitive landscape, regulatory environment, and pricing trajectories for GNP Hemorrhoidal Ointment.

Market Overview

Global Hemorrhoidal Treatment Market

The global hemorrhoidal treatment market has experienced steady growth driven by increasing prevalence of hemorrhoids, aging populations, and rising awareness about minimally invasive therapies. The market size was valued at approximately USD 2.4 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of around 5% through 2028 (Research and Markets, 2022). Top contributors include North America, Europe, and Asia-Pacific, where healthcare infrastructure and patient awareness remain robust.

Key Drivers

- Rising Incidence: Hemorrhoids affect up to 75% of adults at some point, often exacerbated by sedentary lifestyles, obesity, and dietary factors (National Institute of Diabetes and Digestive and Kidney Diseases, 2021).

- Aging Population: Older adults are more susceptible, expanding the applicable patient base.

- Preference for Topicals: Increasing preference for over-the-counter (OTC) ointments and creams facilitates higher volume sales.

- Regulatory Approval: Many formulations, including GNP Hemorrhoidal Ointment, benefit from regulatory familiarity and existing patent protections.

Product Segmentation

While GNP Hemorrhoidal Ointment is one of many topical formulations, its market share remains significant due to brand recognition and efficacy profile. Competitors include preparations with phenylephrine, hydrocortisone, lidocaine, and combination therapies.

Competitive Landscape

The hemorrhoidal ointment market is highly fragmented, comprising both branded and generic products. Major players include:

- Preparation H (Reckitt Benckiser): Market leader with diversified formulations.

- Scovolt (Geminex): Focused on natural ingredients.

- Anusol (Bayer): Long-standing OTC name with broad reach.

- GNP Hemorrhoidal Ointment: Known for its traditional formulation, combining ingredients such as phenylephrine, petrolatum, and lanolin.

Brand loyalty, product efficacy, and marketing strategies influence market share distribution. New entrants face challenges competing against established brands with extensive distribution channels.

Regulatory Environment and Pricing Factors

Regulatory agencies like the FDA (U.S.) and EMA (Europe) govern OTC and prescription hemorrhoidal products. Many ointments are categorized as OTC medications, allowing broad availability but subjecting them to standards for safety and efficacy.

Pricing determinants include:

- Manufacturing costs: Raw materials, stability, and formulation complexity.

- Regulatory approval costs: Clinical trials and compliance.

- Market competition: Price wars are common, especially with generics.

- Distribution channels: Pharmacy, online, and direct sales influence retail margins.

- Brand positioning: Premium brands may command higher prices based on perceived efficacy.

Current Pricing Analysis

Pricing in Key Markets

- United States: OTC hemorrhoidal ointments retail between USD 5-15 for a 15g to 30g tube.

- Europe: Similar pricing, generally EUR 4-12, influenced by local healthcare policies and competition.

- Asia-Pacific: Lower price points, ranging from USD 2-8, due to market sensitivity and high generic penetration.

GNP Hemorrhoidal Ointment is positioned as a mid-tier product, with average retail prices around USD 8-12 in North America and EUR 6-10 in Europe.

Price Projections and Future Trends

Short-term Outlook (Next 2 Years)

- Stability in Pricing: Due to supply chain resilience and unchanged raw material costs, prices are expected to remain stable.

- Margin Pressures: Increased generic competition may drive some brands to lower retail prices or offer promotional discounts.

- Market Penetration Strategies: Companies may adopt promotional pricing to enhance market share, especially in emerging markets.

Mid-to-long-term Outlook (3-5 Years)

- Price Decrease Due to Generics: Patent expirations and the entrance of generics can reduce prices by 20-40% over the medium term.

- Premium Positioning Opportunities: Brands emphasizing natural ingredients, faster relief, or additional benefits can sustain higher prices.

- Impact of Healthcare Policy Changes: Reimbursement policies and OTC classification adjustments could influence retail pricing strategies.

Innovative and Differentiation Trends

The incorporation of natural extracts, sustained-release formulations, or combination therapies could command higher prices, especially if supported by clinical data demonstrating improved outcomes.

Key Market Risks and Opportunities

-

Risks:

- Price erosion from generic entries.

- Regulatory changes impacting OTC classifications.

- Shifts in consumer preferences toward natural or alternative remedies.

-

Opportunities:

- Expansion into emerging markets with increasing healthcare access.

- Development of adjunct therapies to create premium product lines.

- Digital marketing strategies to boost OTC sales.

Conclusion

GNP Hemorrhoidal Ointment remains a stable player within a mature, competitive market. While current prices are relatively fixed, market dynamics forecast a gradual decline in retail prices due to generics and increased competition. Brands that innovate or position themselves as premium options can sustain higher margins. Strategic pricing, aligned with regulatory and consumer trends, will be critical in maintaining profitability.

Key Takeaways

- The global hemorrhoidal treatment market is growing modestly, with OTC ointments like GNP Hemorrhoidal Ointment maintaining foundational importance.

- Price stability persists in the short term, with medium-term downward pressure likely from generics.

- Market differentiation through formulation innovation and natural ingredients can justify premium pricing.

- Regional disparities affect pricing, with North America and Europe commanding higher retail prices than Asia-Pacific.

- Monitoring regulatory developments and consumer preferences will be vital for forecasting future pricing strategies.

FAQs

-

What factors influence the pricing of GNP Hemorrhoidal Ointment?

Pricing is affected by manufacturing costs, competition, regulatory status, distribution channels, and brand positioning. -

How will generic competition impact the price of GNP Hemorrhoidal Ointment?

Generics entering the market typically cause a 20-40% reduction in prices, exerting significant price pressure. -

Are there emerging markets promising for GNP Hemorrhoidal Ointment?

Yes, Asia-Pacific and Latin America show increasing demand due to rising awareness and improving healthcare infrastructure. -

Can innovation extend the product’s premium pricing potential?

Yes, formulations incorporating natural ingredients, sustained-release technology, or additional benefits can command higher prices. -

What regulatory changes could affect future pricing trends?

Changes in OTC classification policies, reimbursement schemes, or new safety standards could influence retail prices and market access.

References

[1] Research and Markets. (2022). Hemorrhoidal Treatment Market - Growth, Trends, and Forecasts (2022-2028).

[2] National Institute of Diabetes and Digestive and Kidney Diseases. (2021). Hemorrhoids.

Disclaimer: This analysis reflects current market conditions and projections based on publicly available information as of 2023. Market dynamics are subject to change due to regulatory, economic, and technological factors.

More… ↓