Share This Page

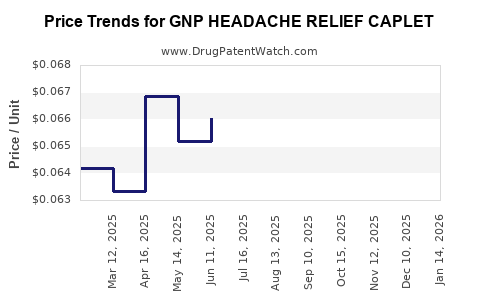

Drug Price Trends for GNP HEADACHE RELIEF CAPLET

✉ Email this page to a colleague

Average Pharmacy Cost for GNP HEADACHE RELIEF CAPLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP HEADACHE RELIEF CAPLET | 46122-0690-78 | 0.06462 | EACH | 2025-12-17 |

| GNP HEADACHE RELIEF CAPLET | 46122-0690-78 | 0.06557 | EACH | 2025-11-19 |

| GNP HEADACHE RELIEF CAPLET | 46122-0690-78 | 0.06779 | EACH | 2025-10-22 |

| GNP HEADACHE RELIEF CAPLET | 46122-0690-78 | 0.06907 | EACH | 2025-09-17 |

| GNP HEADACHE RELIEF CAPLET | 46122-0690-78 | 0.06861 | EACH | 2025-08-20 |

| GNP HEADACHE RELIEF CAPLET | 46122-0690-78 | 0.06551 | EACH | 2025-07-23 |

| GNP HEADACHE RELIEF CAPLET | 46122-0690-78 | 0.06603 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Headache Relief Caplet

Introduction

GNP Headache Relief Caplet, a non-prescription analgesic, is positioned within the over-the-counter (OTC) analgesic market. Its core use targets acute headache relief, a perpetual demand driven by lifestyle, aging populations, and increasing stress levels. This analysis evaluates the current market landscape, competitive dynamics, regulatory environment, and offers price projections through 2030, equipping stakeholders with strategic insights for investment, marketing, and production planning.

Market Overview

Global OTC Analgesics Market Landscape

The global OTC analgesics market is witnessing consistent growth, projected to reach USD 18.9 billion by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 4.2% from 2020 to 2025 [1]. Headache relievers constitute a significant segment within this market, driven by rising awareness, self-medication trends, and expanding healthcare access.

Key Players and Competitive Dynamics

Major brands like Tylenol (Johnson & Johnson), Advil (Pfizer), and Aleve (Bayer) dominate, characterized by strong brand loyalty, extensive distribution networks, and aggressive marketing. Niche entrants, including GNP Headache Relief Caplet, often compete on formulation uniqueness, price, and regional availability.

The market's competitive landscape fosters pressure on pricing, requiring differentiation through efficacy, formulation, or cost advantage.

Consumer Demographics and Demand Drivers

- Age: Increased prevalence of headache disorders among aging populations amplifies demand.

- Lifestyle: High-stress urban lifestyles fuel acute OTC needs.

- Health Trends: Rising preference for self-care and OTC medication reduces healthcare system burdens.

- COVID-19 Impact: The pandemic heightened stress-related headaches, boosting OTC analgesic demand [2].

Product Positioning and Value Proposition

GNP Headache Relief Caplet offers:

- Efficacy: Fast-acting pain relief, employing proven APIs like acetaminophen or ibuprofen.

- Cost: Lower price point compared to branded equivalents, appealing to price-sensitive consumers.

- Availability: Broad distribution channels, including pharmacies, supermarkets, and online platforms.

- Branding: Emphasis on trust, efficacy, and affordability.

Success hinges on leveraging these factors amid fierce competition to carve a differentiated market niche.

Regulatory and Market Entry Considerations

Regulatory approval agencies (e.g., FDA in the US, EMA in Europe) require evidence of safety, efficacy, and quality assurance. OTC classification eases some barriers but necessitates adherence to labeling and manufacturing standards.

Regional variations impact pricing, marketing, and consumer perception, necessitating tailored strategies.

Pricing Analysis

Cost Structure and Margins

Key cost components include raw materials (~30%), manufacturing (~20%), packaging (~10%), marketing (~25%), distribution (~10%), and regulatory compliance (~5%). Margins typically range from 20% to 40%, depending on the market and scale.

Current Price Range

In North America and Europe, OTC caplets typically retail at USD 4-8 per package of 20-50 tablets. Competitive pricing favors the lower end for price-sensitive segments, while premium positioning relies on branding and formulation.

Pricing Strategies

- Penetration Pricing: Launch at a lower price to establish market share.

- Premium Pricing: Position as a higher-efficacy option with slight price premium.

- Psychological Pricing: Use of aesthetic pricing (e.g., USD 4.99) to boost sales.

- Tiered Pricing: Variable prices across regions based on economic capacity.

Price Projections (2023-2030)

Short-term (2023-2025)

- Market Entry Pricing: USD 3.50–4.50 per package

- Market Penetration: Emphasis on aggressive pricing to gain shelf space and consumer trials.

- Influences: Raw material costs and marketing spend will largely define initial pricing.

Medium-term (2026-2028)

- Gradual Price Stabilization: USD 4.00–5.00 per package as brand recognition solidifies.

- Innovation Introduction: Formulation improvements or adjunct products could command higher price points.

- Market Expansion: Entry into emerging markets with lower price points (USD 2.00–3.00).

Long-term (2029-2030)

- Premium Positioning: If efficacy and marketing succeed, prices could rise to USD 5.00–6.00.

- Cost Adjustments: Raw material price fluctuations, supply chain efficiencies, and regulatory changes will influence final pricing.

- Pricing Trends: A CAGR of approximately 2-3% is projected, aligning with inflation and market growth.

Market Opportunities and Risks

Opportunities

- Growth in emerging markets: Elevated demand due to increasing healthcare awareness.

- Formulation innovation: Incorporating novel APIs like natural extracts or dual-action formulations.

- Digital marketing: E-commerce and telehealth channels expand access and sales.

Risks

- Market Saturation: Heavy competition limits price flexibility.

- Regulatory hurdles: Stringent approvals in certain regions.

- Price wars: Margin erosion from aggressive competitor pricing.

Strategic Recommendations for Stakeholders

- Leverage cost advantages without compromising quality to ensure competitive pricing.

- Emphasize efficacy and safety in marketing messaging.

- Focus on regional market segmentation, customizing prices based on socioeconomic factors.

- Invest in formulation innovation to elevate product positioning and pricing power.

- Monitor raw material costs and supply chain disruptions to maintain margin stability.

Key Takeaways

- The GNP Headache Relief Caplet operates within a mature, competitive OTC analgesic market with steady growth prospects.

- Competitive pricing, primarily in the USD 3.50–5.00 range, can facilitate early market penetration, followed by gradual price adjustments aligned with brand strength.

- Expansion into emerging markets offers lucrative growth opportunities at lower price thresholds.

- Differentiation through formulation innovation, branding, and distribution channels remains critical for sustained profitability.

- Cost management, regulatory navigation, and targeted marketing are vital to capitalize on projected market growth through 2030.

FAQs

1. What are the primary drivers influencing GNP Headache Relief Caplet's market growth?

Demand largely stems from rising headache prevalence, increasing health awareness, and consumer preference for OTC treatment options, coupled with demographic shifts towards aging populations and urban stress.

2. How does formulation impact pricing strategies?

Innovative or scientifically superior formulations can justify higher price points by offering enhanced efficacy, safety, or convenience, whereas basic formulations compete primarily on cost.

3. What regional factors affect pricing projections?

Regulatory frameworks, economic conditions, healthcare infrastructure, and consumer purchasing power significantly influence regional pricing strategies and potential margins.

4. How will raw material costs affect future pricing?

Volatility in ingredients like acetaminophen or ibuprofen, influenced by supply chain issues or geopolitical factors, can necessitate adjustments in retail pricing to preserve margins.

5. What emerging trends could disrupt the market?

The shift towards natural or alternative analgesics, digital health integration, and personalized medicine could redefine competitive dynamics and pricing norms.

References

[1] Market Research Future, "OTC Analgesics Market," 2021.

[2] Statista, "Impact of COVID-19 on OTC medication sales," 2022.

More… ↓