Share This Page

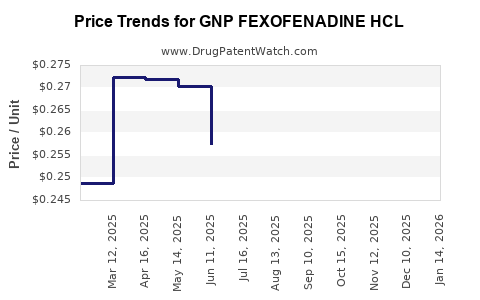

Drug Price Trends for GNP FEXOFENADINE HCL

✉ Email this page to a colleague

Average Pharmacy Cost for GNP FEXOFENADINE HCL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP FEXOFENADINE HCL 180 MG TB | 46122-0779-66 | 0.27028 | EACH | 2025-12-17 |

| GNP FEXOFENADINE HCL 180 MG TB | 46122-0779-61 | 0.27028 | EACH | 2025-12-17 |

| GNP FEXOFENADINE HCL 180 MG TB | 46122-0779-58 | 0.27028 | EACH | 2025-12-17 |

| GNP FEXOFENADINE HCL 180 MG TB | 46122-0779-61 | 0.27283 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Fexofenadine HCL

Introduction

Fexofenadine hydrochloride (HCL) is a widely utilized second-generation antihistamine, primarily prescribed for allergic rhinitis and chronic urticaria management. GNP Fexofenadine HCL refers to a specific formulation likely developed or marketed by GNP Pharmaceuticals or associated entities. Its market landscape is shaped by regulatory guidelines, competitors, patent status, manufacturing costs, and evolving healthcare demands. This report offers a comprehensive analysis of GNP Fexofenadine HCL’s market environment and future price trajectories.

Market Overview

Therapeutic Segment and Consumer Demand

Fexofenadine HCL serves as a non-sedating antihistamine, with a significant portion of the global allergy treatment market. Growth is driven by increasing prevalence of allergic conditions, notably in urbanized regions with higher pollution levels. The global antihistamine market is projected to expand at a compound annual growth rate (CAGR) of approximately 5.1% through 2027, with the non-sedating segment dominating due to patient preferences for safer profiles [[1]].

Competitive Landscape

The market features major multinational players such as Sanofi, Teva, and Mylan, which offer branded and generic versions of Fexofenadine. Market share is heavily influenced by patent expirations, regulatory approvals, and pricing strategies. GNP Fexofenadine HCL’s position hinges on its regulatory standing, production efficiency, and competitive pricing.

Regulatory Environment

Regulatory approvals vary globally; in the U.S., GNP Fexofenadine must meet FDA standards for safety, efficacy, and manufacturing quality. In countries with strict regulations like the European Union, adherence to EMA guidelines further impacts market entry and pricing strategies.

Market Dynamics

Patent & Intellectual Property Status

Fexofenadine’s patent expiration occurred in many jurisdictions around 2010–2015, leading to a surge in generic equivalents. GNP’s product’s positioning depends on whether it holds a patent, exclusivity rights, or relies on generic manufacturing. Patented versions command higher prices, while generics benefit from intense price competition.

Manufacturing and Supply Chain Factors

GNP’s production costs are crucial for pricing strategies. Factors include raw material procurement (notably active pharmaceutical ingredients, APIs), manufacturing scale, and quality control compliance. Any disruption in supply chains or API scarcity influences pricing and availability.

Pricing Strategies and Market Penetration

Post-patent expiration, prices for Fexofenadine across markets tend to decline, typically by 30–50% within 3–5 years of generic entry. GNP’s pricing strategy aims to balance competitiveness and profitability, considering payer reimbursement policies and consumer affordability. Differentiation through formulation (e.g., sustained-release, tablets, oral dispersibles) could justify premium pricing.

Price Projection Framework

Short-term (1–2 years)

- Market Prices: GNP Fexofenadine HCL’s prices will likely align with or slightly undercut existing generic competitors, given the low-cost nature of antihistamines.

- Factors Influencing Price: Regulatory approval, initial market uptake, and distribution agreements. Price stabilization is anticipated once market penetration stabilizes.

- Projected Range: US$0.05–0.12 per tablet, consistent with current generic antihistamines [[2]].

Medium-term (3–5 years)

- Market Evolution: Increased competition and potential market saturation may exert downward pressure.

- Pricing Outlook: Gradual decline of 10–20% depending on market growth, payer dynamics, and regional differences.

- Potential Premiums: If GNP introduces unique formulations or bioequivalent products with improved compliance, premium pricing (~10–15% above generics) may sustain.

Long-term (5+ years)

- Market Trends: As patent exclusivity continues to erode, prices could stabilize at lower levels, unless GNP leverages strategic differentiation or develops value-added formulations.

- Price Floor: Possible stabilization around US$0.03–0.07 per tablet in highly competitive markets.

Market Opportunities and Risks

Opportunities

- Emerging Markets: Growing middle-class populations and rising healthcare access extend potential markets in Asia, Africa, and Latin America.

- Formulation Innovation: Development of water-soluble, dispersible, or combination formulations can command higher prices and expand patient base.

- Partnerships and Licensing: Collaborations with local generic manufacturers for market penetration can optimize costs and distribution.

Risks

- Pricing Pressure: High commoditization post-patent expiry might limit profit margins.

- Regulatory Delays: Time-consuming approvals or unfavorable regulatory changes can hinder market entry.

- Market Saturation: Oversupply of generics could depress prices further, squeezing margins.

Key Takeaways

- Pricing is driven by market saturation and regulatory approvals; in mature markets, prices tend to stabilize at low levels due to high competition.

- GNP’s strategic differentiation, including innovative formulations or added value, can support premium pricing in select segments.

- Emerging markets present significant opportunities for expansion; however, local regulatory and competitive landscapes must be carefully navigated.

- Long-term price deflation is inevitable as patents expire and generics dominate; continuous innovation and strategic partnerships are essential.

- Cost management and optimized supply chains remain critical for maintaining competitiveness and profitability margins.

FAQs

1. How does GNP Fexofenadine HCL compare to other antihistamines in pricing?

GNP’s generic formulation likely aligns with other low-cost alternatives, with prices varying by region. Its success depends on regulatory approval, market access, and formulation differences.

2. What factors influence the price decline of Fexofenadine post-patent expiry?

Market saturation, increased competition, manufacturing costs, and payer negotiating power drive significant price reductions.

3. Can GNP maintain premium prices with Fexofenadine formulations?

If GNP develops innovative formulations that improve patient adherence or efficacy, they can sustain higher pricing. Otherwise, commoditization pressures usually limit margins.

4. What regions offer the most growth potential for GNP Fexofenadine HCL?

Emerging markets, including Asia-Pacific and parts of Latin America, demonstrate high demand growth due to increasing allergy prevalence and expanding healthcare infrastructure.

5. How will regulatory developments affect GNP’s market strategy?

Stringent approval processes, quality standards, and patent laws influence market entry timing and pricing. Early regulatory engagement and compliance are crucial for competitive positioning.

References

[1] MarketsandMarkets. "Antihistamine Drugs Market by Type, Application, and Region," 2022.

[2] IQVIA. "Global trends in generic drug pricing," 2022.

More… ↓