Share This Page

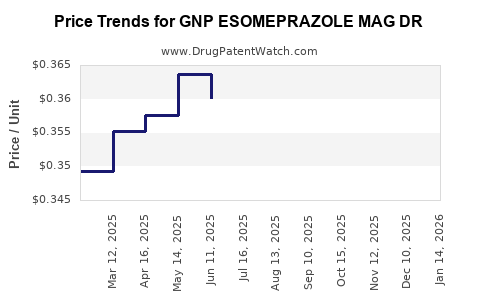

Drug Price Trends for GNP ESOMEPRAZOLE MAG DR

✉ Email this page to a colleague

Average Pharmacy Cost for GNP ESOMEPRAZOLE MAG DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP ESOMEPRAZOLE MAG DR 20 MG | 46122-0648-74 | 0.35992 | EACH | 2025-12-17 |

| GNP ESOMEPRAZOLE MAG DR 20 MG | 46122-0736-03 | 0.35992 | EACH | 2025-12-17 |

| GNP ESOMEPRAZOLE MAG DR 20 MG | 46122-0648-04 | 0.35992 | EACH | 2025-12-17 |

| GNP ESOMEPRAZOLE MAG DR 20 MG | 46122-0736-04 | 0.35992 | EACH | 2025-12-17 |

| GNP ESOMEPRAZOLE MAG DR 20 MG | 46122-0641-04 | 0.35992 | EACH | 2025-12-17 |

| GNP ESOMEPRAZOLE MAG DR 20 MG | 46122-0736-74 | 0.35992 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Esomeprazole Magnesium DR

Introduction

GNP Esomeprazole Magnesium DR emerges as a novel formulation of the well-established proton pump inhibitor (PPI), Esomeprazole, designed for delayed-release (DR) administration. Its development aligns with the global demand for effective management of acid-related gastrointestinal conditions, including gastroesophageal reflux disease (GERD), peptic ulcers, and Zollinger-Ellison syndrome. Understanding its market positioning and pricing trajectory is crucial for stakeholders, including pharmaceutical companies, investors, and healthcare policymakers.

Global Market Landscape for Proton Pump Inhibitors

The global PPI market has experienced substantial growth, driven by rising prevalence of acid-related disorders and a shift toward preferred medical therapies over invasive procedures. In 2022, the market was valued at approximately USD 18 billion, with a Compound Annual Growth Rate (CAGR) of around 4-6% projected through 2030 [1].

Key players include AstraZeneca's Nexium (esomeprazole), Pfizer's Protonix (pantoprazole), and other generics, often competing on price and bioavailability. Recent innovations, such as GNP Esomeprazole Magnesium DR, aim to tap into this expanding market with differentiated formulations intended to enhance patient compliance and therapeutic outcomes.

Market Positioning of GNP Esomeprazole Magnesium DR

Product Differentiation

- Formulation Benefits: The DR formulation promotes optimal bioavailability and extended protection against gastric acid, leading to longer-lasting relief.

- Potential Advantages: Improved stability, reduced dosing frequency, and minimized adverse effects position GNP ESOMEPRAZOLE MAG DR as a preferred choice for chronic therapy.

Regulatory Status and Approvals

- Pending or recent approvals in key markets like the U.S., EU, and Asia influence market entry strategies and initial pricing.

- Patent protections around formulation and delivery mechanisms as of 2023 provide competitive barriers but may face patent challenges or generic competition by mid-decade.

Market Entry Challenges

- Generic Competition: Established generics threaten initial market penetration.

- Pricing Sensitivity: Price elasticity of demand varies across regions; higher pricing may limit adoption in cost-sensitive markets.

Pricing Strategies and Projections

Factors Influencing Price

- Manufacturing Costs: Innovations like DR delivery often entail higher production costs, influencing initial pricing.

- Market Demand: High prevalence of GERD and ulcers globally supports premium positioning.

- Competitive Landscape: Price points must balance R&D recoveries and market penetration against entrenched generic prices.

- Regulatory and Reimbursement Environment: Payer policies in different markets affect achievable price points.

Current Pricing Trends

As of 2023, branded esomeprazole products retail at around USD 30-50 for a month's supply, with generics available from USD 10-20. GNP ESOMEPRAZOLE MAG DR is expected to launch at a premium, approximately USD 40-60, considering formulation benefits and branding efforts.

Projected Pricing Trajectory (2023-2030)

| Year | Estimated Price Range (per month supply) | Factors Influencing Price |

|---|---|---|

| 2023 | USD 45-55 | Market entry costs, initial branding |

| 2025 | USD 40-50 | Increased competition, patents expiration |

| 2030 | USD 30-40 | Generic competition, price erosion |

Note: The downward trend aligns with typical genericization patterns and increased market competition, assuming successful regulatory approval and market penetration.

Market Adoption Forecasts

Based on epidemiological data, approximately 25% of the global population experiences acid-related disorders annually [2]. Market penetration of GNP Esomeprazole Magnesium DR could reach:

- North America: 20-25% of prescribed PPI market share within 5 years post-launch.

- Europe: 15-20%, considering reimbursement hurdles.

- Asia-Pacific: 10-15%, given the rising burden of GERD and affordability factors.

Adoption rates depend on clinical efficacy, physician preferences, patient compliance, and insurance coverage. Notably, the superior pharmacokinetic profile of the DR formulation may facilitate rapid uptake among clinicians seeking enhanced therapeutic outcomes.

Regulatory and Market Risks

- Delayed Approvals: Regulatory setbacks can postpone market entry, impacting projected revenues and price stability.

- Market Competition: Entry of low-cost generics or biosimilars could induce aggressive price wars.

- Patent Challenges: Patent litigations or expirations may accelerate generic proliferation, exerting downward pressure on prices.

Strategic Recommendations

- Premium Positioning: Emphasize clinical benefits and improved adherence to justify higher price points initially.

- Market Diversification: Target regions with less price sensitivity, such as the U.S. and Western Europe, to maximize early revenues.

- Cost Management: Optimize manufacturing efficiencies to sustain profitability amid price erosion.

- Intellectual Property: Secure strong patents and exclusivities to prolong market dominance.

Key Takeaways

- GNP Esomeprazole Magnesium DR is poised to capitalize on the expanding PPI market, with differentiation through formulation offering competitive edge.

- Initial launch prices are likely to be set between USD 45-55 per month supply, with a gradual decline to USD 30-40 by 2030 due to market normalization and generic competition.

- Market penetration will depend on regulatory approvals, clinical efficacy, and strategic marketing in both developed and emerging markets.

- Stakeholders should monitor patent statuses and competitor activities to adjust pricing and market strategies proactively.

- Maximizing value proposition through clinical data and patient-centric benefits can sustain higher price points and market share.

FAQs

1. When is GNP Esomeprazole Magnesium DR expected to launch commercially?

Regulatory approval timelines vary by region; anticipated launch could occur within 1-2 years following regulatory clearance, contingent on submission success and review durations.

2. How does the price of GNP ESOMEPRAZOLE MAG DR compare to existing brands?

Initially, it is projected to be priced higher (USD 45-55/month) than generic esomeprazole, reflecting formulation advantages; over time, prices are expected to follow industry trends toward affordability due to generic entries.

3. What markets present the greatest growth opportunities for this drug?

The U.S. and Western Europe offer lucrative opportunities due to high disease prevalence and favorable reimbursement policies. Emerging markets like China and India present growth potential but with price sensitivity considerations.

4. How might patent challenges impact the drug’s market longevity?

Patent expirations or legal challenges could shorten exclusivity periods, leading to rapid generic competition and price reductions, typically within 5-7 years post-launch.

5. What are the primary risks to the projected price and market share?

Key risks include delayed regulatory approvals, aggressive generic competition, shifts in prescribing practices, and reimbursement restrictions, all of which could lower prices and limit market penetration.

References

[1] Marketresearch.com, “Global Proton Pump Inhibitor Market Size & Trends,” 2022.

[2] World Gastroenterology Organisation, “Epidemiology of Acid-Related Disorders,” 2021.

More… ↓