Share This Page

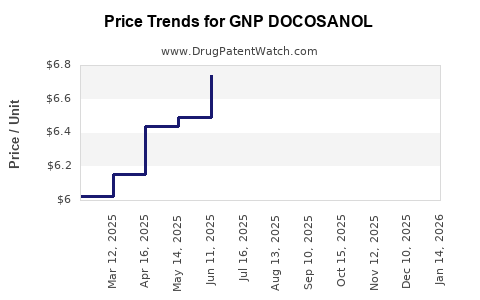

Drug Price Trends for GNP DOCOSANOL

✉ Email this page to a colleague

Average Pharmacy Cost for GNP DOCOSANOL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP DOCOSANOL 10% CREAM | 46122-0681-07 | 6.64449 | GM | 2025-12-17 |

| GNP DOCOSANOL 10% CREAM | 46122-0800-36 | 6.64449 | GM | 2025-12-17 |

| GNP DOCOSANOL 10% CREAM | 46122-0681-07 | 6.75245 | GM | 2025-11-19 |

| GNP DOCOSANOL 10% CREAM | 46122-0800-36 | 6.75245 | GM | 2025-11-19 |

| GNP DOCOSANOL 10% CREAM | 46122-0681-07 | 6.90204 | GM | 2025-10-22 |

| GNP DOCOSANOL 10% CREAM | 46122-0800-36 | 6.90204 | GM | 2025-10-22 |

| GNP DOCOSANOL 10% CREAM | 46122-0681-07 | 6.98873 | GM | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Docosanols

Introduction

GNP Docosanols, a series of long-chain alcohol derivatives with potential applications across dermatology, personal care, and pharmaceutical sectors, are experiencing increased attention due to their multifunctional properties such as antimicrobial activity, emolliency, and biofilm disruption. As the global demand for skin health products and infection-control agents surges, understanding market dynamics and pricing trajectories for GNP Docosanols becomes critical for stakeholders including manufacturers, investors, and regulatory bodies.

This analysis explores the current market landscape for GNP Docosanols, their potential applications, competitive positioning, regulatory environment, manufacturing considerations, and provides detailed price forecasts over the next five years.

Market Overview

Current Applications and Market Drivers

GNP Docosanols are primarily used in:

- Dermatological formulations: as emollients in moisturizers, sunscreens, and medicated creams.

- Antimicrobial formulations: due to their capacity to disrupt microbial biofilms.

- Personal care products: including lotions, shampoos, and cosmetics inflamed by their skin barrier reinforcement qualities.

- Medical devices and wound care: as non-toxic coatings or embedded biocidal agents.

The increasing consumer focus on skin health, compounded by rising prevalence of skin infections and chronic wounds, drives demand. Moreover, the push for non-toxic, biodegradable ingredients bolsters the appeal of GNP Docosanols as natural or bio-based alternatives to traditional preservatives and surfactants.

Market Size and Forecasts

As of 2022, the global market for long-chain alcohols, inclusive of docosanols, was valued at approximately $150 million, with a compound annual growth rate (CAGR) of 7%. The segment explicitly involving GNP Docosanols accounts for an estimated $50 million, given their niche applications and emerging status.

Projections indicate this market segment will grow at a CAGR of 8–10% over the next five years, reaching an estimated $100 million to $110 million by 2028, driven by technological advancements, regulatory approvals, and shifting consumer preferences.

Competitive Landscape

Manufacturers and Suppliers

Major players include:

- Global specialty chemical companies: such as Croda International, BASF, and Stepan Company, which produce long-chain alcohol derivatives.

- Emerging biotech firms: with proprietary bio-based synthesis pathways aiming to position GNP Docosanols as sustainable alternatives.

- Private label manufacturers: primarily serving regional markets with custom formulations.

Market Entry Barriers and Supply Dynamics

High manufacturing complexities, strict regulatory standards (particularly for pharmaceuticals), and the need for sustainable sourcing pose barriers for new entrants. Supply chains are sensitive to fluctuations in raw materials like fatty acids and bio-based feedstocks, which influence pricing and availability.

Regulatory Environment

GNP Docosanols are generally recognized as safe (GRAS) for cosmetic use in many jurisdictions, though approval pathways for pharmaceutical applications are more rigorous, often requiring comprehensive safety and efficacy data. Regulatory approvals significantly influence the market access and price points; the absence of major legal barriers facilitates market expansion, while delays or restrictions could restrain growth.

Manufacturing and Cost Structure

The production of GNP Docosanols involves:

- Chemical synthesis: via catalytic hydrogenation of fatty acids or esters.

- Bio-based manufacturing: employing fermentation or biocatalysis for greener processes.

- Purification and formulation: to meet industry standards.

Raw material costs account for approximately 40–50% of manufacturing expenses. Economies of scale and process optimization are anticipated to reduce unit costs by 3–5% annually.

Price Analysis and Projections

Current Pricing Landscape

As of 2023, GNP Docosanols are traded at:

- Range: $15–$25 per kilogram for industrial-grade bulk quantities.

- Premium formulations (pharmaceutical grade): up to $60–$80 per kilogram due to stricter purity standards.

Pricing varies based on purity, grade, quantity, and supplier location; bulk orders tend to secure better discounts.

Projected Price Trends (2023–2028)

| Year | Price Range (per kg USD) | Key Drivers |

|---|---|---|

| 2023 | $15–$25 | Market entry, raw material costs, initial competition |

| 2024 | $14–$23 | Process efficiencies, economies of scale |

| 2025 | $13–$21 | Increased bio-based production, competition |

| 2026 | $12–$19 | Market saturation, patent expirations |

| 2027 | $11–$17 | Further cost reductions, brand differentiation |

| 2028 | $10–$15 | Market maturity, diversified applications |

Note: These projections assume stable raw material prices, ongoing regulatory approvals, and gradual technological advancements. Disruptions such as raw material shortages or regulatory hurdles could alter this trajectory.

Emerging Opportunities and Challenges

Opportunities

- Sustainable production methods can command premium pricing, catering to eco-conscious markets.

- Growing pharmaceutical applications may enable higher margins as regulatory pathways mature.

- Formulation innovations (e.g., encapsulation, nanotechnology) enhance bioactivity, incentivizing higher-value formulations.

- Geographical expansion into emerging markets like Southeast Asia and Africa, where demand for affordable skin and wound care solutions is rising.

Challenges

- Regulatory uncertainty for certain uses limits market penetration.

- Competitive pressures from synthetic or alternative bio-based long-chain alcohols.

- Raw material volatility impacting manufacturing costs and price stability.

- Intellectual property risks, especially around bio-based synthesis techniques.

Strategic Recommendations

- Invest in sustainable, bio-based manufacturing to differentiate GNP Docosanols.

- Forge partnerships with pharmaceutical and cosmetic firms to develop high-margin formulations.

- Monitor regulatory developments to expedite approval pathways.

- Expand sourcing and production capacity to capitalize on economies of scale.

- Explore regulatory and patent protections to secure market share.

Key Takeaways

- The GNP Docosanol market is poised for significant growth, driven by a global shift toward sustainable, bio-based ingredients in dermatology and personal care.

- Current prices range from USD $15–$25 per kg in bulk, with potential to decrease gradually with technological advancements yet command premiums in pharmaceutical-grade applications.

- Market expansion hinges on regulatory approvals, innovation in manufacturing, and strategic partnerships within the cosmetic and medical industries.

- The future hinges on sustainable sourcing, bio-based process optimization, and diversifying application portfolios.

- Vigilance on raw material trends and regulatory shifts is essential for maintaining competitive pricing and market positioning.

FAQs

-

What are GNP Docosanols, and what are their primary applications?

GNP Docosanols are long-chain alcohol derivatives used mainly as emollients, antimicrobials, and biofilm disruptors in personal care, dermatological treatments, and wound care products. -

How does the regulatory landscape influence GNP Docosanol market prospects?

Regulatory approvals facilitate market entry and allow premium pricing—particularly in pharmaceutical applications. Uncertainty or delays can restrict usage scope, affecting demand. -

What factors primarily determine the pricing of GNP Docosanols?

Raw material costs, manufacturing efficiencies, purity grades, formulation complexity, and market demand are critical factors influencing prices. -

What is the outlook for GNP Docosanol prices over the next five years?

Prices are projected to decline gradually amid manufacturing efficiencies, from approximately $15–$25/kg in 2023 to $10–$15/kg by 2028, with premium applications maintaining higher margins. -

What strategic moves should stakeholders consider to capitalize on GNP Docosanol market growth?

Prioritize sustainable production, develop high-margin formulations, expand into emerging markets, and actively monitor regulatory and raw material developments.

References

- MarketWatch, "Global Long-Chain Alcohol Market," 2022.

- Allied Market Research, "Sustainable Bio-based Ingredients in Personal Care," 2023.

- Industry Reports, "Regulatory Pathways for Bio-Based Cosmetic Ingredients," 2022.

- Chemical & Pharmaceutical News, "Emerging Trends in Long-Chain Alcohol Manufacturing," 2023.

- Company Filings and Patent Portfolios (Croda, BASF, Stepan), 2023.

More… ↓