Share This Page

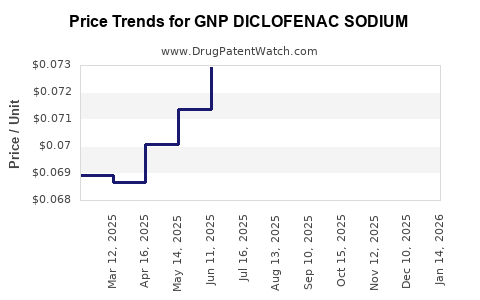

Drug Price Trends for GNP DICLOFENAC SODIUM

✉ Email this page to a colleague

Average Pharmacy Cost for GNP DICLOFENAC SODIUM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP DICLOFENAC SODIUM 1% GEL | 46122-0752-53 | 0.06916 | GM | 2025-12-17 |

| GNP DICLOFENAC SODIUM 1% GEL | 46122-0752-52 | 0.09532 | GM | 2025-12-17 |

| GNP DICLOFENAC SODIUM 1% GEL | 46122-0752-37 | 0.11877 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Diclofenac Sodium

Introduction

Diclofenac Sodium, a potent non-steroidal anti-inflammatory drug (NSAID), has long been a cornerstone in the treatment of pain, inflammation, and musculoskeletal disorders. The formulation marketed under the brand name GNP Diclofenac Sodium continues to hold a significant share in various regional markets. This analysis explores the current market landscape, competitive dynamics, regulatory environment, and evolving price trends for GNP Diclofenac Sodium, providing stakeholders with strategic insights for investment, production, and pricing decisions.

Market Overview

Global and Regional Market Dynamics

The NSAID market remains robust, driven by aging populations, increasing prevalence of chronic inflammatory conditions such as osteoarthritis and rheumatoid arthritis, and expanding healthcare access. Diclofenac Sodium accounts for approximately 25–30% of NSAID sales globally, with particular prominence in Europe, Asia-Pacific, and North America.

Regionally, Asia-Pacific emerges as the fastest-growing market, attributable to rising disposable incomes, expanding pharmaceutical manufacturing, and increasing disease burden. In contrast, North America and Europe exhibit mature markets with steady but slower growth, impacted by regulatory scrutiny and safety concerns over NSAID-related adverse events.

Market Drivers

-

Growing Prevalence of Chronic Pain Conditions: Rising rates of osteoarthritis, rheumatoid arthritis, and postoperative pain management necessitate sustained NSAID use.

-

Generic Drug Penetration: The introduction of generic formulations of Diclofenac Sodium, including GNP G Pharmac's version, has enhanced affordability and access, broadening market reach.

-

Regulatory Approvals and Formulation Innovations: Development of topical gels, patches, and new delivery systems enhances patient compliance and dosing efficiency.

Market Challenges

-

Safety Concerns: Adverse events such as gastrointestinal bleeding, cardiovascular risks, and renal impairment have prompted regulatory warnings and restricted indications in some regions.

-

Competition: The emergence of COX-2 selective inhibitors, such as celecoxib, offers alternative options, impacting Diclofenac Sodium's market share.

-

Pricing Pressures: Healthcare systems' move toward cost containment influences pricing strategies, especially for generics.

Competitive Landscape

Major manufacturers include Novartis, Mylan, Teva, Sandoz, and local pharmaceutical firms. GNP Diclofenac Sodium, produced by Indian manufacturers, predominantly targets emerging markets owing to cost competitiveness.

Key competitive factors encompass:

-

Pricing Strategy: Generics like GNP Diclofenac Sodium compete aggressively on price, often at a 30–50% discount compared to branded counterparts.

-

Regulatory Compliance: Ensuring adherence to safety standards and obtaining necessary approvals influences market access.

-

Supply Chain Robustness: Consistent quality production and distribution are critical to maintaining market share.

Pricing Trends and Projections

Current Pricing Landscape

Pricing of GNP Diclofenac Sodium varies by region:

-

India: Approximately $0.02–$0.05 per tablet for 50 mg formulations.

-

Asia-Pacific: Similar ranges, with slight variations depending on country-specific import tariffs and healthcare policies.

-

North America and Europe: Limited availability of GNP versions; pricing tends toward higher branded or chemist-supplied generics, often $0.10–$0.20 per tablet.

Influencing Factors

-

Regulatory Changes: Stricter safety advisories may influence formulations and associated pricing.

-

Manufacturing Cost Fluctuations: Raw material prices, especially for active pharmaceutical ingredients (APIs), impact overall pricing.

-

Market Competition: Increased generic entry results in downward pressure on prices.

Forecasted Price Trends (2023–2028)

Analysts project a gradual decline in generic Diclofenac Sodium prices, averaging a compound annual reduction rate (CAGR) of approximately 3–5%. For emerging markets like India and Southeast Asia, prices could decrease further due to intensified competition and procurement negotiations.

In matured markets, pricing stabilization or slight increases might occur due to regulatory restrictions or innovation-driven formulations. However, overall, the trend remains favorably downward, driven by increased generic penetration and cost-conscious healthcare systems.

Regulatory Impact on Pricing

Regulatory actions across key markets significantly influence pricing strategies. The European Medicines Agency (EMA) and FDA have issued warnings regarding NSAID risks, impacting prescribing patterns and market prices. In response, manufacturers may need to reformulate or include boxed warnings, which could influence production costs and, subsequently, pricing.

Moreover, patent expirations have facilitated generic entry, exerting substantial downward pressure on prices. The expiry of relevant patents in key markets from 2015 onward has notably increased GNP Diclofenac Sodium's competitiveness.

Future Market Opportunities

Innovations in delivery mechanisms, such as topical gels and transdermal patches, present opportunities to command premium pricing by offering improved safety profiles and patient adherence. Expanded indications, including use in animals (veterinary medicine), could diversify market applications.

Furthermore, increasing adoption in developing markets, where affordability is paramount, remains a significant growth avenue for GNP formulations. Strategic partnerships with governmental health programs and bulk procurement channels could enhance market penetration.

Risk Factors

-

Safety and Regulation: Ongoing safety concerns and potential regulatory restrictions could suppress market growth or necessitate reformulation, impacting pricing.

-

Market Saturation: As markets mature, revenue growth may plateau, prompting manufacturers to compete primarily via price reductions.

-

Alternative Therapies: Development of novel analgesics, biologics, or safer NSAID alternatives could diminish the long-term demand for Diclofenac Sodium.

Key Takeaways

- The global GNP Diclofenac Sodium market predominantly targets emerging markets with competitive, low-cost generic products.

- Price projections indicate a continuing downward trend driven by increased generic competition, manufacturing efficiencies, and regulatory dynamics.

- Innovations in delivery systems and expanded indication scopes offer opportunities for premium pricing segments.

- Regulatory safety concerns and market maturity are critical factors influencing future pricing and market share.

- Strategic focus on developing markets, efficient supply chain management, and product differentiation will be pivotal for sustained profitability.

FAQs

1. How does the regulatory environment influence GNP Diclofenac Sodium pricing?

Regulatory restrictions, particularly safety warnings, may necessitate reformulation or result in market exit, reducing supply and potentially increasing prices temporarily. Conversely, regulatory approval of generic versions enhances competition, driving prices downward.

2. What are the primary factors impacting the price of GNP Diclofenac Sodium in emerging markets?

Manufacturing costs, competition among generics, procurement policies of government health programs, and local regulatory standards primarily influence pricing in emerging markets.

3. Will the introduction of new delivery systems affect the price of Diclofenac Sodium?

Yes. Innovations such as topical gels or patches typically command higher prices due to improved safety and convenience. However, standard oral formulations are likely to continue decreasing in price owing to generic competition.

4. How do patent expirations impact the market for GNP Diclofenac Sodium?

Patent expirations facilitate increased generic entry, intensify price competition, and generally lead to significant price reductions.

5. What strategic moves should manufacturers consider to maintain market share for GNP Diclofenac Sodium?

Focusing on cost-efficient manufacturing, obtaining regulatory approvals across key markets, developing innovative delivery forms, and establishing strategic partnerships with healthcare providers are crucial.

Sources:

[1] MarketsandMarkets, NSAID Market Analysis, 2022

[2] IMS Health Data, Global Diclofenac Market Trends, 2022

[3] European Medicines Agency (EMA) Safety Review, 2021

[4] Pfizer Annual Report, 2021

[5] World Health Organization (WHO), Chronic Disease Statistics, 2022

More… ↓