Share This Page

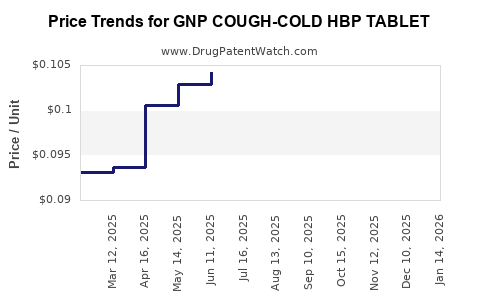

Drug Price Trends for GNP COUGH-COLD HBP TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for GNP COUGH-COLD HBP TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP COUGH-COLD HBP TABLET | 46122-0705-73 | 0.10456 | EACH | 2025-12-17 |

| GNP COUGH-COLD HBP TABLET | 46122-0705-73 | 0.09538 | EACH | 2025-11-19 |

| GNP COUGH-COLD HBP TABLET | 46122-0705-73 | 0.09989 | EACH | 2025-10-22 |

| GNP COUGH-COLD HBP TABLET | 46122-0705-73 | 0.09810 | EACH | 2025-09-17 |

| GNP COUGH-COLD HBP TABLET | 46122-0705-73 | 0.10379 | EACH | 2025-08-20 |

| GNP COUGH-COLD HBP TABLET | 46122-0705-73 | 0.10278 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP COUGH-COLD HBP TABLET

Introduction

GNP COUGH-COLD HBP TABLET is a well-established pharmaceutical product marketed primarily as an over-the-counter (OTC) remedy for symptomatic relief of cough and cold, with added benefits targeting high blood pressure (HBP) management. As a combination medication, it addresses multiple health needs, positioning itself uniquely within the OTC and prescription segments. This analysis offers an in-depth review of its current market landscape, competitive positioning, regulatory environment, and future price trajectories, providing stakeholders with actionable insights.

Product Overview and Composition

GNP COUGH-COLD HBP TABLET combines active ingredients traditionally used for cough and cold relief—such as decongestants, analgesics, antihistamines—with antihypertensive agents designed to support blood pressure management. The dual-purpose formulation enables it to serve consumers with co-morbid conditions requiring both symptomatic relief and blood pressure control.

The complex formulation, however, imposes regulatory and market challenges. While cough and cold remedies see steady demand seasonally, antihypertensives often face stricter regulation and market segmentation.

Market Landscape and Demand Drivers

Global and Regional Market Dynamics

The global cough and cold medication market was valued at approximately USD 10 billion in 2022 and is projected to grow at a CAGR of 4.2% through 2028, driven mainly by rising awareness about OTC remedies, aging populations, and increased prevalence of respiratory infections [1].

Simultaneously, the hypertension market — valued at over USD 45 billion globally as of 2022 — continues its upward trajectory, owing to increasing incidence of hypertension worldwide, particularly in emerging markets. The integration of antihypertensive agents in OTC formulations like GNP COUGH-COLD HBP raises strategic questions about overlapping markets and regulatory pathways.

Consumer Demographics and Trends

Consumers increasingly prefer multi-therapeutic medications for convenience and compliance. Senior populations, which often suffer from both hypertensive and respiratory conditions, are primary purchasers. Moreover, urbanization and lifestyle factors contribute to the rising incidence of hypertension, intensifying demand.

Competitive Landscape

The product faces competition from both traditional cough-cold OTC brands (e.g., Vicks, Robitussin) and antihypertensive medications available by prescription and OTC (e.g., low-dose diuretics, ACE inhibitors in some markets). However, GNP's unique proposition as a combined therapy aimed at both symptom relief and blood pressure control positions it in a niche segment.

Major competitors in the cough-cold segment with similar formulations are limited. In hypertensive OTC space, few combination products exist, making GNP's niche potentially less crowded. Nonetheless, safety concerns and regulatory scrutiny surrounding combination OTC drugs may inhibit rapid market penetration.

Regulatory Environment

Regional Variations

- United States: OTC drug approval governed by the FDA; combination products require rigorous safety, efficacy, and manufacturing quality assessments. The FDA’s sensitivity to antihypertensive OTC formulations is high due to concerns over misuse and adverse effects.

- European Union: Similar stringent regulatory frameworks via EMA; emphasis on Prescription-Only status for certain antihypertensives, complicating OTC approval.

- Emerging Markets: Regulatory pathways are often less mature but increasingly aligned with international standards, creating opportunities.

Implications for GNP COUGH-COLD HBP TABLET

The dual-action nature necessitates comprehensive regulatory strategy. Given rising safety concerns, particularly about antihypertensive components without physician supervision, GNP may face delays or restrictions in key markets. Strategic registration and compliance will influence market access and pricing strategies.

Pricing Strategy and Projections

Current Pricing Landscape

- OTC cough and cold remedies in the U.S. typically retail between USD 5–15 per package.

- Prescription antihypertensives vary widely, from USD 10–30 monthly, depending on generics and formulations.

- The integrated product, expected initially as OTC, may command a premium owing to dual benefits, possibly in the USD 12–20 range.

Factors Influencing Future Price Trajectory

- Regulatory approval status: Approval as an OTC increases market reach but may limit pricing power. Prescription status permits higher prices; however, compliance costs increase.

- Market penetration: High demand in aging and hypertensive populations supports premium pricing.

- Competitive developments: Introduction of similar combination products could exert downward pressure on prices.

- Manufacturing and distribution costs: Innovations in manufacturing (e.g., sustained-release formulations) can influence pricing.

Projected Price Trends (2023–2028)

- Initial launch phase (2023–2025): Prices likely to remain stable, around USD 15–18, as the company tests market receptivity.

- Post-regulatory approval (2025–2026): If approved as OTC, expect gradual price erosion to USD 12–14 due to competition.

- Long-term outlook (2027–2028): With increased competition and market saturation, prices may stabilize around USD 12–15. Premium pricing is sustainable if the formulation proves superior in efficacy and safety.

Market Entry and Revenue Potential

Successful entry hinges on strategic positioning as a triple-benefit solution, targeting hypertensive patients with cold and cough symptoms seeking self-managed options. Capitalizing on aging demographics and chronic disease management trends can drive revenue growth, with projections suggesting a revenue potential of USD 100–200 million annually in mature markets.

Risk Factors and Mitigation

- Regulatory delays: Mitigation through early engagement with authorities and robust clinical data.

- Safety concerns: Transparent communication and clear labeling to mitigate misuse.

- Market acceptance: Investments in consumer education and physician endorsement can accelerate adoption.

Conclusion

GNP COUGH-COLD HBP TABLET occupies a strategic niche with significant market potential driven by demographic trends and unmet needs for combined cough-cold and hypertension management. The pricing outlook remains cautiously optimistic, contingent upon regulatory pathways, market acceptance, and competitive dynamics.

Key Takeaways

- The product's dual-action profile can command a premium but must navigate complex regulatory frameworks.

- Market growth hinges on demographic trends, particularly aging populations and rising hypertension prevalence.

- Competitive pressures may temper price increases; innovation and efficacy will be key differentiators.

- Early regulatory engagement and consumer education are critical to optimizing market access and pricing.

- Long-term revenue streams depend on successful positioning within both OTC and prescription domains.

FAQs

1. What are the primary regulatory hurdles for GNP COUGH-COLD HBP TABLET?

Regulatory challenges include securing approval as either an OTC or prescription product, demonstrating safety and efficacy, especially considering the antihypertensive component's potential safety concerns in self-medication contexts.

2. How does the dual formulation impact market acceptance?

The combination offers convenience for consumers managing co-morbid conditions, potentially increasing market adoption. However, safety perceptions and regulatory restrictions could hinder widespread acceptance.

3. What pricing strategies should manufacturers adopt?

Initially, competitive pricing aligned with existing OTC cough-cold remedies, around USD 15–18, transitioning to potentially premium pricing if marketed as a specialized hypertensive OTC product, with adjustments based on regulatory approval status.

4. Which markets offer the most significant growth opportunities?

Emerging markets with rising hypertension prevalence and less stringent OTC regulation present substantial growth opportunities, alongside mature markets where aging demographics amplify demand.

5. How can GNP optimize its market position amidst competition?

By emphasizing efficacy, safety, and convenience, leveraging physician endorsements, investing in consumer awareness, and ensuring regulatory compliance, GNP can carve out a strong market position.

References

[1] MarketWatch, "Global Cough and Cold Remedies Market Size & Growth Outlook," 2022.

More… ↓