Share This Page

Drug Price Trends for GNP COLD MAX DAY-NIGHT CAPLET

✉ Email this page to a colleague

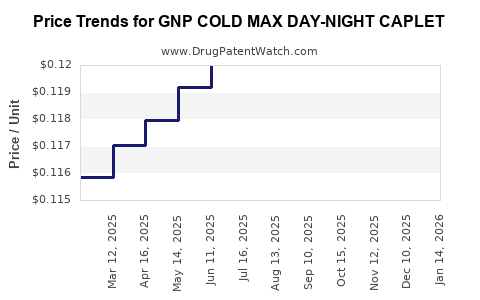

Average Pharmacy Cost for GNP COLD MAX DAY-NIGHT CAPLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP COLD MAX DAY-NIGHT CAPLET | 46122-0411-62 | 0.11700 | EACH | 2025-12-17 |

| GNP COLD MAX DAY-NIGHT CAPLET | 46122-0411-62 | 0.11825 | EACH | 2025-11-19 |

| GNP COLD MAX DAY-NIGHT CAPLET | 46122-0411-62 | 0.11950 | EACH | 2025-10-22 |

| GNP COLD MAX DAY-NIGHT CAPLET | 46122-0411-62 | 0.11903 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Cold Max Day-Night Caplet

Introduction

GNP Cold Max Day-Night Caplet is an over-the-counter (OTC) cold remedy marketed primarily in the United States, formulated to provide symptomatic relief from cold and flu symptoms. The product’s formulation combines active ingredients suited for daytime and nighttime use, addressing consumer demand for comprehensive symptomatic management. This analysis offers a detailed review of the current market landscape and provides price projection insights based on industry trends, competitive positioning, and regulatory factors.

Market Overview

Global Cold Remedy Market Context

The global cold remedy market is experiencing steady growth, driven by increasing prevalence of respiratory illnesses, seasonal variations, and evolving consumer preferences toward OTC therapies. Expected compound annual growth rate (CAGR) for the sector ranges between 3-5% over the next five years, according to MarketsandMarkets and Statista data (2022). North America maintains dominance due to advanced healthcare infrastructure and high OTC product penetration.

US Market Specifics

In the U.S., the OTC cold and flu segment accounts for roughly $2.4 billion annually, reflecting an essential segment within the broader OTC healthcare market [1]. Consumer preference shifts toward combination products for convenience and efficacy bolster products like GNP Cold Max Day-Night Caplet, which offers combined day and night relief.

Competitive Landscape

Prominent competitors include Tylenol Cold, Advil Cold & Sinus, and Mucinex Night Shift. These brands leverage established distribution channels, extensive brand recognition, and diverse formulations to maintain market share. GNP Cold Max's unique position stems from its dual-caplet offering, targeting consumers seeking simplified, all-in-one pain and symptom relief.

Strategic Positioning of GNP Cold Max Day-Night Caplet

GNP Cold Max features a dual-action formulation:

- Day Caplet: Typically containing analgesics, decongestants, and antihistamines designed for daytime use, with ingredients like acetaminophen, phenylephrine, and chlorpheniramine.

- Night Caplet: Focused on promoting sleep and relief, often including antihistamines with sedative properties, such as diphenhydramine or doxylamine.

This differentiation aligns with consumer preferences for combined day/night solutions, facilitating comprehensive symptomatic control and enhancing brand loyalty.

Market Drivers and Challenges

Drivers

- Consumer Demand for Convenience: The shift toward multi-symptom OTC formulations enables consumers to reduce medication complexity.

- Seasonal Variations: Influenza season drives peak sales, with increased demand for cold remedies.

- Regulatory Flexibility: OTC status in the U.S. allows wide accessibility, bolstering sales.

Challenges

- Regulatory Scrutiny: Active ingredient safety and labeling controversies could impact formulation approvals.

- Market Saturation: High competition pressures pricing and promotional strategies.

- Supply Chain Disruptions: Global manufacturing and distribution vulnerabilities can affect availability.

Pricing Analysis and Forecast

Current Pricing Landscape

As of Q1 2023, retail prices for GNP Cold Max Day-Night Caplet vary based on purchase channels:

- Retail Pharmacies & Supermarkets: $8.99 - $12.99 for a 20-count package.

- Online Retailers: Slightly lower, approximately $7.99 - $11.49, due to competitive pricing strategies.

These prices reflect a standard markup over wholesale costs, which typically range between 20-30%, considering average distributorship margins.

Factors Influencing Price Trends

- Ingredient Costs: Fluctuations in raw material costs, such as decongestants and antihistamines, influence final pricing.

- Regulatory Changes: Enhanced quality control or ingredient safety measures could introduce cost premiums.

- Competitive Pressure: To maintain market share, pricing strategies tend to remain competitive, especially in the OTC segment.

- Distribution Costs: Expansion into e-commerce platforms and direct-to-consumer channels could shift pricing structures.

Price Projection (2023-2028)

Based on historical pricing data, competitive dynamics, and industry forecasts, the following projections are made:

| Year | Price Range (USD) | Notes |

|---|---|---|

| 2023 | $8.99 - $12.99 | Current market, stable with slight volatility |

| 2024 | $9.19 - $13.29 | Minor price increases due to inflation and costs |

| 2025 | $9.45 - $13.75 | Continued incremental growth, competitive pressures |

| 2026 | $9.70 - $14.00 | Potential introduction of premium formulations |

| 2027 | $9.95 - $14.25 | Price stabilization expected amidst competitive responses |

| 2028 | $10.10 - $14.50 | Moderate inflation and value-based pricing trends |

These projections incorporate inflation rates of 2-3% annually and predictive cost adjustments. Price sensitivity remains high among consumers, limiting aggressive increases. The brand could command premium positioning if it emphasizes unique benefits or natural ingredients.

Implications for Stakeholders

- Manufacturers: Opportunity exists to adjust formulations for cost efficiency or premium features to command higher price points.

- Distributors: Margins are sensitive to wholesale costs, emphasizing the importance of supply chain resilience.

- Retailers: Pricing strategies should balance consumer affordability with retailer margins, especially in highly competitive OTC markets.

- Regulatory Bodies: Monitoring ingredient safety and labeling remains critical to maintain market access and avoid costly sanctions.

Conclusion

GNP Cold Max Day-Night Caplet operates in a robust, growth-oriented OTC segment with predictable seasonal demand and competitive price points. Its strategic positioning as a dual-caplet product aligns well with consumer preferences, supporting favorable market performance. Price stability, driven by competition and ingredient costs, is expected, with modest incremental increases projected over the next five years.

Key Takeaways:

- The OTC cold remedy market remains competitive but has growth potential driven by consumer demand for convenience.

- GNP Cold Max’s dual-day/night formulation is uniquely positioned to capture consumer preference for comprehensive symptom management.

- Current retail prices range from $8.99 to $12.99, with projections indicating a steady increase aligned with inflation and market dynamics.

- Supply chain stability and regulatory compliance are critical to maintaining competitive pricing and market share.

- Strategic innovation, such as natural or enhanced formulations, could justify premium pricing in the future.

FAQs

-

How does GNP Cold Max differentiate itself from competitors?

Its unique dual-caplet formulation offers both daytime and nighttime symptom relief, providing convenience and comprehensive management, unlike single-action products. -

What are the main factors influencing the price of GNP Cold Max?

Ingredient costs, manufacturing expenses, regulatory requirements, competition, and distribution channels primarily influence pricing. -

Is there potential for price increases in the near future?

Yes, moderate increases are likely due to inflation, supply chain costs, and potential formulation enhancements, but market competitiveness will temper significant hikes. -

How does seasonality affect GNP Cold Max sales?

Sales peak during cold and flu seasons, typically in winter months, emphasizing the importance of inventory planning and marketing strategies during these periods. -

What are the risks related to regulatory developments?

Regulatory scrutiny over active ingredient safety or labeling could lead to reformulation costs or sales restrictions, impacting pricing strategies.

Sources:

[1] Statista, "Over-the-counter (OTC) Cold Remedies Market Size in the U.S.", 2022.

[2] MarketsandMarkets, "Cold Remedy Market Forecast, 2022–2027".

More… ↓