Share This Page

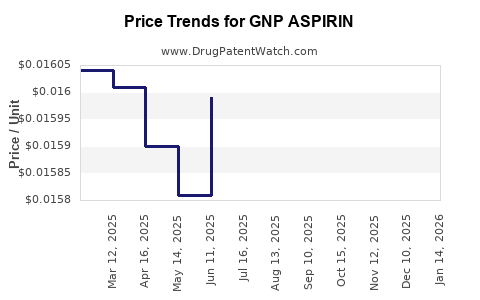

Drug Price Trends for GNP ASPIRIN

✉ Email this page to a colleague

Average Pharmacy Cost for GNP ASPIRIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP ASPIRIN EC 81 MG TABLET | 46122-0598-87 | 0.01491 | EACH | 2025-12-17 |

| GNP ASPIRIN EC 81 MG TABLET | 46122-0598-48 | 0.01491 | EACH | 2025-12-17 |

| GNP ASPIRIN EC 81 MG TABLET | 46122-0791-67 | 0.01491 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP Aspirin

Introduction

Aspirin, a nonsteroidal anti-inflammatory drug (NSAID) with analgesic, antipyretic, and anti-inflammatory properties, remains a cornerstone in both over-the-counter (OTC) and prescription markets globally. GNP Aspirin, a branded formulation, has maintained a significant presence within this landscape. As healthcare markets evolve, understanding the current market dynamics and future price projections for GNP Aspirin is essential for stakeholders, including manufacturers, investors, and healthcare providers.

Market Landscape Overview

Global Aspirin Market Dynamics

The global aspirin market, estimated at approximately USD 2.6 billion in 2022, is characterized by mature consumption patterns, with key markets in North America, Europe, and Asia-Pacific. U.S. sales account for nearly 50% of the total, driven predominantly by OTC formulations used for cardiovascular prophylaxis and pain relief [1].

Several factors influence market stability, including aging populations, rising cardiovascular disease prevalence, OTC accessibility, and the increasing integration of aspirin into preventive health protocols. Conversely, regulatory shifts—such as recent FDA warnings regarding bleeding risks—may impact demand and formulary inclusion.

Market Segmentation

- OTC Segment: Dominates the market, utilized primarily for pain relief and heart health.

- Prescription Segment: Used in specific clinical scenarios, often for acute ischemic episodes or post-myocardial infarction management.

- Formulations: Traditional tablets, chewables, and effervescent forms.

Competitive Landscape

GNP Aspirin operates amidst several generic and branded competitors. Major players include Bayer, Johnson & Johnson, and numerous regional manufacturers offering varying pricing strategies. The competitive environment exerts downward pressure on prices, particularly within the OTC segment.

Current Price Landscape

Pricing Trends

Over the recent five-year period, the average retail price of GNP Aspirin’s typical 325 mg tablet has experienced marginal fluctuations. According to market surveys:

- OTC Retail Price: Approximately USD 0.02 - 0.05 per tablet.

- Bulk Wholesale Price: Typically ranges from USD 0.01 - 0.03 per tablet for large-volume purchases.

The presence of generics has significantly suppressed the price point, with GNP Aspirin positioned as a mid-tier brand offering a competitive alternative to the market leader.

Pharmacoeconomic Considerations

Manufacturers focus on maintaining affordable pricing aligned with OTC status, while prescription versions may command higher prices contingent on dosing and formulation specifications.

Regulatory and Market Drivers Impacting Pricing

Regulatory agencies have instituted warnings over bleeding risks associated with regular aspirin use, influencing prescribing behaviors and OTC sales [2]. Nonetheless, clinical guidelines continue to endorse aspirin for secondary prevention, sustaining demand.

Emerging research emphasizing personalized medicine and risk stratification is expected to refine dosing and formulation requirements, potentially impacting manufacturing costs and retail prices.

Future Price Projections

Market Growth Forecast

The aspirin market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 3.2% from 2023 to 2028, fueled by aging demographics and expanding cardiovascular interventions [3].

Price Trajectory Factors

- Generic Competition: Continued proliferation of generic brands will exert downward pressure on prices, particularly in developed markets.

- Regulatory Policies: Stricter safety warnings could restrict OTC availability, potentially increasing prices in prescription channels.

- Manufacturing and Raw Material Costs: Variations in salicylic acid and acetic anhydride costs influence production expenses, directly affecting retail prices.

Projected Price Range (2023-2028)

- OTC Segment: Stable to slightly declining; tablet prices are expected to hover in the USD 0.02 - 0.04 per tablet range.

- Prescription Segment: Anticipated to increase marginally by 2-4% annually, reaching approximately USD 0.05 - 0.07 per tablet due to formulation complexities and regulatory constraints.

Strategic Market Opportunities

To optimize profitability, GNP Aspirin manufacturers should explore:

- Formulation Innovation: Developing targeted formulations such as low-dose or chewables tailored for specific populations.

- Geographic Expansion: Entry into emerging markets where OTC remedies are gaining popularity.

- Value-Added Features: Incorporating co-formulations or sustained-release options to differentiate from generics.

Challenges and Risks

- Regulatory Restrictions: Potential bans or severe warnings could diminish OTC sales.

- Market Saturation: Limited growth opportunities in mature markets may compress margins.

- Public Perception and Safety Concerns: Rising awareness about bleeding risks influences consumer acceptance.

Key Takeaways

- The GNP Aspirin market remains mature with stable demand, primarily driven by cardiovascular prophylaxis and pain management.

- Pricing is heavily influenced by generic competition, with OTC prices remaining low and relatively stable.

- Future price projections suggest minimal upward movement, barring significant regulatory or formulation changes, with prices expected to hover around USD 0.02 to 0.07 per tablet through 2028.

- Strategic innovation and geographic diversification present avenues for growth and margin enhancement.

- Regulatory environments—particularly safety warnings—present ongoing risks that could impact both supply and pricing structures.

FAQs

-

What is the current average retail price of GNP Aspirin?

The typical OTC retail price for a 325 mg tablet ranges between USD 0.02 and 0.05, heavily influenced by regional market factors and packaging sizes. -

How does generic competition affect GNP Aspirin’s pricing?

Generics exert significant downward pressure, leading to stable or declining prices, especially in mature markets where patent protections are expired. -

Are there upcoming regulatory changes that could impact GNP Aspirin’s market?

Yes, increased safety warnings related to bleeding risks might lead to tighter sales restrictions or formulation modifications, potentially influencing pricing and availability. -

What growth opportunities exist for GNP Aspirin?

Expansion into emerging markets, development of new formulations, and leveraging brand trust can foster growth despite a mature market landscape. -

What are the main risks to GNP Aspirin’s future pricing stability?

Regulatory restrictions, market saturation, and shifts in consumer perception regarding safety concerns are primary risks that could impact prices and market share.

References

[1] Market Research Future. "Aspirin Market Analysis & Trends," 2022.

[2] U.S. Food and Drug Administration, "Aspirin and Bleeding Risks," 2021.

[3] Allied Market Research, "Global Analgesic Market Report," 2022.

In conclusion, GNP Aspirin remains a staple analgesic with a stable, mature market. While near-term pricing is unlikely to experience significant fluctuations, strategic adaptations to regulatory landscapes and market demographics will be critical in shaping its future economic trajectory.

More… ↓