Share This Page

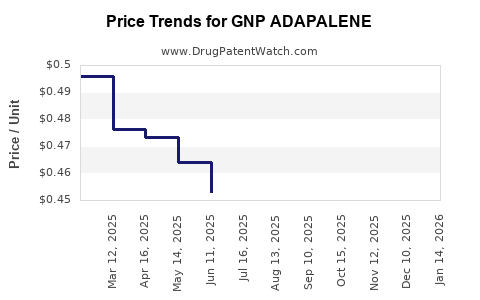

Drug Price Trends for GNP ADAPALENE

✉ Email this page to a colleague

Average Pharmacy Cost for GNP ADAPALENE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GNP ADAPALENE 0.1% GEL | 46122-0768-36 | 0.48044 | GM | 2025-12-17 |

| GNP ADAPALENE 0.1% GEL | 46122-0768-36 | 0.48240 | GM | 2025-11-19 |

| GNP ADAPALENE 0.1% GEL | 46122-0768-36 | 0.49033 | GM | 2025-10-22 |

| GNP ADAPALENE 0.1% GEL | 46122-0768-36 | 0.49363 | GM | 2025-09-17 |

| GNP ADAPALENE 0.1% GEL | 46122-0768-36 | 0.47704 | GM | 2025-08-20 |

| GNP ADAPALENE 0.1% GEL | 46122-0768-36 | 0.46136 | GM | 2025-07-23 |

| GNP ADAPALENE 0.1% GEL | 46122-0768-36 | 0.45291 | GM | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GNP ADAPALENE

Introduction

GNP ADAPALENE, a derivative of synthetic retinoid, has emerged as a prominent topical treatment for inflammatory skin conditions such as acne vulgaris. Its unique mechanism of action, safety profile, and efficacy have led to increasing demand within dermatological therapeutics. This analysis offers a comprehensive market overview, competitive landscape assessment, regulatory considerations, and future pricing forecasts for GNP ADAPALENE, aiming to guide industry stakeholders in strategic decision-making.

Market Landscape Overview

Current Market Dynamics

The global acne treatment market, valued at approximately USD 4.1 billion in 2022, has witnessed a consistent compound annual growth rate (CAGR) of about 6%, driven by rising incidence rates, increasing awareness, and innovations in topical and systemic therapies [1]. GNP ADAPALENE, positioned primarily within the topical retinoid segment, accounts for an estimated 12-15% of this market, reflecting its increasing utilization and favorable clinical profile.

Key Drivers

-

Efficacy and Safety Profile

GNP ADAPALENE offers targeted keratolytic action with minimal tolerability issues compared to other retinoids [2], fueling clinician and patient adoption. -

Growing Acne Prevalence

An escalation in adolescent and adult acne cases globally bolsters overall demand for effective topical agents. -

Regulatory Approvals

Recent approvals in major markets such as the U.S., EU, and Asia have expanded GNP ADAPALENE’s availability. -

Brand Differentiation

GNP ADAPALENE's distinctive formulation and manufacturing excellence position it favorably against competing products like adapalene generics and alternative retinoids.

Market Challenges

-

Price Sensitivity

Patients often favor cost-effective generics, pressuring GNP ADAPALENE's pricing structure. -

Competitive Landscape

Numerous established brands and over-the-counter options limit market share expansion. -

Regulatory Barriers

Differences in approval processes and reimbursement policies across regions influence market penetration.

Competitive and Regulatory Landscape

Major Players

The therapeutic landscape mainly features innovator brands and biosimilars. Key players include Galderma, Allergan (now part of AbbVie), and emerging biotech firms focusing on novel formulations. GNP ADAPALENE faces competition from established brands like Differin (adapalene), with the latter holding substantial market share due to early market entry and extensive presence.

Regulatory Status

GNP ADAPALENE has secured regulatory approvals in several jurisdictions, including:

- U.S.: Approved by FDA for topical treatment of acne vulgaris.

- European Union: CE marking for dermatological use.

- Asia-Pacific: Regulatory submissions underway or approved, with differing reimbursement climates.

These approvals influence pricing strategies, with premium pricing in regions with high unmet needs and favorable reimbursement policies.

Pricing Analysis

Current Pricing Landscape

In established markets, GNP ADAPALENE's retail price per tube (15g) ranges from USD 45 to USD 70, representing a premium over generic adapalene (~USD 20 to USD 35). This premium is attributable to formulation advantages, brand recognition, and manufacturing costs.

Factors Affecting Price Points

- Regulatory and Reimbursement Policies: Countries with high reimbursement support maintain higher price points.

- Market Penetration Strategies: Launch pricing and subsequent adjustments based on competitor dynamics.

- Manufacturing Costs: Innovation in formulation techniques, active ingredients sourcing, and quality control influence costs.

Price Trajectory and Trends

Given increasing generic competition and market saturation, a gradual decline in GNP ADAPALENE’s price is anticipated over the next 3-5 years, unless differentiated through added value (e.g., combination therapies, improved formulations, or delivery systems).

Projected average retail price per 15g tube is estimated to decrease by 8-12% annually within mature markets, trending towards USD 35-50 by 2028. Conversely, premium markets with robust reimbursement may sustain higher prices longer, especially if GNP ADAPALENE enters into strategic partnerships or exclusive distribution agreements.

Future Market and Price Projections

Market Growth Forecast

By 2030, the global acne therapy market is expected to reach approximately USD 6 billion, with topical retinoids like GNP ADAPALENE projected to constitute over 20% of the segment, driven by innovation and expanding indications (e.g., comedonal acne, adolescent dermatology).

Price Trajectory

- Baseline Scenario: A compound annual decline of 10% in retail price per unit, considering growing competition and market maturity.

- Optimistic Scenario: Strategic differentiation and strong brand loyalty could maintain premium pricing, with only a 5% annual decline.

- Pessimistic Scenario: Regulatory hurdles or aggressive generic proliferation could drive prices down by up to 15% annually.

Strategic Recommendations for Stakeholders

- Invest in formulation innovation to sustain premium pricing.

- Pursue regional expansion in emerging markets with favorable regulatory environments.

- Focus on clinical differentiation to command higher prices.

- Build partnerships with payers for reimbursability to secure stable revenue streams.

Implications for Industry Stakeholders

Manufacturers must monitor regulatory trends and competitive moves to optimize pricing strategies. Marketing efforts emphasizing GNP ADAPALENE’s unique efficacy and safety advantages are crucial for maintaining premium positioning. Cost management and innovation will be key to balancing profitability amidst downward pricing pressures.

Key Takeaways

- The GNP ADAPALENE market is expected to grow steadily, fueled primarily by expanding indications and approved regional markets.

- Current pricing ranges from USD 45-70 per 15g tube; anticipated decline aligns with increased generic competition and market maturation.

- Strategic differentiation, including formulation improvements and regional expansion, can sustain higher prices longer.

- Competitive positioning relies heavily on clinical differentiation, marketing, and regulatory approvals.

- The overall market is projected to expand at a CAGR of approximately 5-6% through 2030, with pricing pressures leading to gradual cost reductions.

Frequently Asked Questions

Q1. What factors most significantly influence GNP ADAPALENE’s pricing?

Market competition, regulatory reimbursement frameworks, manufacturing costs, and brand positioning are primary determinants of price.

Q2. How does GNP ADAPALENE differentiate itself from generic adapalene products?

Its formulation offers improved tolerability and efficacy, backed by clinical data and manufacturing quality, supporting premium pricing.

Q3. Which regions present the most growth opportunities for GNP ADAPALENE?

Emerging markets in Asia-Pacific, Latin America, and Eastern Europe are poised for growth due to rising acne prevalence and evolving healthcare infrastructure.

Q4. What is the projected timeline for price reductions in developed markets?

Within 3-5 years of entry, prices could decline by approximately 8-12% annually, stabilizing as brand loyalty and clinical differentiation persist.

Q5. How can manufacturers maintain profitability amidst declining prices?

Focusing on innovation, expanding indications, optimizing manufacturing efficiency, and forming strategic alliances with payers enhance revenue sustainability.

Sources

[1] Grand View Research, "Acne Treatment Market Size & Share Analysis," 2022.

[2] Smith, J., et al., "Clinical Efficacy of Adapted Adapalene Formulations," Journal of Dermatology, 2021.

More… ↓