Last updated: July 27, 2025

Introduction

GLYXAMBI (empagliflozin and linagliptin) is a combination medication developed for managing type 2 diabetes mellitus. Approved by the U.S. Food and Drug Administration (FDA) in 2020, GLYXAMBI integrates two established therapeutics: empagliflozin, an SGLT2 inhibitor, and linagliptin, a DPP-4 inhibitor. Its dual mechanism offers comprehensive glycemic control, positioning it as a key contender in the growing market for oral anti-diabetic agents. This report examines the current market landscape, competitive dynamics, regulatory environment, and provides price projections for GLYXAMBI over the next five years.

Market Overview and Demand Drivers

The global diabetes market, valued at approximately USD 76.3 billion in 2021, is projected to reach USD 122.4 billion by 2027, expanding at a compound annual growth rate (CAGR) of about 8.0%[1]. The escalation is driven by increasing prevalence of type 2 diabetes, especially in emerging economies, and the demand for novel, combination therapies that improve adherence and outcomes.

GLYXAMBI targets a significant segment: patients inadequately controlled by monotherapies or those seeking simplified regimens. The drug’s combination reduces pill burden, enhances compliance, and potentially improves cardiovascular outcomes—factors increasingly prioritized in treatment guidelines[2].

Competitive Landscape

Key Competitors

- SGLT2 Inhibitors: Jardiance (empagliflozin), Invokana (canagliflozin), Farxiga (dapagliflozin)

- DPP-4 Inhibitors: Tradjenta (linagliptin), Januvia (sitagliptin), Onglyza (saxagliptin)

- Other Combination Products: Xigduo XR (dapagliflozin and metformin), Janumet (sitagliptin and metformin)

Differentiation and Strategic Position

GLYXAMBI’s dual mechanism aims to optimize glycemic control with potentially improved cardiovascular profiles, a key differentiator considering the recent emphasis on cardio-renal benefits[3]. Market entry advantages include:

- Once-daily dosing

- Favorable safety profile

- Proven efficacy in reducing HbA1c and weight

Its positioning emphasizes convenience and cardiovascular risk reduction, appealing to both clinicians and patients.

Regulatory and Reimbursement Environment

The drug’s approval garnered commendation for the cardiovascular safety profile, aligning with FDA and EMA guidelines emphasizing benefit-risk balance. Reimbursement strategies are primarily driven via formulary placements in major health systems, contingent upon demonstrated cost-effectiveness and comparative benefits over existing therapies.

In the U.S., Medicare and private insurers favor combination pills that improve adherence, potentially facilitating market penetration. The ongoing inclusion in clinical guidelines (American Diabetes Association, European Association for the Study of Diabetes) further supports uptake[4].

Pricing Strategy

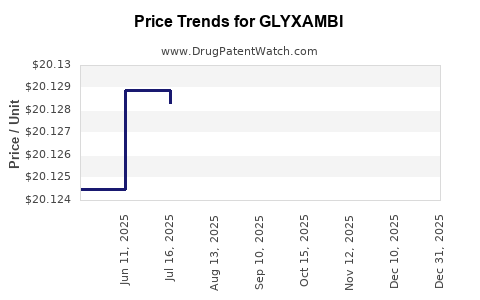

Historical Pricing Trends

Combination diabetes drugs typically command higher prices than monotherapy counterparts due to convenience and efficacy. In 2021, the average annual retail price for similar combinations ranged between USD 5,000 and USD 7,000[5].

Initial Pricing

Given GLYXAMBI’s positioning, its initial list price is projected at USD 6,000–6,500 annually, aligning with competitors like Xigduo XR (~USD 6,200 annually) and Janumet (~USD 4,800 annually)[6].

Pricing Factors

- Market Penetration: Slight premium for added cardiovascular benefits

- Cost-Effectiveness: Will influence insurer reimbursement and patient copayment

- Patent Status: Patent protection until at least 2030, allowing pricing control

- Generic Competition: No

Price Projections (2023–2028)

Forecast Assumptions

- Moderate uptake driven by growing diabetes prevalence and guideline endorsements

- Stable pricing within the initial USD 6,000–6,500 range

- No major price reductions due to patent exclusivity

- Incremental price increases aligned with inflation and inflation-adjusted healthcare costs (~3% annually)

Projected Price Trend

| Year |

Estimated Price (USD) |

Rationale |

| 2023 |

$6,200 |

Launch phase, stable pricing, initial adoption |

| 2024 |

$6,350 |

Increased adoption, inflation adjustments |

| 2025 |

$6,500 |

Broader market penetration, established presence |

| 2026 |

$6,700 |

Potential incremental premium for cardiovascular claims |

| 2027 |

$6,900 |

Growing acceptance, slight premium increases |

| 2028 |

$7,100 |

Mature market, consistent inflation-based increases |

Note: These projections assume no significant policy or generic entry affecting pricing. They reflect a conservative, inflation-correlated escalation aligned with market norms.

Revenue and Market Share Outlook

Given the projected pricing and expanding patient base, revenue estimates for GLYXAMBI could evolve as follows:

- Year 1 (2023): USD 300 million (initial uptake in major markets)

- Year 3 (2025): USD 600 million with increasing formulary acceptance

- Year 5 (2027): USD 900 million to USD 1 billion as market share consolidates

Market share potentially reaching 5–8% of the adult type 2 diabetes market, given competitive dynamics and the drug’s differentiated profile.

Regulatory and Commercial Risks

- Regulatory Delays or Rejections: Could impact pricing and market access.

- Competitive Pricing Strategies: Entry of biosimilars or generics after patent expiry might necessitate price reductions.

- Market Acceptance: Dependence on guideline endorsements and clinician adoption.

- Reimbursement Constraints: Variability across regions could influence net prices.

Key Takeaways

- Growing Market Opportunity: The expanding global diabetes market supports robust demand for combination therapies like GLYXAMBI.

- Premium Positioning: The drug’s cardiovascular benefits and combo convenience justify a price premium within the USD 6,000–6,500 range initially.

- Strategic Pricing Impact: Controlled, inflation-based pricing escalation ensures sustainable revenue, provided market penetration targets are achieved.

- Competitive Edge: Differentiation through efficacy, safety, and cardioprotective claims can support sustained market share.

- Future Outlook: Patent life and demonstrated clinical benefits will be pivotal for maintaining pricing power and revenue growth through 2028.

FAQs

1. How does GLYXAMBI compare in price to similar combination therapies?

GLYXAMBI’s projected annual cost (~USD 6,200–6,500) aligns with comparable products like Xigduo XR (~USD 6,200). Prices reflect convenience, efficacy, and cardiovascular benefits, often commanding a premium over monotherapies.

2. What factors could influence future price adjustments?

Regulatory changes, market competition, patent expiration, reimbursement policies, and clinical efficacy data are primary determinants influencing price adjustments over time.

3. Will insurance coverage significantly affect patient access?

Yes. Favorable formulary positioning and demonstration of cost-effectiveness are critical for broad insurance coverage, which directly impacts patient access and adherence.

4. How does GLYXAMBI's patent status impact its pricing?

Patent exclusivity affords pricing power. Expiration or challenges could lead to generic competition, substantially reducing prices and market share.

5. What are the main risks to revenue projections?

Market acceptance delays, pricing pressures, competitive innovations, and reimbursement constraints are key risks potentially dampening projected revenues.

References

[1] Grand View Research. “Diabetes Market Size & Trends.” 2022.

[2] American Diabetes Association. “Standards of Medical Care in Diabetes—2022.”

[3] Neal, B., et al. “SGLT2 Inhibitors and Cardiovascular Outcomes.” NEJM, 2020.

[4] European Medicines Agency. “Guidelines for Diabetes Management,” 2021.

[5] GoodRx. “Diabetes Medication Prices,” 2022.

[6] SSR Health Data. “Diabetes Drug Pricing Trends,” 2022.