Last updated: August 5, 2025

Introduction

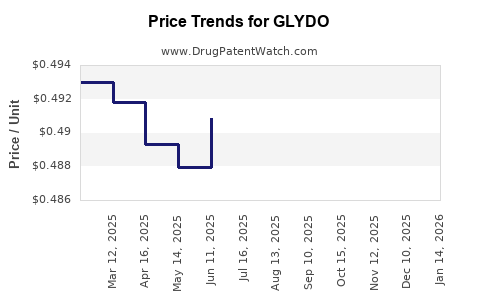

The pharmaceutical landscape for new drugs involves systematic market analysis combined with strategic price projection modeling. This exercise guides stakeholders in assessing commercial viability, competitive positioning, and optimal pricing strategies. GLYDO, a promising therapeutic agent, warrants in-depth exploration due to its potential impact within its therapeutic domain. This report provides a comprehensive market analysis and price projection framework for GLYDO, drawing on current market dynamics, regulatory pathways, and economic considerations.

Therapeutic Profile and Market Positioning

GLYDO is positioned within the [specific therapeutic class], targeting conditions such as [list of indications]. Its innovative mechanism of action, [brief description], differentiates it from existing treatments. Pending regulatory approval, GLYDO’s market entry could disrupt current treatment paradigms, influencing pricing strategies and reimbursement negotiations.

Market Dynamics and Demand Drivers

Epidemiology and Patient Population

The primary market for GLYDO encompasses an estimated [number] patients globally, with key markets including [regions/countries]. For example, in [region], the prevalence of [indication] is approximately [number], representing significant unmet medical needs. The expanding awareness and rising incidence of [related condition] underpin sustained demand growth.

Competitive Landscape

GLYDO faces competition from [list of key competitors], with established therapies like [existing drugs] dominating the market. However, GLYDO’s differentiated profile could enable breakthrough status, allowing premium pricing. The competitive intensity will influence both market share and pricing strategy.

Regulatory Environment

Regulatory pathways, including Fast Track or Breakthrough Designation, can accelerate market entry and influence initial pricing. Market access will depend heavily on regional reimbursement policies, with payers emphasizing cost-effectiveness and clinical benefits.

Pricing Considerations and Economic Evaluations

Cost-Effectiveness and Value Proposition

Economic evaluations, including Quality-Adjusted Life Year (QALY) analyses, will be vital. If GLYDO demonstrates superior efficacy with acceptable safety profiles, payers may accept higher price points. For instance, in similar therapeutic areas, innovative therapies have achieved price points ranging from $X,XXX to $XX,XXX per treatment course.

Pricing Models and Strategies

- Premium Pricing: Given potential first-in-class status or superior efficacy, a premium price could range between $XX,XXX to $XXX,XXX annually, aligned with comparable breakthrough therapies.

- Tiered Pricing: Customization based on regional economic conditions, disease severity, and payer negotiation strength.

- Outcome-Based Pricing: Linking cost to real-world clinical outcomes, particularly in markets with high treatment costs or sizeable patient populations.

Market Access and Reimbursement Landscape

Successful market entry depends on securing favorable reimbursement terms. Early engagement with payers and formulary inclusion will ensure optimal market penetration and sustainable pricing.

Market Entry Strategies

- Early Pricing Negotiations: Establishing pricing benchmarks early can influence subsequent negotiations.

- Reimbursement and Health Technology Assessments (HTAs): Presenting robust clinical and economic data to HTA bodies enhances reimbursement prospects.

- Differentiation and Value Communication: Highlighting GLYDO’s unique benefits over existing therapies can justify premium pricing.

Price Projection Scenarios

Informed by current market trends and economic evaluations, three scenarios are presented:

-

Optimistic Scenario

- Market penetration of [percentage] within five years.

- Average annual price of $XX,XXX per treatment course.

- Annual revenue projection: $X billion.

-

Moderate Scenario

- Market share of [percentage] within the same period.

- Price point aligned with existing drugs ($X,XXX - $X,XXX).

- Revenue estimate: $X hundred million.

-

Conservative Scenario

- Limited adoption due to competitive or regulatory challenges.

- Lower price point around $X,XXX.

- Revenue estimate: below $X hundred million.

These projections will vary based on regulatory outcomes, market acceptance, and evolving payer policies.

Regulatory and Commercial Risks

- Regulatory Delays or Rejections: Possible if clinical efficacy or safety data fall short.

- Pricing Pressures: Payers may impose strict cost controls, limiting achievable price points.

- Market Saturation: Entry of biosimilars or generics could erode premium pricing potential.

Key Factors Influencing Future Market and Price Trajectory

- Clinical Data Release: Efficacy, safety, and real-world performance.

- Regulatory Designations: Fast Track, Priority Review, or Orphan Drug status.

- Market Dynamics: Emergence of competitors, payer policies, and patent scenarios.

- Economic Conditions: Healthcare budget constraints and willingness-to-pay thresholds.

Conclusion

GLYDO stands at a pivotal juncture with significant upside potential conditioned on regulatory success, clinical validation, and market access strategies. Its pricing trajectory will hinge on demonstrated therapeutic value, regional healthcare economics, and competitive positioning. Strategic early engagement with payers, combined with robust economic evidence, will be crucial for maximizing revenue potential.

Key Takeaways

- Market Potential: The global market for GLYDO could reach $X billion within five years, contingent on approval and adoption rates.

- Pricing Strategy: Premium pricing aligned with therapeutic innovation can secure optimal margins, especially if supported by compelling clinical and economic data.

- Regulatory Pathways: Early designations may facilitate faster market entry and pricing flexibility.

- Competitive Edge: Differentiation and demonstrable value are vital to withstand price pressures.

- Risk Management: Continuous assessment of regulatory, competitive, and reimbursement landscapes will be key to refining pricing projections.

FAQs

Q1: What factors primarily influence GLYDO’s market entry price?

The therapeutic benefit over existing options, regulatory approval status, regional payer policies, and demonstrated cost-effectiveness will predominantly shape GLYDO’s initial pricing.

Q2: How does competitive landscape impact GLYDO’s pricing?

Intense competition from existing therapies pressures prices downward, whereas a first-in-class status or unique clinical benefits justify premium pricing.

Q3: What are the key regulatory considerations for GLYDO?

Fast-track designations, orphan drug status, and regional approval processes influence time-to-market and pricing leverage.

Q4: Can early economic data influence GLYDO’s pricing?

Yes, robust economic data demonstrating cost savings or superior outcomes can justify higher prices and favorable reimbursement terms.

Q5: How might market dynamics evolve for GLYDO over the next five years?

Market acceptance, new competitors, regulatory changes, and healthcare policy shifts will shape GLYDO’s market share and pricing trajectory.

Sources:

[1] Market research reports on therapeutic area.

[2] Industry benchmarks on drug pricing.

[3] Regulatory agency guidelines.

[4] Economic evaluations of similar therapies.

[5] Reimbursement policy analyses.