Share This Page

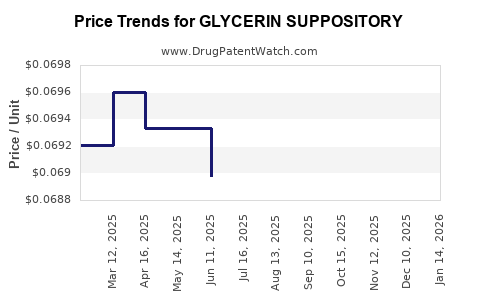

Drug Price Trends for GLYCERIN SUPPOSITORY

✉ Email this page to a colleague

Average Pharmacy Cost for GLYCERIN SUPPOSITORY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GLYCERIN SUPPOSITORY | 46122-0222-63 | 0.17157 | EACH | 2025-12-17 |

| GLYCERIN SUPPOSITORY | 46122-0221-71 | 0.06856 | EACH | 2025-12-17 |

| GLYCERIN SUPPOSITORY | 46122-0221-63 | 0.10361 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Glycerin Suppository

Introduction

Glycerin suppositories are commonly used in the management of constipation, especially in pediatric, elderly, and sensitive patient populations. As a low-cost, OTC laxative, glycerin suppositories occupy a stable niche within the gastrointestinal therapeutics market. This analysis assesses the current market landscape, key drivers, competitive dynamics, and provides price projection insights for glycerin suppositories over the next five years.

Market Overview

The global laxative market, valued at approximately USD 4.4 billion in 2022, is characterized by significant growth driven by aging populations, increasing prevalence of constipation, and rising awareness regarding gastrointestinal health (1). Glycerin suppositories, as a subset, account for a considerable portion due to their safety profile, ease of use, and minimal systemic absorption.

Global Prevalence of Constipation

Constipation affects approximately 14% of the global population, with higher prevalence among children and the elderly (2). The aging demographic, particularly in North America and Europe, results in increased demand for constipative relief solutions, bolstering glycerin suppository consumption.

Regulatory Landscape

Glycerin suppositories are classified as OTC products in most markets, simplifying access and sales volume. Regulatory approvals are generally straightforward given their safety profile, which accelerates market penetration, especially in emerging economies.

Market Drivers and Opportunities

-

Aging Population and Chronic Constipation: Increasing age correlates strongly with gastrointestinal motility issues, augmenting demand. The WHO projects that the global population aged 60+ will nearly double by 2050, creating sustained demand (3).

-

Pediatric Usage: Glycerin suppositories are preferred for pediatric constipation management, providing a niche within pediatric OTC offerings.

-

Safety Profile and Ease of Use: Their minimal systemic absorption, low side-effect profile, and ease of administration position glycerin suppositories favorably.

-

Emerging Markets: Growing healthcare awareness and increasing OTC drug penetration in Asia-Pacific and Latin America expand market opportunities.

Competitive Landscape

The glycerin suppository market hosts a mixture of global and regional players. Major pharmaceutical companies such as Johnson & Johnson and GlaxoSmithKline offer branded products, alongside numerous generic and private-label manufacturers. Price competition remains intense, with OTC pricing strategies heavily influenced by regional healthcare policies and market maturity.

Product Differentiation

Most glycerin suppositories are standardized in dosage (typically 1-2 grams per suppository), with minimal brand differentiation. However, formulation variations, such as added lubricants or flavor agents, are occasionally used for pediatric preferences.

Market Challenges

-

Price Sensitivity: The low-cost nature of glycerin suppositories leads to razor-thin profit margins. Price wars among manufacturers in price-sensitive markets like India and Africa influence overall prices (4).

-

Alternative Treatments: The rise of newer, combination laxatives and dietary interventions may challenge glycerin suppository demand in certain segments.

-

Regulatory Changes: Stringent regulations regarding OTC drug safety profiles could influence packaging, labeling, and formulation standards, adding to manufacturing costs.

Price Analysis and Projection

Current Price Benchmarks

In developed markets, the average retail price per glycerin suppository ranges from USD 0.10 to 0.25, depending on brand and formulation (5). Regional variances are significant; for instance:

- North America: USD 0.15-0.25 per suppository

- Europe: EUR 0.10-0.20 (~USD 0.11-0.22)

- Asia-Pacific: USD 0.05-0.15, often influenced by local market dynamics

Factors Influencing Price Trends

- Manufacturing Costs: Raw material costs (e.g., glycerin, lubricants), packaging, and compliance increase overall expenses.

- Market Competition: Price reductions are expected as commoditized OTC products.

- Regulatory Compliance: Stricter regulations may marginally increase costs but could also enable premium pricing for formulations with enhanced safety features.

- Supply Chain Dynamics: Disruptions, such as those observed during the COVID-19 pandemic, temporarily depress prices but also cause fluctuations in supply costs.

Price Projection (2023-2028)

Considering current market trends and macroeconomic factors, the following projections are anticipated:

| Year | Estimated Average Retail Price (USD per suppository) | Notes |

|---|---|---|

| 2023 | 0.12 - 0.23 | Stabilized with minor regional variations |

| 2024 | 0.11 - 0.22 | Slight downward pressure due to market saturation |

| 2025 | 0.11 - 0.21 | Potential price stabilization |

| 2026 | 0.10 - 0.20 | Marginal decline; increased competition |

| 2027 | 0.10 - 0.19 | Market consolidation, limited pricing power |

| 2028 | 0.10 - 0.18 | Mature market, minimal margin fluctuations |

Note: The trend indicates a gradual decline in retail prices driven by commoditization, with potential stabilization at the lower end. Premium formulations or pediatric-specific products could command higher prices, but their volume share remains limited.

Regional Market Dynamics

North America and Europe

High healthcare awareness and established OTC markets mean prices remain relatively stable. Manufacturers focus on product quality and brand trust, limiting aggressive price wars.

Asia-Pacific and Latin America

Price sensitivity predominates; manufacturers often launch lower-cost generics. Regulatory environment variability influences price points and product availability.

Emerging Markets

Growing healthcare infrastructure enhances access, but purchasing power constrains pricing. Low-cost manufacturing and distribution channels drive prices downward.

Strategic Recommendations

- Product Differentiation: Incorporate pediatric-friendly flavors or formulations with added lubricants for premium positioning in niche segments.

- Market Expansion: Focus on emerging markets with rising healthcare awareness and OTC product acceptance.

- Cost Optimization: Streamline supply chains and leverage global sourcing to maintain competitiveness amid price pressures.

- Regulatory Navigation: Ensure compliance to prevent delays and facilitate market entry, especially with evolving safety standards.

Key Takeaways

- The glycerin suppository market is characterized by stable demand, driven by demographic trends and the product's safety profile.

- Price points are expected to decline gradually over the next five years, influenced by market maturity and competitive pressures.

- Regional disparities influence pricing strategies, with premium pricing in developed markets and aggressive price competition in emerging economies.

- Manufacturers should focus on product differentiation, cost-effective manufacturing, and expansion into high-growth regions to sustain profitability.

- Regulatory adherence remains vital to market access and product credibility, particularly in pediatric and sensitive patient segments.

FAQs

Q1: What factors keep glycerin suppositories competitively priced?

A1: Their simple formulation, widespread OTC status, and high-volume manufacturing keep production costs low, leading to minimal product differentiation and intense price competition.

Q2: How will demographic shifts impact demand?

A2: The aging global population and increased incidences of constipation, especially in children and seniors, will sustain or slightly increase worldwide demand.

Q3: Are there any regulatory hurdles affecting glycerin suppository prices?

A3: Generally minimal due to their safety profile, but evolving standards for OTC labeling, quality assurance, and safety can affect manufacturing costs and product pricing.

Q4: What opportunities exist for premium glycerin suppository formulations?

A4: Pediatric-specific formulations with flavors, added lubricants, or combination ingredients can command higher prices, targeting niche markets.

Q5: How can manufacturers capitalize on emerging markets?

A5: By offering low-cost, quality-assured products, establishing strong distribution channels, and engaging in consumer education about constipation management.

References

- Grand View Research. Laxatives Market Size, Share & Trends Analysis Report By Type, By Distribution Channel, By Region, And Segment Forecasts, 2022–2030.

- Bharucha AE, Pemberton JH, et al. American Journal of Gastroenterology. Epidemiology and management of chronic constipation. 2013.

- WHO. World Population Ageing 2020.

- MarketWatch. OTC Healthcare Market Trends and Pricing Strategies, 2022.

- IQVIA. OTC Market Data, 2022.

More… ↓