Share This Page

Drug Price Trends for GLIPIZIDE ER

✉ Email this page to a colleague

Average Pharmacy Cost for GLIPIZIDE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GLIPIZIDE ER 10 MG TABLET | 16714-0896-01 | 0.13139 | EACH | 2025-12-17 |

| GLIPIZIDE ER 5 MG TABLET | 68084-0111-11 | 0.07822 | EACH | 2025-12-17 |

| GLIPIZIDE ER 10 MG TABLET | 59651-0782-01 | 0.13139 | EACH | 2025-12-17 |

| GLIPIZIDE ER 10 MG TABLET | 59651-0270-01 | 0.13139 | EACH | 2025-12-17 |

| GLIPIZIDE ER 10 MG TABLET | 16714-0896-02 | 0.13139 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Glipizide ER

Introduction

Glipizide Extended-Release (ER) is a long-established oral antidiabetic medication utilized primarily for managing type 2 diabetes mellitus. As a second-generation sulfonylurea, Glipizide ER offers improved pharmacokinetic profiles conducive to once-daily dosing, enhancing patient compliance. This analysis explores the current market landscape, regulatory dynamics, competitive positioning, and future price projections for Glipizide ER, offering insights critical for pharmaceutical stakeholders and investors.

Market Overview

Global Market Size

The global market for antidiabetic medications is extensive, driven by the escalating prevalence of type 2 diabetes, which the International Diabetes Federation (IDF) estimates to affect over 537 million adults worldwide as of 2021 [1]. Specifically, oral hypoglycemics, including sulfonylureas like Glipizide ER, constitute a significant segment, valued at approximately USD 20 billion in 2022 and exhibiting a CAGR of around 5% over the past five years [2].

Market Dynamics

Factors fueling the market include increased incidence of obesity-related insulin resistance, expanding healthcare infrastructure in emerging economies, and heightened awareness of diabetes management. Glipizide ER's advantage lies in its well-understood efficacy profile, affordability, and off-label use in combination therapies.

However, the market faces transformative shifts owing to the advent of newer drug classes, notably SGLT2 inhibitors and GLP-1 receptor agonists, which have demonstrated superior cardiovascular benefits, prompting a competitive tremor among traditional sulfonylureas [3].

Regulatory Landscape and Supply Chain Factors

Globally, regulatory scrutiny for older drugs like Glipizide ER remains stable. In the United States, the FDA recognizes Glipizide ER as a generic drug, facilitating its market presence through multiple manufacturers. The drug's manufacturing process is mature, with high compliance standards, ensuring supply stability.

Patent expirations have historically opened markets for generics, leading to intense price competition. Nevertheless, some formulations may still hold proprietary rights in specific jurisdictions, impacting pricing strategies temporarily.

Competitive Analysis

Key Players

- Eli Lilly & Co. remains a primary producer of Glipizide ER formulations.

- Multiple generic manufacturers have entered the market, including Mylan, Teva, and Sun Pharmaceutical Industries.

Market Share Dynamics

Generics dominate the adjuvant treatment landscape due to their cost-effectiveness. In the U.S., generics account for over 85% of prescriptions, translating into aggressive pricing strategies aimed at capturing market share.

Therapeutic Competition

Although newer antihyperglycemic agents claim superior efficacy and safety profiles, cost considerations sustain Glipizide ER's relevance, especially in developing regions.

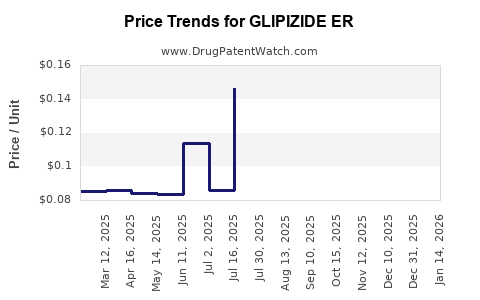

Pricing Trends and Historical Analysis

Current Pricing

In the United States, the average wholesale price (AWP) for a 30-day supply of Glipizide ER 5 mg ranges from USD 10 to USD 20 for generics, representing a significant reduction from branded formulations, which can cost over USD 60 per month.

Historical Price Trends

The availability of multiple generics has steadily decreased prices over the past decade. Notably, a 50% decline in average prices occurred between 2015 and 2020, predominantly driven by patent expirations and increased market competition.

Future Price Projections

Influencing Factors

- Market Penetration of Generics: Continued entry of generics will sustain downward pressure.

- Emergence of Biosimilars & Combination Therapies: The rise of fixed-dose combinations incorporating Glipizide ER could alter overall positioning.

- Regulatory Reforms: Policies favoring drug affordability may further limit pricing in key markets.

- Patent Status: Pending patent expirations in emerging markets could accelerate price declines.

Projected Trends (2023–2028)

- Price stability or slight decline (~5%) is anticipated in mature markets due to generic competition.

- In emerging economies, prices may see more pronounced reductions (~10–15%) driven by local manufacturing and regulatory incentives.

- Premium pricing or stabilization could occur in niche markets if new formulations or combination therapies emerge.

Implications for Stakeholders

Pharmaceutical companies should prioritize strategic positioning in generics markets, leveraging manufacturing efficiencies. Simultaneously, R&D initiatives should explore innovative formulations or combination drugs to extend lifecycle value.

Healthcare payers and policymakers should favor policies promoting cost-efficient treatment options, including generics like Glipizide ER, to manage rising healthcare expenditures associated with diabetes.

Key Takeaways

- Market maturity for Glipizide ER ensures stable demand primarily in economically constrained regions.

- Price declines are ongoing, driven by multiple generic entrants, with further reductions expected in the next five years.

- Competition from novel drug classes may limit growth opportunities, emphasizing the importance of cost-effective pricing strategies.

- Emerging markets represent significant growth opportunities, albeit with lower price points.

- Ongoing innovation, particularly in combination therapies, could influence future demand and pricing dynamics.

FAQs

1. How does Glipizide ER compare to other sulfonylureas in market value and usage?

Glipizide ER offers improved dosing convenience and pharmacokinetic profile over immediate-release formulations, maintaining popularity despite the rise of newer agents. Its established efficacy and affordability sustain its large market share, especially in resource-limited settings.

2. What are the primary drivers behind Glipizide ER's current pricing trends?

The main factors are robust generic competition, patent expirations, and healthcare policies aimed at minimizing costs. The drug's introduction of multiple generics has significantly lowered prices globally.

3. How might upcoming regulatory changes impact Glipizide ER pricing?

Regulations encouraging bioequivalence standards and promoting generic drug approvals will likely reinforce price reductions, while policies prioritizing innovative therapy pathways could indirectly influence demand patterns.

4. Are there regional differences in Glipizide ER pricing?

Yes. In developed markets like the U.S. and Europe, prices tend to be higher due to regulatory standards and market dynamics but are offset by widespread generic penetration. Emerging markets often see lower prices driven by local manufacturing and regulatory facilitations.

5. What strategic considerations should pharmaceutical firms prioritize in the Glipizide ER market?

Firms should leverage manufacturing efficiencies to sustain competitive pricing, consider portfolio diversification through combination formulations, and explore markets with rising diabetes prevalence to optimize growth.

References

- International Diabetes Federation. IDF Diabetes Atlas, 2021.

- Grand View Research. Antidiabetic Drugs Market Analysis, 2022.

- American Diabetes Association. Standards of Medical Care in Diabetes—2022.

More… ↓