Share This Page

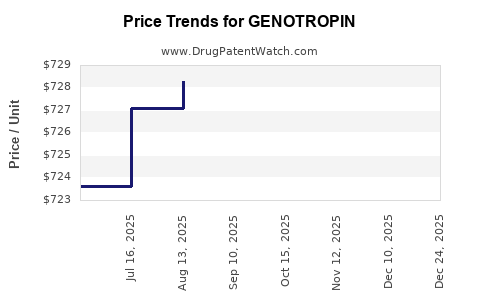

Drug Price Trends for GENOTROPIN

✉ Email this page to a colleague

Average Pharmacy Cost for GENOTROPIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GENOTROPIN 5 MG CARTRIDGE | 00013-2626-81 | 726.55000 | EACH | 2025-12-17 |

| GENOTROPIN MINIQUICK 0.2 MG | 00013-2649-02 | 29.99843 | EACH | 2025-12-17 |

| GENOTROPIN 12 MG CARTRIDGE | 00013-2646-81 | 1757.67333 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GENOTROPIN

Introduction

GENOTROPIN, a recombinant human growth hormone (hGH) developed by Eli Lilly and marketed by other pharmaceutical entities following licensing agreements, holds a significant position within the biopharmaceutical landscape. Primarily prescribed for growth hormone deficiencies, idiopathic short stature, and certain genetic conditions, GENOTROPIN remains a cornerstone therapy within the pediatric and adult endocrinology markets. This article offers a comprehensive market analysis and price projection framework, designed to inform industry stakeholders, investors, and healthcare providers about current dynamics and future trends shaping GENOTROPIN’s commercial landscape.

Market Overview

The global growth hormone therapy market, estimated at approximately USD 4.8 billion in 2022, grows annually at a compound annual growth rate (CAGR) of roughly 6-8% [1]. The steady expansion signals increasing acceptance of growth hormone treatments, driven by rising prevalence of growth hormone deficiencies (GHD), increased diagnosis rates, and broader indications including metabolic and aging-related applications.

Key Market Drivers:

- Increasing Disease Prevalence: GHD affects approximately 1 in 4,000 children globally, with underdiagnosis still prevalent [2]. Rising awareness and improved diagnostic methods bolster treatment numbers.

- Expanding Indications: Beyond pediatric conditions, adult GHD treatments are gaining momentum, accounting for about 40% of market value, due to evidence supporting improved quality of life and metabolic profiles.

- Technological Advancements: Longer-acting formulations and precision dosing improve patient adherence and outcomes, driving market growth.

- Regulatory Environment: Favorable reimbursement policies in developed economies stimulate market penetration and affordability.

Competitive Landscape:

GENOTROPIN competes with biosimilars, authorized generics, and other branded products, including Norditropin (Novo Nordisk), Saizen (Merck), and Omnitrope (Sandoz). The market's structure indicates increasing erosion of exclusivity as biosimilar approvals expand globally, especially post-exclusivity periods in key jurisdictions.

Economic and Pricing Dynamics

Pricing Landscape:

In the United States, the list price for GENOTROPIN units hovers around USD 60,000–USD 90,000 annually per patient, with significant variation based on dosage, insurance coverage, and negotiated discounts [3]. Biosimilars introduced post-patent expiry tend to exert downward pressure, with price discounts ranging from 20%–35% [4].

Pricing Factors:

- Regulatory Approvals: Patent expiries and biosimilar approvals in major markets (US, EU, Japan) strongly influence pricing strategies.

- Reimbursement and Insurance Dynamics: Payers aim to control cost through formulary management, influencing net prices.

- Production Costs: Advances in manufacturing and formulation have slightly reduced unit costs, supporting more competitive pricing.

- Market Penetration Efforts: Marketing strategies focus on clinician education, emphasizing safety, efficacy, and convenience, influencing willingness to pay.

Future Price Projections

Short-Term (Next 1-3 Years):

- Stability with Slight Decline: Discounting driven by biosimilar entries and increasing market competition is expected to reduce net prices by approximately 10-15%. The trend reflects a mature market consolidating around a few key generic or biosimilar competitors.

- Price Range: US annual treatments could decline to USD 50,000–USD 70,000, with variations influenced by insurer negotiations and regional policies.

Medium to Long-Term (3-10 Years):

- Impact of Advanced Biologics: Development of long-acting growth hormone formulations (e.g., ATL1103, National biotech pipelines) could shift market dynamics, possibly leading to further price reductions for traditional weekly or daily GH products.

- Global Market Expansion: Emerging markets (India, China, Latin America) are anticipated to adopt biosimilar versions, propelling prices down by up to 50% relative to current premium pricing, driven by local manufacturing and regulatory policies.

- Regulatory Push for Cost-effective Therapies: Governments worldwide are increasingly incentivizing biosimilar adoption to reduce healthcare expenditures, likely accelerating price decreases.

Long-term Outlook:

Given these dynamics, average treatment prices for GENOTROPIN in developed economies are projected to decline by 20-30% over the next decade, aligning with biosimilar penetration and the evolution of more cost-effective treatment options. Conversely, in emerging markets, prices may decrease more sharply, with some regions experiencing reductions of up to 50% or more, contingent upon local regulation and market access strategies.

Market Challenges and Opportunities

Challenges:

- Biosimilar Competition: Rapid approval and market introduction of biosimilars threaten branded product exclusivity and profit margins.

- Pricing Regulations: Governments in Europe and Asia are enforcing stricter price controls, limiting revenue growth.

- Patient Access and Adherence: High treatment costs impede access and adherence, affecting overall market size.

Opportunities:

- Innovation in Delivery: Development of long-acting formulations and needle-free delivery systems could command premium pricing due to improved compliance.

- Expanding Indications: Label expansions into aging-related conditions and metabolic disorders offer avenues for revenue growth.

- Emerging Markets Growth: Increasing healthcare infrastructure and insurance coverage in developing countries present significant expansion opportunities.

Conclusion

GENOTROPIN’s market remains robust amidst evolving competitive pressures. As biosimilars and innovative therapies gain prominence, the product’s pricing is poised for gradual decline, especially in mature markets. Strategic positioning, such as embracing long-acting formulations and expanding indications, can mitigate potential revenue erosion. Stakeholders must monitor regulatory developments, biosimilar entry timelines, and regional healthcare policies to optimize pricing strategies and market share.

Key Takeaways

- The global growth hormone market is experiencing steady growth, driven by expanding indications and improving diagnostic practices.

- In the near term, GENOTROPIN prices are likely to decline modestly (~10-15%) due to biosimilar competition and negotiations.

- Long-term projections suggest a 20-30% reduction over the next decade, with more significant declines expected in emerging markets.

- Innovation in formulation (long-acting) and expanding clinical indications present opportunities to retain premium positioning.

- Policymaker actions enforcing price controls can influence overall revenue and necessitate strategic adjustments by manufacturers.

FAQs

1. How will biosimilar entry affect GENOTROPIN’s pricing?

Biosimilar competition introduces downward pricing pressure, reducing list and net prices by approximately 20-35%, particularly in mature markets where biosimilars are approved and adopted rapidly.

2. Are there upcoming regulatory changes that could influence GENOTROPIN prices?

Yes. Price regulation policies, especially in Europe and Asia, aim to contain healthcare costs, which could further depress prices and limit revenue growth for branded products.

3. What innovations could help GENOTROPIN maintain market share?

The development of long-acting formulations, improved delivery systems, and expanded indications could enhance patient compliance, justify higher pricing, and offset biosimilar erosion.

4. How do regional differences impact future price trends?

Developed countries will likely see moderate price declines, while emerging markets may experience more substantial reductions due to local biosimilar manufacturing and lower healthcare spending.

5. What strategies should manufacturers adopt to optimize revenue?

Investing in product differentiation, expanding indications, engaging in strategic pricing, leveraging preferential payer negotiations, and accelerating biosimilar development can support sustained profitability.

References

- MarketWatch. (2022). Growth hormone treatment market size and forecast.

- NIH. (2021). Prevalence and diagnosis of growth hormone deficiency.

- IQVIA. (2022). US pharmaceutical pricing and reimbursement reports.

- Global Data. (2022). Biosimilar market impact analysis.

More… ↓