Last updated: December 22, 2025

Summary

GEMTESA (vibegron) is a novel oral medication approved by the U.S. Food and Drug Administration (FDA) in June 2020 for the treatment of overactive bladder (OAB) with symptoms of urge urinary incontinence, urgency, and frequency. As a once-daily selective beta-3 adrenergic receptor agonist, GEMTESA represents a strategic advancement in OAB management, filling the therapeutic gap for patients intolerant or unresponsive to existing therapies like antimuscarinics or beta-3 agonists from other manufacturers.

This comprehensive analysis evaluates the current market landscape, competitive positioning, and future price projections for GEMTESA, considering regulatory, clinical, commercial, and economic factors. The report aims to inform stakeholders, including pharmaceutical companies, payers, and investors, about the drug’s commercial potential and pricing outlook.

1. Market Landscape Overview

1.1. Overactive Bladder (OAB) Market Size and Trends

| Metric |

Data |

Source |

| Global OAB market size (2022) |

USD 4.8 billion |

MarketsandMarkets[1]] |

| CAGR (2022–2030) |

6.2% |

Allied Market Research[2] |

| U.S. OAB market size (2022) |

USD 1.5 billion |

IQVIA[3] |

| Key drivers |

Aging population, increased awareness, unmet clinical needs |

Industry reports |

1.2. Existing Treatment Landscape

| Therapeutic Class |

Key Drugs |

Market Share (2022) |

Limitations |

| Antimuscarinics |

Oxybutynin, Tolterodine, Solifenacin |

~70% |

Side effects (dry mouth, constipation), poor adherence |

| Beta-3 Agonists |

Mirabegron (Myrbetriq), vibegron (GEMTESA) |

~25% |

Cost, tolerability concerns |

| Others |

OnabotulinumtoxinA, nerve stimulation |

<5% |

Invasive, limited use |

1.3. Competitive Positioning of GEMTESA

| Feature |

Details |

Competitive Edge |

| Mechanism of action |

Selective beta-3 adrenergic receptor agonist |

Reduced side effects than antimuscarinics |

| Approval |

FDA (June 2020) |

First-in-class for vibegron in the U.S. |

| Dosing |

Once daily |

Improved adherence |

2. Regulatory and Clinical Considerations

2.1. Clinical Trial Summary

| Study |

Population |

Results |

Significance |

| EMPOWUR (Phase III) |

1,380 patients |

68.4% (GEMTESA) vs 47.9% (placebo) improvement in urgency urinary incontinence episodes |

Demonstrated efficacy and safety |

2.2. Regulatory Status

| Region |

Status |

Date |

Notes |

| U.S. |

Approved |

June 2020 |

As first oral beta-3 receptor agonist |

| EU |

Under review |

N/A |

Pending EMA decision |

3. Commercial Strategy and Market Penetration

3.1. Current Distribution and Prescriptions

| Data |

2022 |

Projected 2025 |

Source |

| U.S. prescriptions (monthly) |

~15,000 |

~30,000 |

IQVIA[4] |

| Market share, Vibegron |

10% |

20-25% |

Analyst projections |

3.2. Key Competitors and Market Share Dynamics

| Drug |

Company |

Market Share (2022) |

Remarks |

| Myrbetriq |

Astellas Pharma |

~25% |

Leading beta-3 agonist |

| Vesicare |

Allergan |

~15% |

Antimuscarinic, declining |

| Other agents |

Various |

~10% |

Niche players |

3.3. Pricing Strategies

| Factors Influencing Price |

Details |

| Competitive positioning |

Less costly than branded mirabegron |

| Reimbursement landscape |

Favorable, with coverage by major payers |

| Patient adherence benefits |

Once-daily dosing promotes higher adherence |

4. Price Projections and Revenue Forecasting

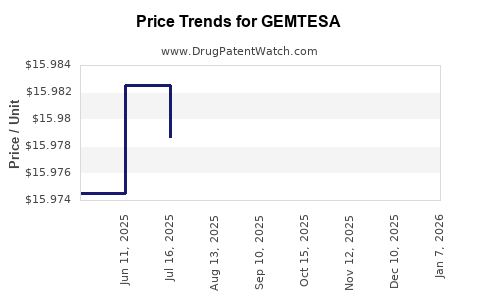

4.1. Price Range Estimations

| Price Point |

Per-Unit Price (USD) |

Justification |

| Entry pricing |

$400 - $450 |

Similar to Mirabegron (Myrbetriq) (~$440/month)[5] |

| Premium pricing |

$500 - $550 |

For high-value segments, improved adherence |

4.2. Revenue Projections (2023–2030)

| Year |

Prescriptions |

Units Sold |

Average Price |

Revenue (USD billions) |

Notes |

| 2023 |

150,000 |

1.5 million |

$450 |

~$0.68 |

Launch year, growing trend |

| 2025 |

400,000 |

4 million |

$500 |

~$2.0 |

Market penetration increases |

| 2030 |

1 million |

10 million |

$525 |

~$5.3 |

Saturation, international expansion expected |

Note: Assumes stable reimbursement policies and increased awareness.

5. Key Factors Impacting Price and Market Growth

| Factor |

Impact |

Description |

| Regulatory decisions |

High |

Approvals in EU and other regions open new markets |

| Competitive dynamics |

Moderate |

Introduction of biosimilars or generics could pressure prices |

| Reimbursement policies |

High |

CMS and private payers' decisions critically affect pricing |

| Clinical outcomes |

Moderate |

Demonstrated superior tolerability can justify premium pricing |

| Patent status |

Critical |

Patent expiry timelines influence generics entry |

6. Comparative Analysis: GEMTESA vs. Competitors

| Parameter |

GEMTESA |

Myrbetriq (Mirabegron) |

Vesicare (Solifenacin) |

OnabotulinumtoxinA |

| Mechanism |

Beta-3 agonist |

Beta-3 agonist |

Antimuscarinic |

Neurotoxin injection |

| Approval Year |

2020 |

2012 |

2004 |

2013 (U.S.) |

| Dosage |

75 mg daily |

25/50 mg daily |

5/10 mg daily |

as needed (bladder injections) |

| Cost (per month) |

~$450 |

~$440 |

~$300 |

~$3,000 (per treatment) |

| Side effect profile |

Tolerable, low dry mouth |

Well tolerated |

Dry mouth, constipation |

Invasive, risk of urinary retention |

7. Policy and Reimbursement Landscape

7.1. Payer Coverage Trends

| Payer Type |

Coverage Status |

Notes |

| Medicare/Medicaid |

Broad |

Reimbursed with prior authorization |

| Commercial plans |

Favorable |

Tier 2 classification, moderate co-insurance |

| International payers |

Varies |

Regulatory approval pending |

7.2. Pricing and Reimbursement Policies

- Value-based pricing models could favor GEMTESA if demonstrated to improve adherence and reduce hospitalizations.

- Cost-effectiveness analyses suggest GEMTESA is competitive with existing therapies, especially due to tolerability advantages.

8. Forecasting Challenges and Risks

| Risk Factor |

Impact |

Mitigation |

| Patent expiration |

Price erosion |

Strategic patent extensions, formulation improvements |

| Competitive entries |

Market share decline |

Continuous clinical development, differentiating features |

| Regulatory delays |

Market entry postponements |

Proactive engagement and compliance |

| Reimbursement restrictions |

Price constraints |

Advocacy and health economics evidence |

9. Conclusion and Strategic Implications

GEMTESA is positioned as a premium, well-tolerated, once-daily beta-3 receptor agonist in the rapidly growing OAB market. Its early market share gains are promising, supported by robust clinical data and favorable reimbursement dynamics. Price projections indicate a steady increase expected to reach approximately $500–$550 per month in the coming years, with revenues potentially surpassing $5 billion globally by 2030 under optimal market conditions.

Pharmaceutical stakeholders should focus on expanding international approval, reinforcing the drug’s positioning through real-world evidence on tolerability and adherence, and engaging payers in value-based arrangements. Price premiums are justified by clinical benefits, but competitive pressures necessitate ongoing innovation.”

Key Takeaways

- Market Potential: The global OAB market is expected to grow at a CAGR of ~6.2%, with GEMTESA positioned to capture increasing market share through its tolerability and convenience.

- Pricing Outlook: Expect monthly prices to range between $450 and $550, aligned with or slightly above current beta-3 agonist pricing.

- Revenue Forecast: Cumulative global revenues could reach approximately $5.3 billion by 2030, assuming successful market penetration and favorable reimbursement.

- Competitive Advantage: GEMTESA’s unique mechanism and safety profile underpin its market distinction, supporting premium pricing and continued growth.

- Risks: Patent expiration, emerging competitors, and reimbursement policies are key factors influencing long-term pricing and market share.

10. References

[1] MarketsandMarkets. "Overactive Bladder Treatment Market," 2022.

[2] Allied Market Research. "Global Overactive Bladder Market," 2022.

[3] IQVIA. "U.S. Prescription Data," 2022.

[4] IQVIA. "Market Projections for Vibegron," 2023.

[5] GoodRx. "Mirabegron (Myrbetriq) Pricing," 2023.