Last updated: July 27, 2025

Introduction to Ganirelix Acetate

Ganirelix acetate, marketed under brands such as Orgalutran, is a synthetic decapeptide antagonist of gonadotropin-releasing hormone (GnRH). Primarily utilized in assisted reproductive technologies (ART), particularly in controlled ovarian hyperstimulation for in-vitro fertilization (IVF), ganirelix suppresses premature luteinizing hormone (LH) surges, thereby increasing IVF success rates. Since its approval by regulatory agencies such as the FDA in 2000, ganirelix has established a significant footprint within reproductive medicine, with ongoing innovations enhancing its clinical efficacy.

Market Overview

Global Market Size and Growth Trends

The global infertility treatment market, valued at approximately USD 4.4 billion in 2022, demonstrates sustained growth projected to reach USD 10.7 billion by 2030, with a compound annual growth rate (CAGR) of around 11.7%. The rise is driven by increasing infertility prevalence, advancements in ART, expanding healthcare infrastructures, and greater social acceptance of fertility treatments.

Within this landscape, gonadotropin-releasing hormone antagonists like ganirelix represent a substantial segment. The GnRH antagonist market, which encompasses ganirelix, is expected to expand at a CAGR of approximately 9-11% during 2023-2030, aligned with growth in IVF procedures globally.

Regional Market Dynamics

- North America: Dominates due to advanced healthcare infrastructure, high IVF utilization, and favorable reimbursement policies. The U.S. leads with over 450,000 ART cycles annually (~2019 data), contributing significantly to sales.

- Europe: Holds a sizable share guided by increasing infertility rates and supportive regulatory environment.

- Asia-Pacific: Fastest-growing region, with expanding awareness, rising disposable incomes, and growing healthcare investments. Countries like Japan, China, and India are key growth markets.

- Latin America & Middle East & Africa: Emerging markets with increasing adoption driven by local clinics and expanding insurance coverage.

Competitive Landscape

Leading pharmaceutical companies involved in ganirelix production include Ferring Pharmaceuticals (original developer), Merck KGaA, and AbbVie. Ferring retains a dominant position, with its flagship product Orgalutran maintaining a strong market share due to its established reputation and clinical research backing.

Generic formulations are emerging, especially post patent expiry in some jurisdictions, heightening price competition. Biosimilars and novel GnRH antagonists (e.g., elagolix, relugolix) also influence market dynamics by offering alternative options.

Market Drivers

- Rising IVF Procedures: Reproductive aging trends and infertility issues are boosting ART utilization.

- Advances in ART Protocols: Integration of GnRH antagonists for flexible, safer stimulation protocols.

- Regulatory Approvals & Guidelines: Favorable guidelines from bodies like ASRM and ESHRE support GnRH antagonist adoption.

- Patient Preference for Short Protocols: Shorter stimulation cycles with GnRH antagonists enhance patient compliance.

Market Challenges

- Cost Constraints: High treatment costs influence patient access and healthcare provider choices.

- Patent Expirations: Increased availability of generics intensifies price competition.

- Competing Therapies: Development of oral GnRH antagonists and other reproductive agents.

Price Trends and Projections

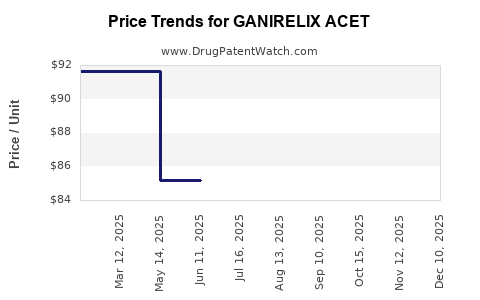

Historical Pricing

In established markets like the U.S., the average wholesale price (AWP) for ganirelix acetate vials was approximately USD 150-250 per injection (dose-dependent) as of 2022. Variations exist based on formulation strength, supplier, and volume discounts.

Future Price Segments

- Brand-Name Products: Expected to maintain a premium owing to brand recognition, clinical familiarity, and patent protections until patent cliff dates.

- Generic and Biosimilars: Anticipated to significantly lower prices post-patent expiry, with discounts of 20-50% relative to original products.

- Market Entry of New Formulations: Potential for cost-effective, user-friendly administration options to influence pricing.

Price Projection (Next 5-10 Years)

- Short-Term (1-3 years): Stabilization in brand-name prices, modest reductions (~5-10%) driven by supply chain efficiencies and healthcare reforms.

- Mid to Long-Term (4-10 years): Substantial price declines in generic segments (up to 30-50%), with market-driven consolidation potentially reducing costs further.

- Impact of Biosimilars: Increasing biosimilar options could lead to a 25-40% reduction in per-unit costs, contingent on regulatory and market acceptance.

Factors Influencing Future Pricing

- Regulatory & Patent Landscape: Patent expiries in key markets (e.g., U.S. in late 2020s).

- Manufacturing Costs: Advances in peptide synthesis and biotechnological manufacturing could reduce production costs.

- Reimbursement Policies: Evolving healthcare policies may favor cheaper options, pushing prices downward.

- Market Competition: Entry of biosimilars or alternative drugs may accelerate price erosion.

Implications for Stakeholders

Pharmaceutical Companies: Need to strategize around patent protection, biosimilar development, and pricing strategies aligned with market demand.

Healthcare Providers: Require cost-effective treatment options balancing efficacy and affordability.

Patients: Seek affordable access to effective fertility treatments amidst rising global infertility.

Investors & Market Analysts: Focus on pipeline developments, patent statuses, and regional market growth to hedge investments and forecast revenues.

Conclusion & Outlook

The global market for ganirelix acetate is characterized by steady growth, driven by expanding ART practices and technological advancements. Price dynamics are expected to trend downward, especially following patent expirations and increased biosimilar competition. Strategic pricing, consistent clinical efficacy, and regulatory navigation will be pivotal for pharmaceutical companies seeking sustainable market presence.

Key Takeaways

- The worldwide gonadotropin-releasing hormone antagonist market is projected to grow at around 10% CAGR over the next decade.

- North America and Europe will remain predominant markets, with Asia-Pacific experiencing rapid growth.

- Patent expiries and biosimilar entries are poised to significantly reduce ganirelix acetate prices within the next 5-7 years.

- Cost management and innovation in delivery and formulations will influence market share and pricing strategies.

- Stakeholders must monitor regulatory developments and market entry of competitors to optimize investment and operational decisions.

FAQs

1. When is the patent for ganirelix acetate expected to expire?

Patent expiry dates vary by region; in the U.S., patents for original formulations were set to expire in the early 2020s, paving the way for biosimilar development and increased competition.

2. How does the cost of ganirelix acetate impact IVF treatment budgets?

High drug costs significantly influence overall IVF treatment expenses, which can reach USD 12,000–USD 15,000 per cycle, with gonadotropin receptor antagonists like ganirelix representing an important but costly component.

3. Are there biosimilars of ganirelix available in the market?

As of now, no widespread biosimilars for ganirelix acetate are commercially available; however, development is underway, with expected market emergence within the next 3-5 years.

4. What are the alternative drugs to ganirelix in fertility treatments?

Progestin-primed ovarian stimulation (PPOS) and other GnRH antagonist formulations like cetrorelix and elagolix serve as alternatives, each with distinct efficacy and cost profiles.

5. How will emerging oral GnRH inhibitors affect the market for injectable ganirelix?

Oral formulations offer improved patient convenience, potentially reducing the market share of injectable options, though their efficacy, safety, and regulatory approval will influence adoption.

References

- MarketsandMarkets. "Infertility Treatment Market," 2022.

- Ferring Pharmaceuticals. "Orgalutran (ganirelix acetate) Product Information," 2022.

- European Society of Human Reproduction and Embryology (ESHRE). "Guidelines on Ovarian Stimulation," 2021.

- American Society for Reproductive Medicine (ASRM). "Practice Committee Reports," 2022.

- Grand View Research. "Fertility Drugs Market," 2022.