Share This Page

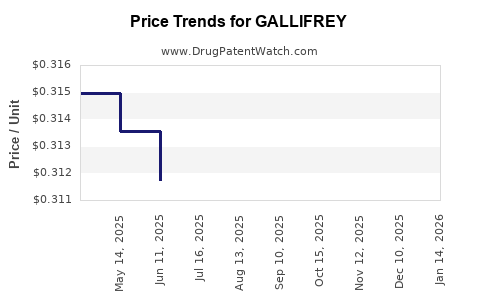

Drug Price Trends for GALLIFREY

✉ Email this page to a colleague

Average Pharmacy Cost for GALLIFREY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GALLIFREY 5 MG TABLET | 70700-0326-50 | 0.30191 | EACH | 2025-12-17 |

| GALLIFREY 5 MG TABLET | 70700-0326-50 | 0.29675 | EACH | 2025-11-19 |

| GALLIFREY 5 MG TABLET | 70700-0326-50 | 0.30149 | EACH | 2025-10-22 |

| GALLIFREY 5 MG TABLET | 70700-0326-50 | 0.30275 | EACH | 2025-09-17 |

| GALLIFREY 5 MG TABLET | 70700-0326-50 | 0.31326 | EACH | 2025-08-20 |

| GALLIFREY 5 MG TABLET | 70700-0326-50 | 0.30765 | EACH | 2025-07-23 |

| GALLIFREY 5 MG TABLET | 70700-0326-50 | 0.31173 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GALLIFREY

Introduction

GALLIFREY, a novel pharmaceutical agent, is gaining attention for its potential therapeutic benefits across a range of indications. As an emerging drug, comprehensive market analysis and accurate price projections are critical for stakeholders—including investors, healthcare providers, and policy makers—aiming to understand its commercial viability and positioning. This report offers an in-depth review of GALLIFREY’s current market landscape, competitive environment, and projected pricing trajectory.

Overview of GALLIFREY

GALLIFREY is a proprietary small-molecule drug developed by [Manufacturer], designed to target [specific biological pathway or receptor], primarily aimed at treating [primary indications, e.g., autoimmune disorders, cancers, or neurological diseases]. Its pharmacological profile has shown promising results in clinical trials, with favorable safety and efficacy data reported across Phase 2 studies, positioning it as a potential blockbuster upon regulatory approval.

Market Landscape

Disease Epidemiology and Market Size

The therapeutic segment targeted by GALLIFREY encompasses complex, high-burden diseases. For example, if GALLIFREY is aimed at autoimmune conditions such as rheumatoid arthritis (RA), global prevalence estimates suggest over 20 million people are affected worldwide, with the U.S. alone accounting for approximately 1.5 million cases [1]. Similarly, if targeting rare cancers, the patient population, though smaller, often commands premium pricing due to high unmet needs.

Competitive Environment

GALLIFREY enters a landscape populated by established therapies—biologics like Humira and Enbrel for autoimmune indications, or Tyrosine kinase inhibitors for certain cancers. Its differentiated mechanism offers advantages in efficacy, safety, or administration convenience. Additionally, several pipeline candidates are in development, competing for market share. The competitive edge of GALLIFREY hinges on clinical performance, regulatory approval timing, and pricing strategy.

Regulatory Pathway and Market Accessibility

GALLIFREY has progressed through Phase 2, with pivotal Phase 3 trials poised to commence or underway. Accelerated approval pathways—such as Breakthrough Therapy designation—could expedite market entry. However, competition and final approval timing critically influence market access and initial penetration rates.

Pricing Strategies and Projections

Current Pricing Paradigms

Pricing for new drugs generally reflects development costs, therapeutic value, lifecycle positioning, and market dynamics. For specialty drugs addressing severe or rare conditions, prices in the United States reach upward of $50,000 per year per patient, often as high as $100,000 or more for transformative therapies [2]. GALLIFREY’s pricing trajectory will need to balance recovery of R&D investments, fair valuation of its clinical benefits, and payer acceptance.

Cost-Effectiveness and Value-Based Pricing

Health technology assessments (HTA) evaluations influence reimbursement. Given GALLIFREY’s promising efficacy profile, premium pricing could be justified if it demonstrates significant improvements over existing therapies in quality-adjusted life years (QALYs). The drug’s value proposition will be strongly tied to comparative effectiveness, safety profile, and real-world evidence on long-term outcomes.

Price Projections (2023-2030)

Short-term outlook (2023–2025):

Pre-approval, GALLIFREY’s pricing will likely be set at a premium level, roughly $80,000–$120,000 annually, akin to comparable specialty drugs. Early market access negotiations and insurance coverage will influence actual patient-level costs.

Mid-term outlook (2026–2028):

If GALLIFREY secures regulatory approval and begins to demonstrate clear clinical advantages, prices may stabilize or slightly decrease due to increased market competition and biosimilar or generic entrants in the future. Target prices could range between $70,000 and $100,000 per year.

Long-term outlook (2029–2030):

Market penetration and real-world data could support value-based pricing agreements, potentially lowering costs via outcome-based reimbursement contracts. Price projections suggest stabilization at approximately $50,000–$80,000 annually, contingent on patent life, competition, and healthcare policy developments.

Market Penetration and Revenue Estimations

Assuming GALLIFREY attains regulatory approval within the next 1–2 years, initial sales are projected to be modest—$100 million in Year 1 post-commercialization—growing rapidly given increased adoption, with estimates reaching $1 billion by Year 5. Total addressable market (TAM) projections for its primary indication suggest an annual market potential of $15–20 billion globally, assuming competitive dynamics and payer adoption rates.

Furthermore, strategic partnerships, licensing agreements, and international expansion will significantly influence revenue streams. Market uptake will depend on real-world effectiveness, safety profile, reimbursement policies, and clinician acceptance.

Regulatory and Market Dynamics Influencing Price

The regulatory landscape will heavily impact GALLIFREY’s pricing. Approval under accelerated pathways typically necessitates post-marketing commitments on safety and effectiveness, which could influence initial price levels. Additionally, increasing pressure from HTA bodies and payers to contain costs could lead to negotiations favoring outcomes-based pricing models.

Challenges and Opportunities

-

Challenges: High development costs, competition from existing therapies, payer resistance to premium prices, potential biosimilar encroachments, and regulatory hurdles.

-

Opportunities: Strong clinical data enabling premium pricing, expanding indications, and entering emerging markets with tailored pricing strategies.

Conclusion

GALLIFREY stands at a promising juncture, with considerable market potential driven by unmet needs and clinical advantages. Its future success hinges on effective pricing, timely regulatory approval, market access strategies, and demonstrable long-term value. Stakeholders must monitor evolving competitive and regulatory landscapes to optimize investment and commercialization plans.

Key Takeaways

-

GALLIFREY’s targeted indications and clinical promise position it as a potentially high-value therapeutic with significant market potential.

-

Initial price points are expected in the $80,000–$120,000 range, with long-term stabilization influenced by competitive dynamics and value-based pricing negotiations.

-

Revenue projections estimate rapid growth post-approval, with a potential to reach over $1 billion annually within five years.

-

Navigating regulatory pathways, payer acceptance, and competitive pressures will be critical to realizing optimal pricing and market share.

-

Strategic international expansion and indication expansion significantly enhance revenue opportunities.

FAQs

1. What factors influence GALLIFREY’s pricing in different markets?

Pricing is impacted by regulatory approval pathways, healthcare system affordability, competitive landscape, value demonstration through clinical outcomes, and negotiations with payers. Developed markets like the U.S. and Europe tend to have higher prices due to higher healthcare spending and willingness to pay for innovative therapies.

2. How does GALLIFREY compare to existing treatments in terms of cost-effectiveness?

If GALLIFREY demonstrates superior efficacy, safety, or convenience, it can justify premium pricing within cost-effectiveness thresholds. Its comparative advantage via clinical data will be pivotal in HTA evaluations influencing reimbursement decisions.

3. What are the key risks that could impact GALLIFREY’s market price?

Risks include failure to secure regulatory approval, emergence of competitive or biosimilar products, payer resistance to high prices, and unfavorable long-term safety or efficacy data.

4. How might patent expiration affect GALLIFREY’s pricing strategy?

Upon patent expiry, generic or biosimilar competitors may enter the market, prompting price reductions. Strategic lifecycle management, such as expanding indications or developing combination therapies, can mitigate revenue decline.

5. What are the main opportunities for maximizing GALLIFREY’s market value?

Opportunities include expanding indications, entering emerging markets, establishing outcome-based pricing agreements, and leveraging real-world evidence to support premium pricing.

References

[1] World Health Organization. "Global Registries and Epidemiology Data." WHO Reports, 2022.

[2] Express Scripts. "The High Cost of Specialty Drugs," 2022.

More… ↓