Share This Page

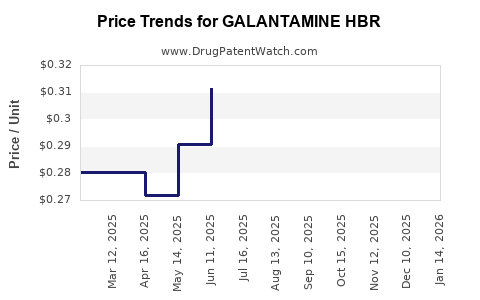

Drug Price Trends for GALANTAMINE HBR

✉ Email this page to a colleague

Average Pharmacy Cost for GALANTAMINE HBR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GALANTAMINE HBR 4 MG TABLET | 24979-0722-04 | 0.32805 | EACH | 2025-12-17 |

| GALANTAMINE HBR 4 MG TABLET | 57237-0049-60 | 0.32805 | EACH | 2025-12-17 |

| GALANTAMINE HBR 12 MG TABLET | 65862-0460-60 | 0.57336 | EACH | 2025-12-17 |

| GALANTAMINE HBR 4 MG TABLET | 65862-0458-60 | 0.32805 | EACH | 2025-12-17 |

| GALANTAMINE HBR 12 MG TABLET | 24979-0724-04 | 0.57336 | EACH | 2025-12-17 |

| GALANTAMINE HBR 12 MG TABLET | 57237-0051-60 | 0.57336 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GALANTAMINE HBR

Introduction

Galantamine Hydrobromide (HBR) is a cholinesterase inhibitor primarily used to treat mild to moderate Alzheimer’s disease and other cognitive disorders. Since its approval, galantamine has established itself as a significant player within the neurodegenerative disease therapeutics market. This analysis explores the current market landscape, competitive positioning, pricing trends, and forecasts future price trajectories.

Market Overview

Galantamine's market entry traces back to the early 2000s, with approval by regulatory agencies such as the FDA and EMA for Alzheimer’s treatment. Its efficacy in symptomatic management, coupled with its oral administration, positions it favorably against other cholinesterase inhibitors. The global Alzheimer’s disease therapeutics market was valued at approximately USD 6.0 billion in 2022, with cholinesterase inhibitors representing a sizable segment, further bolstered by a growing aging population and rising prevalence of neurodegenerative disorders [1].

Market Dynamics

The demand for galantamine is driven by several factors:

- Aging Population: The global elderly demographic (65+) is projected to reach 1.6 billion by 2040, intensifying the need for cognitive disorder treatments [2].

- Competitive Landscape: While rivastigmine, donepezil, and emerging agents like memantine dominate the space, galantamine’s unique mechanism and favorable side effect profile sustain its relevancy.

- Regulatory Approvals & Product Availability: Both branded and generic formulations exist, affecting market price variability. Patents and exclusivity periods directly impact pricing dynamics.

Geographical Market Distribution

North America accounts for roughly 45% of global galantamine sales, attributable to strong healthcare infrastructure and AD awareness campaigns. Europe contributes an additional 35%. Emerging markets in Asia-Pacific are experiencing increased uptake due to expanding healthcare access and demographic shifts.

Competitive Environment

The competitive landscape is characterized by:

- Brand-Name Drugs: Reminyl (Johnson & Johnson), Razadyne (Johnson & Johnson), and galantamine products from Teva and other generics.

- Generic Manufacturers: After patent expiry, generic versions of galantamine proliferated, exerting downward price pressure.

- Pipeline & Alternatives: The entry of disease-modifying therapies (DMTs), such as Aducanumab and Lecanemab, could affect overall demand but currently influence pricing indirectly through market perception.

Pricing Trends and Historical Data

Historically, the price of galantamine has declined post-generic entry:

- Branded Formulations: In the US, a 30-day supply of branded galantamine has ranged from USD 300 to USD 450.

- Generic Formulations: Post-patent expiry, prices fell by approximately 50-65%, with average costs around USD 150–USD 200 per month [3].

- Market Pricing Factors:

- Patent status

- Manufacturing scale

- Regulatory changes

- Regional drug reimbursement policies

Future Price Projections

Factors Influencing Future Pricing:

-

Patent Expiry and Generic Competition: Most key patents related to galantamine have expired globally, strengthening generic market penetration. This trend exerts continuous downward pressure on prices.

-

Market Penetration of Biosimilars and Alternatives: While biosimilars are less relevant for small molecules like galantamine, emerging therapies targeting dementia could influence pricing by shifting demand.

-

Regulatory and Policy Initiatives: Governments emphasizing cost-effective treatments due to aging populations may further promote generic utilization, maintaining low prices.

-

Supply Chain and Manufacturing Disruptions: Potential disruptions could temporarily impact costs but are unlikely to cause sustained price increases in a highly competitive environment.

Projected Price Trajectory (2023–2030):

- Short-term (2023–2025): Stabilization at current generic price points; minor fluctuations based on regional reimbursement changes.

- Mid-term (2025–2027): Slight further decline, reaching USD 120–USD 150 per month in mature markets, driven by increased competition.

- Long-term (2028–2030): Prices may plateau as manufacturing efficiencies are optimized; potential slight rises if new formulations or combination therapies emerge.

In summary: The price of galantamine is expected to remain on a downward trajectory, with average costs declining by an additional 20–30% from current levels by 2030, barring unforeseen market or regulatory shifts.

Implications for Stakeholders

- Pharmaceutical Companies: Opportunities exist primarily in generic manufacturing or developing novel delivery systems to differentiate products.

- Healthcare Providers: Cost reductions could expand access, especially in emerging markets.

- Payers & Policymakers: Encouraging generic use can lead to significant savings; however, balancing affordability and supply stability remains crucial.

Key Takeaways

- Market dynamics are predominantly shaped by patent expirations and competitive generic entry, leading to sustained price declines for galantamine.

- Demographic trends will continue to drive demand, ensuring the drug remains a relevant component of Alzheimer’s treatment regimens.

- Future pricing will likely stabilize around USD 120–USD 150 per month in mature markets, with potential for minor variations depending on regional factors.

- Emerging therapies and policy initiatives might influence the competitive landscape and pricing strategies over the next decade.

- Investments in formulation innovation could offer alternative revenue streams despite overall pricing pressures.

FAQs

1. How has the patent expiration affected the price of galantamine?

Patent expiry has led to a significant reduction in price due to the proliferation of generic versions, decreasing average monthly costs by over 50% in many markets.

2. Are there regional differences in galantamine pricing?

Yes, pricing varies based on regional healthcare policies, reimbursement frameworks, and market competition. For example, prices tend to be higher in North America compared to Asia-Pacific due to differing healthcare systems.

3. Will new Alzheimer's therapies impact galantamine's market share?

Potentially. Disease-modifying therapies might shift demand away from symptomatic treatments like galantamine, but until such therapies are widely adopted, galantamine remains a cost-effective option.

4. What regulatory trends could influence future galantamine prices?

Approval pathways for biosimilars or stricter pricing regulations in certain economies could further suppress prices or modulate market access.

5. Is there potential for premium pricing with formulation innovations?

Yes. Extended-release or combination formulations that improve adherence or efficacy might command higher prices, though market penetration would depend on demonstrated clinical benefits.

References

[1] MarketWatch. Alzheimer's Therapeutics Market Size & Share. 2022.

[2] United Nations. World Population Prospects, 2022.

[3] GoodRx. Galantamine Price Comparison. 2023.

More… ↓