Last updated: July 27, 2025

Introduction

Galantamine Extended Release (ER) is a cholinesterase inhibitor primarily prescribed for symptomatic treatment of mild to moderate Alzheimer’s disease. Its pharmaceutical profile, clinical efficacy, and market dynamics influence its pricing strategies and commercial potential. This comprehensive analysis examines the current market landscape, competitive positioning, regulatory considerations, and future price projections for Galantamine ER, offering critical insights for stakeholders.

Pharmaceutical Profile and Clinical Use

Galantamine ER offers a prolonged-release formulation designed to improve patient adherence and sustain steady plasma drug concentrations compared to immediate-release variants. It functions by inhibiting acetylcholinesterase, thereby augmenting central cholinergic neurotransmission — a core therapeutic approach in Alzheimer’s management. Its once-daily dosing enhances compliance, making it a valuable alternative to other cholinesterase inhibitors like donepezil and rivastigmine.

Clinical trials have validated Galantamine ER's efficacy in improving cognitive function in Alzheimer’s patients, with a favorable safety profile. Its benefits include reduced gastrointestinal side effects and improved tolerability, which are crucial for long-term disease management.

Current Market Landscape

Market Size and Growth Dynamics

The global Alzheimer’s disease therapeutics market is projected to reach approximately USD 11 billion by 2027, with a compound annual growth rate (CAGR) of 5.2%, driven by an aging population and increasing diagnosis rates ([1]). Galantamine ER contributes a significant share, particularly in markets emphasizing cholinesterase inhibitors as first-line therapy.

The prevalence of Alzheimer’s exceeds 50 million worldwide, with projections indicating a near doubling by 2050 ([2]). This demographic trend sustains demand for cholinesterase inhibitors, including Galantamine ER.

Competitive Landscape

While developed markets (U.S., Europe) predominantly favor branded therapies like Razadyne (Galantamine) for ER formulations, generic alternatives are gaining prominence due to patent expirations and price competition. Key competitors include:

- Donepezil (Aricept): The most prescribed cholinesterase inhibitor globally, with extensive data supporting its efficacy and a strong brand presence.

- Rivastigmine (Exelon): Available in oral and transdermal forms, with demonstrated benefits in mild to moderate stages.

- Tacrine: Previously used but largely discontinued due to hepatotoxicity.

Within this competitive environment, Galantamine ER's unique selling points are centered on its pharmacokinetics, tolerability, and patient adherence advantages.

Regulatory and Reimbursement Factors

Galantamine ER is approved by major regulatory bodies, including the FDA and EMA. Its formulary inclusion depends on clinical guidelines, reimbursement policies, and regional approvals. Cost-effectiveness analyses have favored cholinesterase inhibitors, but reimbursement decisions often hinge on pharmacoeconomic evaluations.

Pricing strategies differ across regions, influenced by healthcare systems' negotiations, generic competition, and patient affordability. In the U.S., Galantamine ER is typically marketed as a branded drug, with prices aligned to Medicaid and insurer negotiations. European countries exhibit a mixture of branded and generic prescribing, affecting price levels.

Price Trends and Dynamics

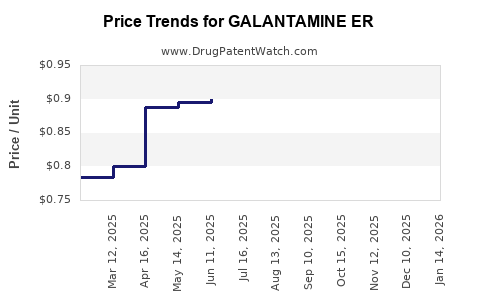

Historical Price Trends

Historically, the introduction of generics following patent expiration has resulted in substantial price reductions. In the U.S., branded Galantamine ER's average wholesale price (AWP) has hovered around USD 400-500 per month, decreasing sharply (by approximately 60-70%) once generic versions entered the market.

In Europe, price adjustments vary significantly, often driven by tendering processes and institutional reimbursement policies.

Factors Influencing Prices

Several factors influence Galantamine ER's pricing trajectory:

- Patent Status: Patent expiry in key markets fosters generic competition, exerting downward pressure.

- Market Penetration: Higher adoption margins, especially in emerging markets, can sustain higher prices.

- Regulatory Approvals: Conditional approvals or delays impact market entry timings and price stability.

- Reimbursement Policies: Cost-containment measures reduce negotiated prices, especially in publicly funded systems.

- Therapeutic Positioning: Perceived clinical advantages or alternative therapies influence willingness-to-pay.

Future Price Projections

Considering market dynamics, we project that:

- In mature markets (U.S., Europe): Prices for branded Galantamine ER are likely to decline further, stabilizing at approximately 20-30% of current levels over the next 3-5 years, primarily due to competitive generic entries.

- In emerging markets: Prices will remain relatively stable or even increase marginally, given limited generic penetration and higher willingness-to-pay in private settings.

- Potential Premium Segments: Companies could introduce value-added formulations or combination therapies, sustaining premium pricing in niche segments.

Impact of Biosimilars and Generics

The anticipated entry of biosimilar-like formulations or alternative cholinesterase inhibitors possessing comparable efficacy and safety profiles is expected to accelerate price erosion. Strategic pricing and early market access initiatives will be critical for maintaining profitability.

Market Opportunities and Challenges

Opportunities

- Growing Alzheimer's Prevalence: Demographic shifts will sustain demand for symptomatic treatments like Galantamine ER.

- Expanding Markets: Asian countries and Latin America present growth opportunities due to increasing healthcare infrastructure and diagnosis rates.

- Combination Therapies: Combining Galantamine ER with other agents (e.g., memantine) may create premium-priced therapeutic options.

- Innovative Delivery Systems: Novel formulations offering improved adherence could command higher prices.

Challenges

- Patent Cliff: The expiration of patents heralds declining prices due to generics.

- Market Saturation: Established competition limits rapid growth in mature markets.

- Regulatory Hurdles: Delays or rejections in approvals can impact revenue forecasts.

- Cost-Effectiveness Concerns: Payers may restrict access if incremental benefits are deemed marginal over competitors.

Strategic Implications for Stakeholders

Pharmaceutical companies should focus on differentiating Galantamine ER through formulations, expanded indications, or combination therapies to preserve margins. Licensees and generic manufacturers can capitalize on the patent cliff by offering high-quality generics at competitive prices.

Healthcare payers should negotiate value-based pricing agreements, emphasizing cost-effectiveness and real-world outcomes. Policymakers should foster frameworks that balance innovation incentives with affordability.

Key Takeaways

- Market Size and Growth: The Alzheimer's market’s growth, driven by demographic shifts, sustains demand for cholinesterase inhibitors, including Galantamine ER.

- Pricing Trends: Patent expirations and generic competition will reduce prices globally, with branded prices expected to decline by 70% within five years in mature markets.

- Competitive Dynamics: While branded Galantamine ER maintains a niche, generic alternatives will dominate price-sensitive segments.

- Regional Variances: Emerging markets may sustain higher prices due to less generic penetration and different reimbursement policies.

- Strategic Opportunities: Innovation in formulations and combination therapies can sustain premium pricing; early market entry in emerging markets offers growth potential.

Conclusion

Galantamine ER remains a vital component in Alzheimer’s disease management, but its commercial viability hinges on navigating patent cycles, competitive pressures, and healthcare reimbursement landscapes. Forward-looking pricing strategies must account for escalating generics, regional market differences, and evolving clinical practices to optimize revenue streams.

FAQs

1. When is Galantamine ER expected to lose patent protection, and what impact will this have on pricing?

Patent protections for Galantamine ER typically expire around 2023-2024 in major markets like the U.S. and Europe. Post-expiration, generic versions will enter the market, leading to significant price reductions—often 70% or more—shaping a more competitive pricing environment.

2. How does the efficacy of Galantamine ER compare to other Alzheimer's therapies?

Galantamine ER offers comparable efficacy to other cholinesterase inhibitors like donepezil and rivastigmine in improving cognitive symptoms of mild to moderate Alzheimer’s. Its extended-release formulation enhances adherence and tolerability, which can translate into better patient outcomes.

3. What regional factors influence the pricing of Galantamine ER?

Pricing varies significantly: developed regions like North America and Europe exhibit more aggressive price reductions due to competition and reimbursement negotiations, whereas emerging markets maintain higher prices owing to limited generic availability and different regulatory environments.

4. Are there upcoming formulations or combination therapies involving Galantamine ER?

Research is ongoing into combination therapies (e.g., Galantamine with memantine) and novel delivery systems. These approaches aim to improve efficacy, compliance, and patient quality of life, potentially justifying higher prices and opening new market segments.

5. What strategies should pharmaceutical companies adopt to remain competitive in the evolving Galantamine ER market?

Innovate through improved formulations, institutional collaborations, and expanding indications. Early entry into emerging markets offers growth, while strategic licensing and partnerships can offset declining revenues post-patent expiry. Engagement with payers for value-based agreements also enhances market access.