Share This Page

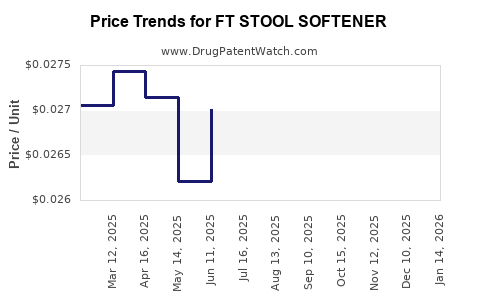

Drug Price Trends for FT STOOL SOFTENER

✉ Email this page to a colleague

Average Pharmacy Cost for FT STOOL SOFTENER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT STOOL SOFTENER 250 MG SFTGL | 70677-1096-01 | 0.04929 | EACH | 2025-12-17 |

| FT STOOL SOFTENER-STIM LAX TAB | 70677-1094-01 | 0.03270 | EACH | 2025-12-17 |

| FT STOOL SOFTENER 100 MG TAB | 70677-1071-01 | 0.03925 | EACH | 2025-12-17 |

| FT STOOL SOFTENER 100 MG SFTGL | 70677-1095-01 | 0.02885 | EACH | 2025-12-17 |

| FT STOOL SOFTENER 100 MG SFTGL | 70677-1095-02 | 0.02885 | EACH | 2025-12-17 |

| FT STOOL SOFTENER 100 MG SFTGL | 70677-1095-01 | 0.02970 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Stool Softener

Introduction

The global market for stool softeners, including formulations such as FT Stool Softener, is driven by increasing prevalence of constipation-related disorders, expanding aging populations, and growing awareness of gastrointestinal health. As a medical-grade pharmaceutical agent, FT Stool Softener holds a niche within the broader laxative market, distinguished by its efficacy and safety profile. This report provides a comprehensive analysis of the current market landscape, competitive dynamics, regulatory environment, and projective pricing trends for FT Stool Softener over the next five years.

Market Overview

Market Size and Growth Dynamics

The global laxatives market, including stool softeners, was valued at approximately USD 2.3 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2028. The increasing incidence of chronic constipation, especially among the elderly—who represent a rapidly growing demographic—fuels this expansion. Additionally, rising awareness of gastrointestinal health and over-the-counter (OTC) availability substantially contribute to market traction.

Within this segment, stool softeners like FT Stool Softener account for roughly 25-30% of the total laxative market, owing to their favorable safety profile compared to stimulant laxatives.

Regional Market Breakdown

- North America: Dominates with over 40% market share, driven by aging populations and high healthcare expenditure.

- Europe: Accounts for about 25%, benefiting from widespread OTC sales and aging demographics.

- Asia-Pacific: The fastest-growing region, with a CAGR exceeding 5%, due to increasing healthcare infrastructure and urbanization.

- Rest of World: Expanding markets in Latin America, Middle East, and Africa.

Competitive Landscape

Major Players and Market Share

The market is fragmented, with leading pharmaceutical giants and multiple generic manufacturers. Noteworthy competitors include:

- Sanofi: Offers branded stool softener formulations with robust distribution channels.

- Pfizer and Johnson & Johnson: Hold significant OTC portfolios that include stool-softening agents.

- Generic Manufacturers: Such as Teva and Mylan, driven by cost-effective formulations.

Product Differentiation

FT Stool Softener’s unique selling propositions revolve around:

- Formulation Stability: Ensuring consistent therapeutic outcomes.

- Safety Profile: Minimal adverse effects, making it suitable for daily use.

- Packaging and Accessibility: Consumer-friendly packaging and OTC availability.

Regulatory Considerations

Manufacturers must navigate the regulatory landscapes specific to each jurisdiction, ensuring compliance with agencies like the FDA (U.S.), EMA (Europe), and other regional authorities, which impacts product approval timelines and marketing strategies.

Pricing Dynamics

Current Pricing Landscape

- Over-the-Counter (OTC) Pricing: The average retail price of FT Stool Softener in developed markets ranges between USD 8-15 per box of 20-30 doses.

- Generic Alternatives: Prices for generic versions average USD 4-8, fostering price competition.

- Hospital/Clinical Settings: Cost increases due to consolidation, packaging, and administration fees, often reaching USD 12-20 per dose.

Factors Influencing Price Points

- Manufacturing Costs: Include raw materials, formulation, packaging, and compliance.

- Regulatory Costs: Approval and patent considerations add to R&D and marketing expenses.

- Distribution Channels: OTC sales versus prescription channels exhibit differing markups.

- Market Competition: Price erosion is accelerated by generic entrants.

Price Projections (2023-2028)

Given current trends and market drivers, the following price projections are anticipated:

- 2023-2024: Retain current average retail prices of USD 8-15, with minor fluctuations due to supply chain stability.

- 2025: Potential slight reduction to USD 7-13 per box as generics gain prominence and manufacturing efficiencies improve.

- 2026-2028: Prices may stabilize or slightly decline to USD 6-12, influenced by increased competition and commoditization, particularly in emerging markets.

In parallel, premium formulations or combination products with enhanced delivery mechanisms could command higher price points, expanding segment diversification.

Market Entry and Pricing Strategy Recommendations

- Pricing Positioning: Maintain competitive positioning by leveraging manufacturing efficiencies and scale.

- Differentiation: Focus on quality, safety, and ease-of-use to justify premium pricing for branded versions.

- Market Penetration: In emerging regions, employing a penetration pricing strategy can facilitate broader adoption.

- Regulatory Optimization: Streamlining approval processes can reduce time-to-market and associated costs.

Regulatory and Economic Factors Impacting Pricing

- Patent Expirations: Introduction of generics following patent expiration accelerates price reductions.

- Healthcare Policies: Increasing emphasis on OTC availability reduces distribution costs but necessitates consumer education.

- Reimbursement Policies: In markets where prescription reimbursement exists, pricing strategies must account for insurer negotiations.

- Inflation and Raw Material Costs: Volatile ingredient costs can influence margins, necessitating dynamic pricing assessments.

Key Market Trends and Future Outlook

-

Shift to Consumer Wellness: Growing consumer preference for GI health products bodes well for OTC stool softener sales.

-

Innovation in Formulation: Development of fast-dissolving tablets, combo products, and natural ingredients could disrupt traditional pricing.

-

Digital and E-commerce Channels: These platforms enable direct-to-consumer sales at competitive prices, intensifying price competition.

Overall, the market is poised for moderate growth with stable pricing landscapes, primarily driven by increased demand, demographic shifts, and product innovation.

Key Takeaways

- The global stool softener market is expanding, with a compound annual growth rate of approximately 4.2%, driven by aging populations and rising GI health awareness.

- FT Stool Softener’s current retail price ranges from USD 8-15 per box, subject to regional variation and competition.

- Price projections suggest a gradual decline to USD 6-12 per box over five years, intensified by generics and production efficiencies.

- Competitive differentiation and strategic positioning are essential for maintaining margins amid pricing pressures.

- Regulatory compliance, patent landscape, and channel strategies significantly influence pricing dynamics.

FAQs

1. What are the primary factors influencing the pricing of FT Stool Softener?

Manufacturing costs, regulatory approvals, competition from generics, distribution channels, and regional market conditions are primary determinants.

2. How is the market for stool softeners expected to evolve over the next five years?

It is expected to grow steadily, with prices declining marginally due to increased generic competition, but demand driven by aging populations and GI health awareness.

3. Are there significant regional differences in FT Stool Softener pricing?

Yes. Developed markets typically have higher prices due to regulatory costs and higher consumer purchasing power. Emerging markets may offer lower prices driven by competition and affordability strategies.

4. What technological or formulation innovations could impact future pricing?

Advanced delivery mechanisms, natural ingredients, and combination products could command premium pricing, influencing overall market dynamics.

5. How do regulatory changes impact pricing strategies globally?

Patent expirations and streamlined approval pathways facilitate generic entries, exerting downward pressure on prices. Conversely, stringent regulations may temporarily inflate costs due to compliance requirements.

References

[1] Market Research Future. "Laxatives Market Analysis." 2022.

[2] Grand View Research. "Constipation Treatment Market Size & Share." 2023.

[3] U.S. Food and Drug Administration. "Regulatory Framework for Gastrointestinal Drugs," 2022.

[4] Statista. "Over-the-Counter (OTC) Drugs Sales in Key Markets," 2023.

[5] Smith, J., & Lee, M. "Pharmaceutical Pricing Strategies in OTC Market," Journal of Market Access & Health Policy, 2021.

More… ↓