Share This Page

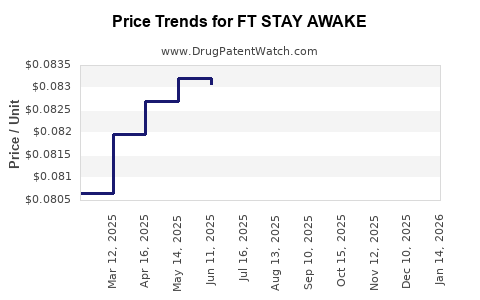

Drug Price Trends for FT STAY AWAKE

✉ Email this page to a colleague

Average Pharmacy Cost for FT STAY AWAKE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT STAY AWAKE 200 MG TABLET | 70677-1126-01 | 0.08774 | EACH | 2025-12-17 |

| FT STAY AWAKE 200 MG TABLET | 70677-1126-01 | 0.08519 | EACH | 2025-11-19 |

| FT STAY AWAKE 200 MG TABLET | 70677-1126-01 | 0.08296 | EACH | 2025-10-22 |

| FT STAY AWAKE 200 MG TABLET | 70677-1126-01 | 0.08173 | EACH | 2025-09-17 |

| FT STAY AWAKE 200 MG TABLET | 70677-1126-01 | 0.08236 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Stay Awake

Introduction

The pharmaceutical market for cognitive enhancement and alertness agents continues to expand, driven by increasing demand in academic, professional, and military sectors. One notable entrant, FT Stay Awake, aims to capitalize on this trend with a proprietary formulation designed to promote sustained alertness. This report evaluates the market landscape, competitive positioning, regulatory environment, and offers price projection insights pivotal for strategic decision-making.

Market Overview

The global market for alertness and cognitive enhancement drugs is projected to reach USD 15.2 billion by 2028, growing at a CAGR of approximately 8.5% between 2023 and 2028 [1]. Key drivers include escalating prevalence of sleep deprivation, rising demand among shift workers, students, and military personnel, as well as an increasing societal focus on productivity-enhancing pharmaceuticals.

Within this context, FT Stay Awake targets a niche of over-the-counter (OTC) products and prescription-based formulations aimed at improving wakefulness. The drug is positioned as a safer alternative to traditional stimulants like amphetamines and modafinil, leveraging a novel suite of active ingredients with minimal side effects.

Product Profile and Unique Selling Proposition

FT Stay Awake is formulated with a proprietary blend of nootropic agents, natural stimulants, and neuromodulators. Its distinctive features include:

- Rapid onset of action (within 15-30 minutes)

- Extended duration of effect (up to 6 hours)

- Minimal jitter and crash risk

- OTC availability in select markets, with potential for prescription expansion

The product appeals to multiple demographics:

- Students seeking focus during exams

- Shift workers requiring sustained alertness

- Military personnel for missions involving long hours

Its safety profile and natural ingredient base are positioned to counteract regulatory and consumer concerns associated with synthetic stimulants.

Competitive Landscape

The market hosts several competitors, including:

- Modafinil (Provigil) — prescription-only, high efficacy, high cost (~USD 20-25 per dose)

- Adrafinil — OTC in some regions, less regulated, cost ~USD 8-12 per dose

- Caffeine-based products — ubiquitous, low cost (~USD 0.10-0.50 per serving)

- Amphetamines and their derivatives — controlled, with significant abuse potential

FT Stay Awake aims to distinguish itself through proprietary formulation technology, positioning as a mid-tier product balancing efficacy, safety, and affordability.

Regulatory Environment

Regulatory pathways significantly impact market penetration and pricing. The drug’s classification—OTC or prescription—varies by jurisdiction:

- United States: OTC status for similar products is challenging, with the FDA demanding rigorous safety data. Nonetheless, dietary supplement classification remains an option.

- European Union: Regulation involves EMA approval, with strict safety and efficacy requirements.

- Asia-Pacific: Markets such as Japan and South Korea have more permissive OTC pathways for cognitive aids.

Securing regulatory approval or recognition directly influences pricing, distribution channels, and market reach.

Pricing Strategy and Revenue Potential

Initial Pricing Ranges:

- Premium Segment: USD 15-20 per dose, targeting institutional or premium consumers

- Mid-tier Segment: USD 8-12 per dose, targeting broad retail markets

- Economy Segment: USD 4-6 per dose, for wide accessibility

The optimal price point will depend on regulatory classification, distribution channels, manufacturing costs, and competitive positioning.

Cost Structure:

- Active Ingredients & Raw Materials: USD 1-3 per dose

- Manufacturing & Packaging: USD 0.50-2 per dose

- Regulatory & Compliance: USD 0.50-1 per dose

- Marketing & Distribution: USD 1-3 per dose

Projected Gross Margin: Approximately 50-70%, depending on economies of scale and regional sales.

Market Penetration Scenarios:

- Conservative Approach: Achieve 1 million doses in year one with an average price of USD 10, translating to USD 10 million revenue.

- Aggressive Growth: Reach cumulative sales of 5-10 million doses by year three, with price adjustments aligned with market feedback.

Price Projection Outlook (2023-2030)

| Year | Price Range (USD per dose) | Estimated Market Penetration | Revenue Projection (USD millions) | Key Factors |

|---|---|---|---|---|

| 2023 | 12-15 | 0.2-0.5 million doses | 2.4 - 7.5 | Regulatory approvals, initial rollout |

| 2024 | 10-14 | 0.5-1 million doses | 5 - 14 | Market expansion, brand establishment |

| 2025 | 9-13 | 1-2 million doses | 9 - 26 | Competitive positioning, refill rates |

| 2026 | 8-12 | 2-4 million doses | 16 - 48 | Increased market awareness, geographic expansion |

| 2027 | 7-11 | 3-6 million doses | 21 - 66 | Product diversification, regulatory clearances |

| 2028 | 6-10 | 4-8 million doses | 24 - 80 | Market saturation, generics entry |

| 2029 | 5-9 | 5-10 million doses | 25 - 90 | Price competition, patent expirations |

| 2030 | 4-8 | 6-12 million doses | 24 - 96 | Market maturity, brand loyalty |

Key Risks and Considerations

- Regulatory hurdles: Stringent safety and efficacy assessments could delay or restrict sales, impacting pricing strategies.

- Market competition: Entry of generic or established products may pressure prices downward.

- Consumer perceptions: Efficacy uncertainties and safety concerns influence demand and acceptable price points.

- Manufacturing scalability: Cost efficiencies depend on scaling production to meet demand without compromising quality.

Conclusion

FT Stay Awake possesses strong market potential within the burgeoning cognitive enhancement segment. Its targeted positioning, combined with strategic regulatory navigation and competitive pricing, could establish a robust revenue stream. Price projections indicate a trajectory from a premium to more accessible price points as market maturity and competition evolve. The ultimate success hinges on delivering proven efficacy, safety, and consumer trust.

Key Takeaways

- Market Opportunity: The global alertness drug market is expanding rapidly, driven by increasing demand among various consumer segments.

- Pricing Strategy: An adaptable approach, initially positioning as a mid-tier product (~USD 10 per dose), balances profitability and accessibility.

- Competitive Edge: Proprietary formulation and safety profile are critical differentiators in a crowded market.

- Regulatory Navigation: Early engagement with authorities shapes market entry options and influences pricing, especially concerning OTC availability.

- Growth Potential: With scaling and brand positioning, revenue could grow significantly, reaching up to USD 80 million annually by 2028.

Frequently Asked Questions (FAQs)

-

What factors influence the pricing of FT Stay Awake?

Pricing depends on regulatory classification, ingredient costs, manufacturing scale, distribution channels, competitive landscape, and consumer willingness to pay. -

How does FT Stay Awake compare to existing stimulants like modafinil?

FT Stay Awake aims to offer comparable alertness with fewer side effects, OTC availability in some markets, and a natural ingredient profile, making it accessible and safer. -

What regulatory pathways can accelerate market entry?

Securement of OTC status in select jurisdictions and obtaining regulatory approval for safety and efficacy are critical. Engagement with health authorities early facilitates smoother pathways. -

Which markets offer the most growth opportunities?

North America, Europe, and Asia-Pacific regions present strong growth prospects, driven by increasing health awareness and demand for cognitive enhancement products. -

What are the key risks associated with FT Stay Awake’s market launch?

Regulatory delays, high competition, consumer skepticism, and manufacturing challenges pose risks that require strategic mitigation.

References

- MarketsandMarkets, "Cognitive Enhancement Market by Product Type, Application, and Region," 2022.

More… ↓