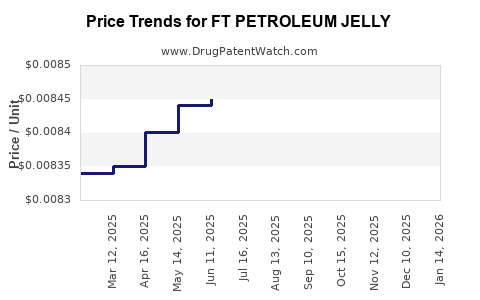

Drug Price Trends for FT PETROLEUM JELLY

✉ Email this page to a colleague

Average Pharmacy Cost for FT PETROLEUM JELLY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT PETROLEUM JELLY | 70677-1235-01 | 0.01244 | GM | 2025-12-17 |

| FT PETROLEUM JELLY | 70677-1235-02 | 0.00825 | GM | 2025-12-17 |

| FT PETROLEUM JELLY | 70677-1235-01 | 0.01243 | GM | 2025-11-19 |

| FT PETROLEUM JELLY | 70677-1235-02 | 0.00824 | GM | 2025-11-19 |

| FT PETROLEUM JELLY | 70677-1235-01 | 0.01251 | GM | 2025-10-22 |

| FT PETROLEUM JELLY | 70677-1235-02 | 0.00827 | GM | 2025-10-22 |

| FT PETROLEUM JELLY | 70677-1235-01 | 0.01228 | GM | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Petroleum Jelly

Introduction

FT Petroleum Jelly, a specialized form of petroleum-based ointment, is widely utilized in pharmaceutical, cosmetic, and industrial applications. Known for its occlusive properties, stability, and inertness, petroleum jelly remains a staple in various formulations. This analysis provides an in-depth overview of the current market landscape, key drivers, competitive dynamics, and future pricing trajectories for FT Petroleum Jelly, equipping stakeholders with actionable insights for strategic decision-making.

Market Overview

The global petroleum jelly market, estimated at approximately USD 700 million in 2022, exhibits a compound annual growth rate (CAGR) of around 4% over the past five years. Factors influencing growth include increasing demand in pharmaceutical products, expanding cosmetic routines, and industrial uses such as lubrication and sealing. FT (free trade) petroleum jelly, distinguished by its purity and compliant manufacturing standards, commands a premium relative to commodity-grade variants.

Key markets for FT Petroleum Jelly are North America, Europe, and Asia-Pacific. North America leads in terms of consumption owing to robust pharmaceutical and personal care sectors, while Asia-Pacific is experiencing rapid growth driven by rising disposable incomes and expanding manufacturing bases.

Market Drivers

-

Growing Pharmaceutical Usage: FT petroleum jelly is essential in topical formulations, wound care, and infant products owing to its hypoallergenic property and inert nature. Regulatory approvals from agencies like the FDA bolster its adoption.

-

Rise in Personal Care & Cosmetics: The demand for skin protection products, lip balms, and baby ointments fuels the need for high-purity petroleum jelly. Skin-sensitive consumers prefer FT grades due to regulatory assurances.

-

Industrial Applications: Food-grade and industrial-grade petroleum jelly, often derived through FT processes, are used as lubricants, rust preventatives, and sealing agents, expanding the market scope.

-

Regulatory Framework: Stringent manufacturing quality standards such as USP, EP, and JP classifications for pharmaceutical-grade petroleum jelly ensure product safety, favoring suppliers of FT versions that meet these standards.

Competitive Landscape

The FT petroleum jelly market features key players such as Dow Inc., ExxonMobil, Valero Energy, and Indian producers like Bhanu Petroleum. These companies differentiate via product purity, supply reliability, and compliance with regulatory standards.

Emerging regional manufacturers focus on cost competitiveness and localized supply, particularly in Asia-Pacific, where the market segment is expanding rapidly. Contract manufacturing and private labeling also influence competitive dynamics.

Supply Chain & Market Trends

Global supply chains are robust, but pandemic-related disruptions and geopolitical tensions have introduced volatility in raw material procurement and freight logistics. Sustainable manufacturing practices and certifications are gaining prominence, aligning with consumer preferences and regulatory trends.

Innovations center on refining processes to achieve higher purity grades with consistent quality, coupled with efforts to reduce environmental impact through cleaner production methods.

Price Analysis and Projections

Current market prices for FT pharmaceutical-grade petroleum jelly vary between USD 2.50 and USD 4.00 per kilogram, depending on purity levels, packaging, and regional factors. Price stability remains contingent on raw material costs, particularly Brent crude oil, which influences feedstock pricing.

Short-term Price Outlook (1-2 years)

In the near term, prices are expected to remain relatively stable, supported by steady demand across pharma and cosmetics sectors. Raw material price fluctuations—driven by crude oil volatility—may induce minor adjustments. The global economic recovery post-pandemic could further stabilize prices, with a potential slight uptick due to rising demand in emerging markets.

Mid to Long-term Price Projections (3-5 years)

Over the next five years, prices are projected to gradually increase at a CAGR of 2-3%, reaching USD 3.00 to USD 4.50 per kilogram for premium FT grades. This rise reflects several factors:

-

Supply Constraints: Environmental regulations and sustainability mandates may limit raw material availability or increase manufacturing costs.

-

Regulatory Standards: Enhanced quality and safety standards will require investments in processing and testing, adding production costs.

-

Emerging Market Demand: Rapid industrialization and consumer health awareness in Asia-Pacific will drive up demand, exerting upward pressure on prices.

-

Sustainability Initiatives: Adoption of greener manufacturing practices could incur higher operating costs, influencing pricing structures.

Pricing Segmentation

More… ↓