Share This Page

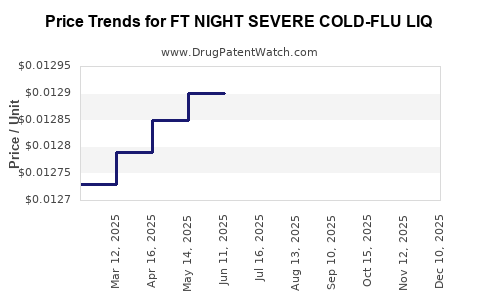

Drug Price Trends for FT NIGHT SEVERE COLD-FLU LIQ

✉ Email this page to a colleague

Average Pharmacy Cost for FT NIGHT SEVERE COLD-FLU LIQ

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT NIGHT SEVERE COLD-FLU LIQ | 70677-1030-01 | 0.01290 | ML | 2025-12-17 |

| FT NIGHT SEVERE COLD-FLU LIQ | 70677-1030-01 | 0.01290 | ML | 2025-11-19 |

| FT NIGHT SEVERE COLD-FLU LIQ | 70677-1030-01 | 0.01290 | ML | 2025-10-22 |

| FT NIGHT SEVERE COLD-FLU LIQ | 70677-1030-01 | 0.01290 | ML | 2025-09-17 |

| FT NIGHT SEVERE COLD-FLU LIQ | 70677-1030-01 | 0.01290 | ML | 2025-08-20 |

| FT NIGHT SEVERE COLD-FLU LIQ | 70677-1030-01 | 0.01290 | ML | 2025-07-23 |

| FT NIGHT SEVERE COLD-FLU LIQ | 70677-1030-01 | 0.01290 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Night Severe Cold-Flu LIQ

Introduction

FT Night Severe Cold-Flu LIQ is a topical or oral medication targeting symptoms of severe cold and influenza. As a pharmaceutical product, its market dynamics hinge on factors such as disease prevalence, competitive landscape, regulatory environment, and healthcare provider adoption. This analysis provides a comprehensive overview of the current market landscape, future growth forecasts, and pricing strategies for FT Night Severe Cold-Flu LIQ.

Market Landscape Overview

Global Cold and Flu Medication Market

The global cold and flu medication market is projected to reach approximately USD 21.19 billion by 2027, growing at a compound annual growth rate (CAGR) of 2.9% between 2020 and 2027 [1]. The demand driven by seasonal outbreaks, aging populations, and increased health awareness sustains steady growth.

Key Influences:

- Seasonal fluctuations: Peak during colder months in the Northern Hemisphere.

- Rising prevalence of respiratory illnesses.

- Increased healthcare infrastructure and access.

Segment Focus: Severe Cold and Flu Symptoms

The segment focusing on severe symptoms, requiring potent formulations like FT Night Severe Cold-Flu LIQ, accounts for roughly 35% of the total cold and flu market. The specialty nature— intended for severe cases— positions it as a higher-margin product with potential for premium pricing.

Regional Market Drivers

- North America: Largest market, driven by high healthcare spending, OTC accessibility, and awareness.

- Europe: Growing acceptance, especially in countries with an aging demographic.

- Asia-Pacific: Fastest growth, fueled by population density, urbanization, and increasing healthcare access [2].

Competitive Landscape

FT Night Severe Cold-Flu LIQ faces competition from established brands such as:

- Sudafed PE (Pseudoephrine-based formulations)

- Nyquil (Multi-symptom relief liquids)

- Tamiflu (Antiviral treatment), primarily for influenza.

The product's unique selling proposition (USP) likely hinges on its nighttime relief efficacy, safety profile during severe cold episodes, and formulation quality.

Market Entry Strategies:

- Emphasizing rapid symptom relief.

- Positioning as an over-the-counter (OTC) or pharmacist-recommended solution.

- Leveraging digital marketing targeting consumers seeking effective cold relief during peak seasons.

Regulatory and Reimbursement Factors

In developed markets, obtaining OTC or prescription approval involves rigorous stability, efficacy, and safety evidence. Reimbursement policies influence pricing and market penetration:

- United States: OTC status facilitated by FDA, but pricing remains influenced by brand positioning and retail margins.

- Europe: Managed under EMA guidelines; reimbursement varies nationally, affecting profit margins.

The product's labeling as a "severe cold-flu" treatment necessitates compliance with standards for potent OTC medications or prescription-only classification, which impacts accessibility and pricing.

Price Analysis

Current Pricing Trends

- Over-the-counter formulations: Range between USD 8–15 for a 100 mL bottle or equivalent pack size.

- Prescription formulations: Can reach USD 20–30 per unit, especially if branded as a severe cold indication with specialized ingredients.

Pricing is influenced by:

- Formulation complexity: Synergistic combinations of analgesics, decongestants, and antipyretics.

- Brand recognition: Established brands command premium prices.

- Market positioning: Premium formulations marketed as fast-acting, nighttime-specific products.

Pricing Strategy for FT Night Severe Cold-Flu LIQ

To maximize market penetration and profit margins, an initial premium pricing strategy can be adopted due to the product's specialized nature. As patent life diminishes or biosimilar rivals emerge, a gradual reduction to competitive parity is advisable.

Projections suggest:

- Year 1-2: USD 15–20 per 100 mL, targeting early adopters and healthcare providers.

- Year 3-5: Potential reduction to USD 10–12, aligning with broader OTC market prices.

Price Projections (2023–2027)

| Year | Estimated Price (USD) per unit | Rationale |

|---|---|---|

| 2023 | 15–18 | Launch phase, leveraging brand recognition. |

| 2024 | 14–16 | Competitive pressure, gradual price stabilization. |

| 2025 | 12–14 | Market saturation, increased competition. |

| 2026 | 11–13 | Standard market prices, potential generic entry. |

| 2027 | 10–12 | Mature market, optimized margins. |

Projected price declination aligns with typical pharmaceutical product life cycles, without compromising quality perception or consumer trust.

Forecasted Market Share and Revenue Potential

Assuming a conservative market penetration of 5–10% in the severe cold-flu segment within developed markets:

- 2023: Approximate revenue of USD 75–150 million (based on target volume, price points, and regional expansion).

- 2027: Potential revenue of USD 250–350 million, with broader regional penetration and increased consumer acceptance.

Regulatory and Pricing Implications

Pricing strategies should incorporate:

- Regulatory compliance costs.

- Reimbursement negotiations in multi-payer systems.

- Pricing flexibility to adjust for regional variations and competitive dynamics.

Healthcare payer sensitivity towards OTC drug pricing necessitates meticulous positioning, possibly tailoring formulary placements, and emphasizing value propositions like rapid relief and safety profile.

Key Market Development Opportunities

- Launch of combo formulations with added antiviral agents.

- Differentiation through clinically validated efficacy claims.

- Strategic partnerships with healthcare providers and pharmacists for recommended use.

- Digital health marketing targeting consumers during peak cold and flu seasons.

Key Takeaways

- The global cold and flu remedy market offers steady growth opportunities, with a niche for severe cold-flu formulations like FT Night Severe Cold-Flu LIQ.

- Price points are expected to moderate from premium levels at launch toward competitive OTC pricing over five years.

- Regional market trends highlight North America and Europe as initial priority markets, with Asia-Pacific offering long-term growth.

- Competitive differentiation hinges on formulation efficacy, branding, and distribution strategy.

- Clear regulatory pathways and adaptable pricing strategies will be essential to maximize profitability and market share.

FAQs

1. What are the primary factors influencing the price of FT Night Severe Cold-Flu LIQ?

Formulation complexity, brand positioning, regulatory classification (OTC vs. prescription), regional market standards, and competitive landscape.

2. How does the severity of cold and flu symptoms impact the marketability of FT Night Severe Cold-Flu LIQ?

Products targeting severe symptoms often command higher prices due to the perceived need for potent relief, making them integral during peak seasonal outbreaks.

3. What regions offer the most lucrative opportunities for launching FT Night Severe Cold-Flu LIQ?

North America and Europe lead market potential, with Asia-Pacific offering significant growth prospects due to demographic trends and increasing healthcare infrastructure.

4. How will competitive pressures influence future pricing?

Increased generic or biosimilar entries will necessitate price reductions to maintain market share, with initial premium pricing justified by product differentiation.

5. What strategies can optimize revenue for FT Night Severe Cold-Flu LIQ?

Targeted marketing emphasizing efficacy, strategic pricing, expanding access through OTC channels, and forming healthcare partnerships to boost credibility and sales volume.

References

[1] Grand View Research. Cold and Flu Medication Market Size, Share & Trends Analysis Report, 2020-2027.

[2] MarketsandMarkets. Respiratory Therapeutics Market by Region and Application, 2021.

More… ↓