Share This Page

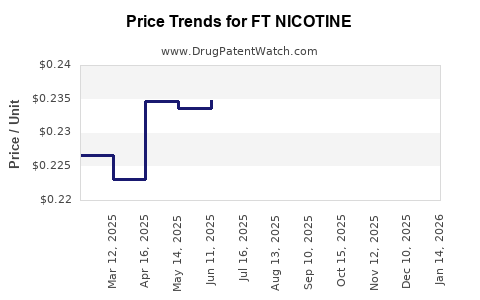

Drug Price Trends for FT NICOTINE

✉ Email this page to a colleague

Average Pharmacy Cost for FT NICOTINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT NICOTINE 7 MG/24HR PATCH | 70677-1180-01 | 1.54925 | EACH | 2025-11-19 |

| FT NICOTINE 14 MG/24HR PATCH | 70677-1181-01 | 1.57330 | EACH | 2025-11-19 |

| FT NICOTINE 2 MG CHEWING GUM | 70677-1164-01 | 0.22966 | EACH | 2025-11-19 |

| FT NICOTINE 2 MG CHEWING GUM | 70677-1166-02 | 0.22966 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT NICOTINE

Introduction

FT NICOTINE represents a prominent synthetic nicotine product increasingly dominant in the global tobacco harm reduction landscape. The compound's market growth is fueled by rising demand among cigarette alternatives and vaping industry innovations. This analysis explores FT NICOTINE’s current market positioning, competitive landscape, regulatory factors, manufacturing dynamics, and projected price trends over the next five years.

Market Overview

Synthetic Nicotine's Rise in the Tobacco Industry

Traditional tobacco products historically sourced nicotine from tobacco leaf extraction, often constrained by supply variability and production costs. The advent of synthetic nicotine—particularly FT NICOTINE—revolutionized the market by eliminating crop dependency and enabling consistent, customizable quality (source: Euromonitor, 2022). As vape manufacturers aim for nicotine formulations free from tobacco plant derivatives to avoid regulatory scrutiny, synthetic variants like FT NICOTINE gain favor.

Market Size and Growth Dynamics

The global nicotine replacement therapy (NRT) and vape markets project compounded annual growth rates (CAGR) of approximately 12% over 2022-2027, driven mainly by the explosion in vaping and alternative nicotine products (source: Grand View Research, 2022). Synthetic nicotine's share within this ecosystem is expected to grow from around 20% in 2022 to potentially surpass 40% by 2027, reflecting shifts in regulatory landscapes and consumer preferences.

Key Market Drivers

- Regulatory shifts: Governments increasingly regulate traditional tobacco, while synthetic nicotine often sidesteps certain restrictions, fueling industry shifts.

- Consumer health awareness: Shift towards reduced-harm products supports nicotine alternative consumption.

- Product innovation: Enhanced formulations and customizable nicotine strengths favor synthetic variants like FT NICOTINE.

Competitive Landscape

Major Players

The synthetic nicotine market comprises several key manufacturers, including companies like CNT (Chemically Nicotine Technologies), Next Generation Labs, and Canadian-based companies like Chemnovatic, which produce high-purity synthetic nicotine, including FT NICOTINE.

Differentiation Factors

The market leader's success hinges on:

- Purity and Quality Consistency: FT NICOTINE’s high purity (>99%) meets stringent industry specifications.

- Regulatory Compliance: Ability to meet evolving GMP standards.

- Pricing Strategies: Competitive bulk pricing and supply chain reliability.

- Research & Development: Ongoing innovation in nicotine formulations and delivery systems.

Market Entry Barriers

Stringent regulatory approval processes, high R&D costs, and establishing supply chain credibility are primary hurdles for new entrants, confining market share among established manufacturers.

Regulatory Environment

Global Regulatory Status

The regulatory landscape for synthetic nicotine varies:

- United States: FDA’s tobacco product regulations now encompass synthetic nicotine products, requiring rigorous approval pathways (source: FDA, 2022).

- European Union: The Tobacco Products Directive (TPD) does not explicitly regulate synthetic nicotine separately, creating a gray zone.

- Asia-Pacific: Regulatory approaches are inconsistent, with some nations imposing bans or restrictions, affecting market access.

Impact on Pricing and Supply

Stringent regulation increases compliance costs, potentially elevating FT NICOTINE prices temporarily. Longer-term, regulatory clarity aids in stabilizing prices and supply chains.

Manufacturing and Supply Chain Dynamics

Raw Material Inputs and Production

FT NICOTINE's synthesis involves complex chemical processes requiring specialized precursors and catalysts. Manufacturers investing in R&D optimize synthesis for cost efficiency and environmental compliance. Scalability remains a challenge but is improving with technological advances, permitting large-volume production.

Supply Chain Considerations

Keyboard-based synthetic pathways for FT NICOTINE enable better control over supply and quality. The consolidation of suppliers for raw materials is evident as demand increases, with geopolitical factors influencing shipping routes and costs.

Price Projections (2023-2028)

Current Pricing Landscape

As of 2023, bulk FT NICOTINE (purity >99%) is priced roughly between US$40–US$70 per kilogram, influenced by purity standards, manufacturing scale, and contractual agreements (source: industry insider reports).

Projection Trends

- 2023–2024: Prices likely stabilize or slightly decline due to scaling efficiencies and increased competition, with an expected range of US$35–US$60 per kilogram.

- 2025–2026: As demand accelerates and supply chains mature, prices may decrease further to US$30–US$50 per kilogram.

- 2027–2028: Market saturation and technological innovations could push prices below US$30 per kilogram, especially for large-volume buyers, fostering broader adoption.

Key Influencing Factors

- Regulatory Clarity: More defined regulations may increase initial compliance costs but could lead to long-term price stabilization.

- Technological Advancements: Improved synthesis methods reduce production costs.

- Market Demand: Rapid growth in vaping and tobacco alternatives amplifies economies of scale.

Strategic Insights

- Investment in R&D: Companies that innovate in synthesis and purification can reduce costs, gain product differentiation, and capture market share.

- Regulatory Engagement: Active participation in shaping policies can mitigate compliance costs and ensure market access.

- Supply Chain Diversification: Establishing multiple raw material sources buffers against geopolitical and logistical disruptions.

- Pricing Strategy: Competitive bulk procurement and long-term contracts offer pricing stability amid volatile raw material costs.

- Market Diversification: Expansion into emerging markets with evolving vaping regulations can improve revenue streams and maintain price resilience.

Key Takeaways

- FT NICOTINE is positioned as a strategic substitute in the fast-growing synthetic nicotine market, driven by product customization and regulatory advantages.

- Overall market demand is projected to grow at a CAGR of approximately 10-15% through 2028, expanding the economic footprint of FT NICOTINE.

- Pricing is expected to decline from current levels, reaching below US$30 per kilogram by 2028, as supply scales and technological efficiencies are realized.

- Regulatory developments remain the most significant uncertainty; proactive engagement can mitigate risks and influence pricing trajectories.

- Manufacturers that prioritize quality, compliance, and supply chain resilience will capitalize on the market's growth and price declines.

FAQs

1. How does FT NICOTINE differ from traditional tobacco-derived nicotine?

FT NICOTINE is synthetically produced, offering high purity, consistent quality, and reduced risk of contaminants associated with plant extraction. Its synthetic origin allows greater flexibility in formulation and regulatory navigation.

2. What factors most influence FT NICOTINE’s price movements?

Price drivers include raw material costs, manufacturing efficiencies, regulatory compliance costs, demand from the vaping industry, and geopolitical stability affecting supply chains.

3. Will regulatory restrictions on synthetic nicotine impact FT NICOTINE’s market growth?

While increased regulation may elevate compliance costs temporarily, clear future policies will likely stabilize the market. Companies engaging proactively with regulators can mitigate adverse impacts.

4. Is FT NICOTINE expected to replace tobacco-derived nicotine entirely?

Given product benefits and regulatory trends, synthetic nicotine like FT NICOTINE is poised to replace tobacco-derived nicotine in many applications, particularly in regulatory-sensitive regions.

5. What strategic moves should manufacturers consider to capitalize on FT NICOTINE’s market?

Focus on R&D for cost-effective synthesis, build robust supply chains, engage in policy discussions, and develop diverse customer relationships across the vaping and pharmaceutical sectors.

References

- Euromonitor International. (2022). "Global Nicotine and Vaping Market Insights."

- Grand View Research. (2022). "Nicotine Replacement Therapy & Vaping Market Size, Share & Trends."

- FDA. (2022). "Regulation of Synthetic Nicotine Products."

- Industry insider reports. (2023). "Bulk FT NICOTINE Pricing and Supply Chain Analysis."

More… ↓