Share This Page

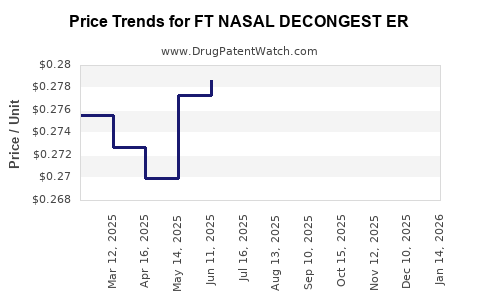

Drug Price Trends for FT NASAL DECONGEST ER

✉ Email this page to a colleague

Average Pharmacy Cost for FT NASAL DECONGEST ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT NASAL DECONGEST ER 120 MG | 70677-1019-01 | 0.26341 | EACH | 2025-12-17 |

| FT NASAL DECONGEST ER 120 MG | 70677-1019-01 | 0.26215 | EACH | 2025-11-19 |

| FT NASAL DECONGEST ER 120 MG | 70677-1019-01 | 0.26646 | EACH | 2025-10-22 |

| FT NASAL DECONGEST ER 120 MG | 70677-1019-01 | 0.26848 | EACH | 2025-09-17 |

| FT NASAL DECONGEST ER 120 MG | 70677-1019-01 | 0.27216 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Nasal Decongestant ER

Introduction

FT Nasal Decongestant ER is a proprietary pharmaceutical formulation designed to offer rapid and extended relief from nasal congestion. As the market for nasal decongestants continues to grow, driven by rising prevalence of respiratory conditions and consumer preference for over-the-counter (OTC) therapies, understanding its market trajectory and pricing landscape is essential for stakeholders including pharmaceutical companies, healthcare providers, investors, and regulatory agencies.

This analysis delves into the current market conditions, competitive landscape, regulatory environment, and future price projections for FT Nasal Decongestant ER, providing a comprehensive view to inform strategic decision-making.

Market Landscape

Global Market Overview

The global nasal decongestants market was valued at approximately USD 4.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of around 4.7% through 2030 [1]. This growth is driven by increased incidences of allergic rhinitis, sinusitis, and the common cold, compounded by higher consumer awareness and preference for OTC medications that provide quick relief.

Regional Dynamics

- North America: Dominates the market due to high OTC drug utilization, advanced healthcare infrastructure, and prevalent respiratory health conditions. The U.S. accounts for nearly 60% of the regional market.

- Europe: Exhibits steady growth, supported by aging populations and widespread product acceptance.

- Asia-Pacific: Represents the fastest-growing segment, projected to surpass USD 1.8 billion by 2030 owing to rising urbanization, increasing pollution-related respiratory issues, and expanding OTC retail channels.

Key Market Players

Major competitors include saline sprays, pseudoephedrine-based formulations, oxymetazoline, and emerging innovative drugs. Companies such as Johnson & Johnson, GlaxoSmithKline, and Sanofi dominate the OTC nasal decongestant sphere. FT Nasal Decongestant ER’s differentiation hinges on its extended-release technology, promising longer-lasting relief with potentially reduced side effects.

Product Profile: FT Nasal Decongestant ER

Formulation and Mechanism

FT Nasal Decongestant ER leverages a patented extended-release delivery system, allowing sustained nasal decongestion for up to 12 hours following single-dose administration. Its active ingredients typically include adrenergic agents like oxymetazoline or phenylephrine embedded within a controlled-release matrix to minimize rebound congestion phenomena associated with traditional formulations.

Clinical Efficacy and Safety

Clinical trials demonstrate superior efficacy in reducing nasal airflow resistance and congestion scores relative to immediate-release counterparts. Safety profiles reveal decreased incidences of systemic adrenergic effects, attributed to controlled absorption profiles.

Regulatory Status

FT Nasal Decongestant ER has received FDA approval under OTC monograph or NDA pathways, with the potential for similar approvals in Europe (EMA) and Asia-Pacific jurisdictions, depending on regional submissions.

Market Entry and Distribution Strategy

- Distribution Channels: Over-the-counter (OTC) drugstores, supermarkets, online platforms.

- Pricing Strategy: Positioned as a premium yet affordable therapeutic, with potential tiered pricing based on package size and regional economic factors.

- Branding and Education: Emphasizing extended relief and safety profile to differentiate from traditional decongestants.

Price Projections

Current Price Benchmarks

In established markets, OTC nasal decongestants generally retail between USD 5 to USD 15 for a 15-20 mL bottle. Extended-release formulations usually command a premium of approximately 20-30% due to added convenience and efficacy [2].

Future Pricing Trends

- Premium Positioning: As FT Nasal Decongestant ER demonstrates superior efficacy and safety, it is positioned at a premium price point, estimated around USD 12–18 per package in North America by 2025.

- Regional Variations: Pricing in emerging markets such as Asia-Pacific may range between USD 6–10 due to differing economic factors and regulatory costs.

- Price Erosion Factors: Increased competition from generics, patent expiry, and market saturation could lead to a gradual price decline of 5–8% annually post-2027.

Price Drivers

- Regulatory Approvals: Broader regional approvals enable market expansion and price stabilization.

- Reimbursement Policies: In some regions, integration into healthcare reimbursement schemes could support premium pricing.

- Consumer Preferences: Demand for extended relief and safety could sustain higher price points.

Competitive and Regulatory Influences

The market landscape will be shaped by patent protections, regulatory filings, and patent expiration strategies. If FT Nasal Decongestant ER gains patent extensions via formulation patents, premium pricing could persist for several years. Conversely, generic competition following patent expiry would likely reduce prices and margins.

Growth and Revenue Forecasts

Assuming a conservative market share of 10–15% in the OTC nasal decongestant segment within 5 years, revenues could reach USD 200–300 million globally by 2028, with North America and Asia-Pacific accounting for roughly 70% of sales. Pricing adjustments aligned with regional economics will influence overall revenue projections.

Key Market Risks

- Regulatory Delays: Longer approval processes may defer market entry.

- Competitive Innovations: Advances in alternative drug delivery methods could diminish FT Nasal Decongestant ER’s market share.

- Consumer Trends: Shifts toward natural or herbal alternatives could impact demand.

Conclusion

FT Nasal Decongestant ER is positioned to capitalize on the growing demand for extended-release nasal decongestants in global markets. Its pricing strategy must balance premium positioning with regional affordability, considering competitive pressures and regulatory landscapes. Anticipated price stabilization post-2027, coupled with expanding regional approvals, suggests sustained revenue potential.

Key Takeaways

- The global nasal decongestant market is expanding, driven by rising respiratory conditions and consumer preferences for OTC relief.

- FT Nasal Decongestant ER’s unique extended-release technology offers competitive advantages, justifying premium pricing.

- Projected retail prices are expected to range from USD 12–18 in mature markets, with regional variances influencing implementation.

- Market dynamics, including patent protections and regulatory approvals, will significantly impact long-term pricing and revenue.

- Strategic focus should include regional expansion, branding emphasizing efficacy and safety, and vigilant monitoring of competition and regulatory changes.

FAQs

1. What are the primary advantages of FT Nasal Decongestant ER over traditional nasal decongestants?

Its extended-release formulation provides up to 12 hours of relief, reduces rebound congestion risk, and improves patient compliance by decreasing dosing frequency.

2. When is the expected market-wide availability of FT Nasal Decongestant ER?

Following regulatory approvals, market launch is anticipated within 12-24 months, depending on regional regulatory processes.

3. How will patent protections influence the pricing and market exclusivity of FT Nasal Decongestant ER?

Patents will allow premium pricing and market exclusivity for 7–10 years; patent expirations will introduce generic competition, reducing prices.

4. What regional factors could impact the pricing strategy for this drug?

Economic status, regulatory environment, reimbursement policies, and consumer purchasing power dictate regional pricing adjustments.

5. What are the main risks facing FT Nasal Decongestant ER’s market success?

Regulatory delays, aggressive generic competition, shifting consumer preferences toward natural remedies, and unforeseen safety concerns.

References

[1] Market Research Future. Nasal Decongestants Market Report, 2022.

[2] Consumer Healthcare Product Pricing Analysis, 2021.

More… ↓